Building authentic connections across generations

By Irene Stolte

Clients from different generations and upbringings walk through my office doors every day.

Some days, I meet with retired clients to ensure their investments are in line with their risk profile. On other days I will see young clients saving to purchase their first home. The purpose behind financial planning is universal, and applicable to anyone even as language and technology evolve.

I have found that working with Gen Z clients is similar to working with any client, the major difference being Gen Z’s innate desire to leverage technology in the process.

Gen Z, those born between 1996 and 2012, has never known life without on-demand technology. Virtual meetings are a norm for them. By sharing that you are open to meeting them virtually, you already have their attention. This knack for technology also plays a role in how most Gen Z clients understand investing.

Embracing technology

For example, a new client may already buy stocks with an app like RobinHood. Rather than immediately dismissing the app, I use this as a starting point. Why did they make their investments? Was there something that made them choose a specific stock? I can use this to better understand their values and goals, a common practice with all clients. Building a sense of trust allows me to assist in developing financial goals that go beyond a singular investment.

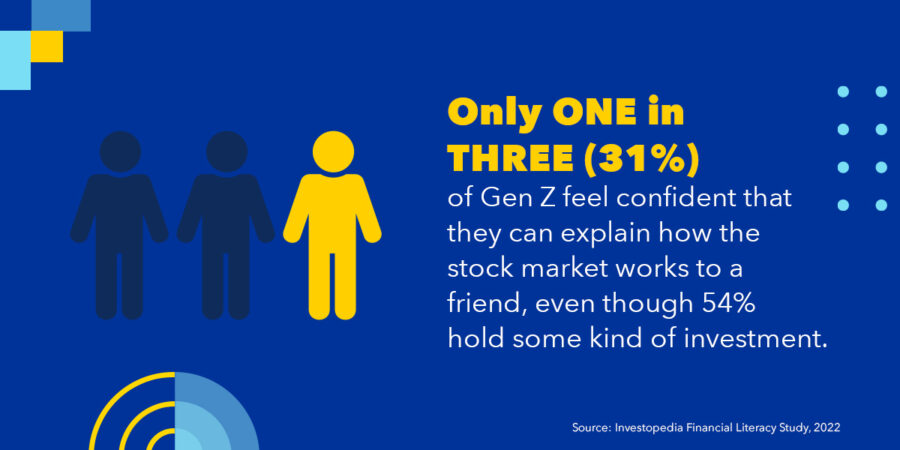

According to a 2022 Investopedia survey, 54% of Gen Z own some kind of investment. However, only one-third of Gen Z feel confident they could explain how the stock market works to a friend. There is a lack of understanding of finance despite the plethora of resources available. Since many do not feel confident in their understanding of investments, Gen Z particularly wants to learn from an expert without fear of misinformation.

Their most common path to meeting an advisor is like that of many clients – referrals. Almost all my Gen Z clients are either my daughter’s friends or my older clients’ children. What I’ve found makes me approachable to this generation is both my connections and my willingness to meet them virtually.

No age limit

I am often referred to Gen Z clients to help them with retirement planning or building emergency funds. Again, these are common questions among all my clients regardless of age.

My goal is to help build positive habits like making consistent investments. Sometimes, it is as simple as explaining employer 401(k) matching contributions. It could be by starting small with low-risk investments or adding additional insurance coverage. Gen Z is used to the idea of a monthly payment with subscription services like Amazon, Netflix or Spotify.

We can use that to our advantage, helping the client establish a monthly addition to their investment portfolio. These conversations lead the client to establish their own financial goals and build a sense of ownership of their finances.

Solidifying yourself as a trusted financial advisor to Gen Z individuals is crucial to adding longevity to your business. Including young people in your client pool can not only diversify the type of work you do but also prove to potential clients that you can help at every stage of life. As you look to develop your client list in the future, remember that these young people are looking for the same thing any client is: peace of mind and a better understanding of finance.

About the Author

Since 2001, Irene Stolte, ChFC, CLTC, LUTCF has built a reputation for providing superior service to her clients. Stolte joined Horizon Wealth Strategies in December 2014. In her role as a Financial Adviser with Eagle Strategies LLC, Stolte helps to provide a foundation for her client’s financial future. Stolte’s professional strengths help instill confidence within her clients, as she navigates them through what can often be a complicated and overwhelming process of identifying and coordinating financial goals. Irene has been an MDRT member for 9 years and has earned Court of the Table status.

Gen Z: What the insurance industry needs to know

Court: Zurich not liable for agents accused of misappropriating trade info

Advisor News

- How OBBBA is a once-in-a-career window

- RICKETTS RECAPS 2025, A YEAR OF DELIVERING WINS FOR NEBRASKANS

- 5 things I wish I knew before leaving my broker-dealer

- Global economic growth will moderate as the labor force shrinks

- Estate planning during the great wealth transfer

More Advisor NewsAnnuity News

- An Application for the Trademark “DYNAMIC RETIREMENT MANAGER” Has Been Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

- Product understanding will drive the future of insurance

- Prudential launches FlexGuard 2.0 RILA

- Lincoln Financial Introduces First Capital Group ETF Strategy for Fixed Indexed Annuities

- Iowa defends Athene pension risk transfer deal in Lockheed Martin lawsuit

More Annuity NewsHealth/Employee Benefits News

Life Insurance News

- ROUNDS LEADS LEGISLATION TO INCREASE TRANSPARENCY AND ACCOUNTABILITY FOR FINANCIAL REGULATORS

- The 2025-2026 risk agenda for insurers

- Jackson Names Alison Reed Head of Distribution

- Consumer group calls on life insurers to improve flexible premium policy practices

- Best’s Market Segment Report: Hong Kong’s Non-Life Insurance Segment Shows Growth and Resilience Amid Market Challenges

More Life Insurance News