Booming MYGA Sales Highlight Wink’s 1Q Annuity Sales Report

By Staff Reports

Total first-quarter sales for all deferred annuities were $55.5 billion -- led by the dominating sales of multi-year guaranteed annuities, Wink’s Sales & Market Report reports.

Noteworthy highlights for all deferred annuity sales in the first quarter include AIG ranking as the No. 1 carrier overall for deferred annuity sales, with a market share of 7.2%.

Jackson National Life followed in second place, while Lincoln National Life, New York Life and Allianz Life rounded-out the top five carriers in the market, respectively. Jackson National’s Perspective II Flexible Premium Variable & Fixed Deferred Annuity, a variable annuity, was the No. 1 selling deferred annuity, for all channels combined, in overall sales.

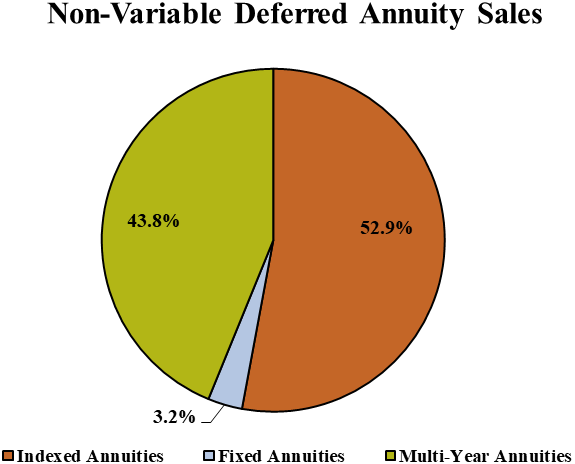

Total first-quarter non-variable deferred annuity sales were $33.4 billion; up 2.6% when compared to the previous quarter and up 44.8% when compared to the same period last year. Non-variable deferred annuities include the indexed annuity, traditional fixed annuity, and MYGA product lines.

Noteworthy highlights for non-variable deferred annuity sales in the first quarter include AIG ranking as the No. 1 carrier overall for non-variable deferred annuity sales, with a market share of 10.3%.

New York Life moved into second place, while Global Atlantic Financial Group, Allianz Life and Athene USA rounded-out the top five carriers in the market, respectively. Allianz Life’s Allianz 222 Annuity, an indexed annuity, was the No. 1 selling non-variable deferred annuity, for all channels combined, in overall sales.

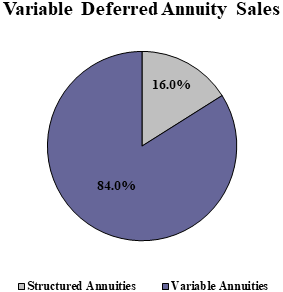

Total first-quarter variable deferred annuity sales were $22 billion. Given that this is the first quarter that Wink has collected data on sales of variable annuities, comparisons will be available in future quarters. Variable deferred annuities include the structured annuity and variable annuity product lines.

Noteworthy highlights for variable deferred annuity sales in the first quarter include Jackson National Life ranking as the No. 1 carrier overall for variable deferred annuity sales, with a market share of 15.6%.

AXS US took second place as Lincoln National Life, Prudential and Brighthouse Financial rounded-out the top five carriers in the market, respectively. Jackson National’s Perspective II Flexible Premium Variable & Fixed Deferred Annuity, a variable annuity, was the No. 1 selling variable deferred annuity, for all channels combined, in overall sales.

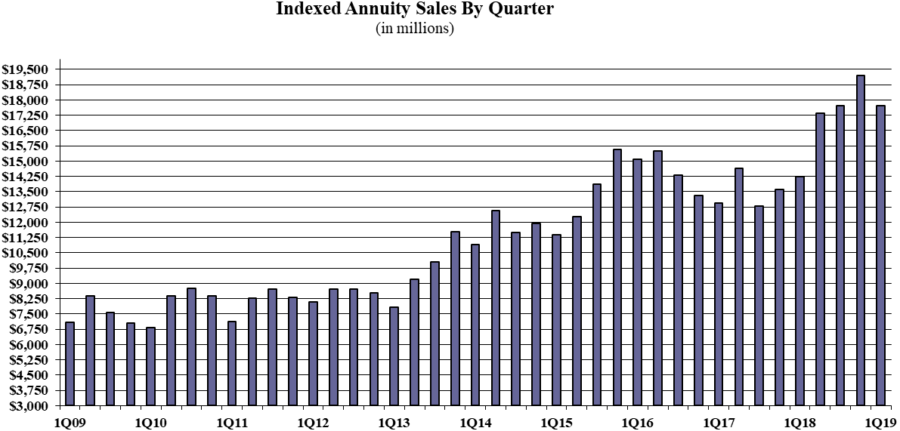

Indexed annuity sales for the first quarter were $17.7 billion; down 7.7% when compared to the previous quarter, and up 24.5% when compared with the same period last year. Indexed annuities have a floor of no less than zero percent and limited excess interest that is determined by the performance of an external index, such as Standard and Poor’s 500®.

“This was the strongest first quarter ever for indexed annuity sales” said Sheryl J. Moore, president and CEO of both Moore Market Intelligence and Wink, Inc. “It is unusual to see sales up this much year-over-year, but low fixed rates and market volatility have lent favorably to this product line.”

Noteworthy highlights for indexed annuities in the first quarter include Allianz Life retaining their No. 1 ranking in indexed annuities, with a market share of 11.9%. Athene USA held the second-ranked position while AIG, American Equity Companies, and Pacific Life Companies rounded-out the top five carriers in the market, respectively.

Allianz Life’s Allianz 222 Annuity was the No. 1 selling indexed annuity, for all channels combined, for the 19th consecutive quarter.

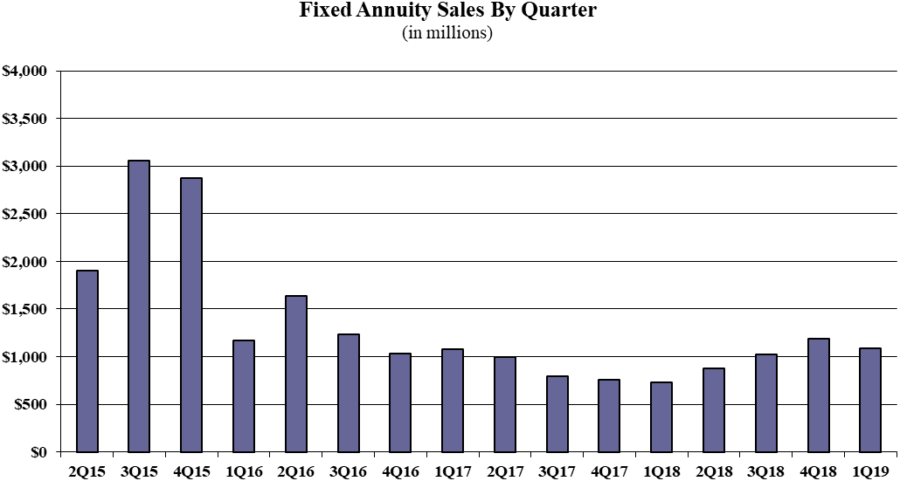

Traditional fixed annuity sales in the first quarter were $1 billion; down 8.2% when compared to the previous quarter, and up 48.9% when compared with the same period last year. Traditional fixed annuities have a fixed rate that is guaranteed for one year only.

Noteworthy highlights for traditional fixed annuities in the first quarter include Great American Insurance Group ranking as the No. 1 carrier in fixed annuities, with a market share of 14.6%. Modern Woodman of America ranked second while, Jackson National Life, Global Atlantic Financial Group and OneAmerica rounded-out the top five carriers in the market, respectively.

Great American’s American Freedom Aspire 5 was the No. 1 selling fixed annuity for the quarter, for all channels combined.

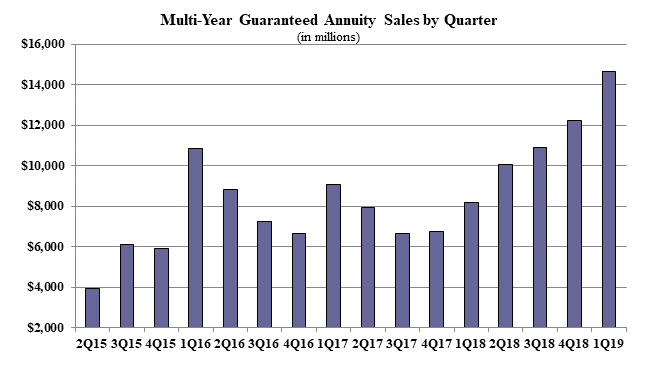

Multi-year guaranteed annuity (MYGA) sales in the first quarter were $14.6 billion; up over 19.8% when compared to the previous quarter, and up 79.8 % when compared to the same period last year. MYGAs have a fixed rate that is guaranteed for more than one year.

“Sales of MYGAs increased more over the past year than any other product line,” Moore said.

Noteworthy highlights for MYGAs in the first quarter include New York Life ranking as the No. 1 carrier, with a market share of 16.9%.

AIG moved into the second-ranked position, as Global Atlantic Financial Group, Massachusetts Mutual Life Companies, and Security Benefit Life rounded-out the top five carriers in the market, respectively. Forethought Life’s SecureFore 3 Fixed Annuity was the #1 selling multi-year guaranteed annuity for the quarter, for all channels combined.

Structured annuity sales in the first quarter were $3.5 billion; sales were flat as compared to the previous quarter and up 60.3% as compared to the previous year.

Structured annuities have a limited negative floor and limited excess interest that is determined by the performance of an external index or subaccounts.

“Structured annuity sales have consistently increased since their creation," Moore said. "When you talk about 60% increases in sales, people turn heads. This is definitely a product line that has plenty of opportunities for growth and innovation!”

Noteworthy highlights for structured annuities in the first quarter include AXA US ranking as the No. 1 carrier in structured annuities, with a market share of 31.2%. Brighthouse Life’s Shield Level Select 6-Year was the No. 1 selling structured annuity for the quarter, for all channels combined for the fifth consecutive quarter.

Variable annuity sales in the first quarter were $18.5 billion. Given that this is the first quarter that Wink has collected data on sales of variable annuities, comparisons will be available in future quarters.

Variable annuities have no floor, and potential for gains/losses that are determined by the performance of the subaccounts that may be invested in an external index, stocks, bonds, commodities, or other investments.

Noteworthy highlights for variable annuities in the first quarter include Jackson National Life ranking as the No. 1 carrier in variable annuities, with a market share of 18.6%. Prudential ranked second while, Lincoln National Life, AXA US, and Nationwide rounded-out the top five carriers in the market, respectively.

Jackson National’s Perspective II Flexible Premium Variable & Fixed Deferred Annuity was the No. 1 selling variable annuity for the quarter, for all channels combined.

Fifty-nine indexed annuity providers, 55 fixed annuity providers, 78 Multi-Year Guaranteed Annuity (MYGA) providers, 10 structured annuity providers, and 43 variable annuity providers participated in the 87th edition of Wink’s Sales & Market Report for 1st Quarter, 2019.

While Wink currently reports on indexed annuity, fixed annuity, multi-year guaranteed annuity, structured annuity, variable annuity, and multiple life insurance lines’ product sales. Sales reporting on additional product lines will follow at some point in the future, Moore said.

The Latest Must-Have Wedding Registry Item? Life Insurance

SEC To Vote On Best Interest Rule

Advisor News

- Americans increasingly worried about new tariffs, worsening inflation

- As tariffs roil market, separate ‘signal from the noise’

- Investors worried about outliving assets

- Essential insights a financial advisor needs to grow their practice

- Goldman Sachs survey identifies top threats to insurer investments

More Advisor NewsAnnuity News

- AM Best Comments on the Credit Ratings of Talcott Financial Group Ltd.’s Subsidiaries Following Announced Reinsurance Transaction With Japan Post Insurance Co., Ltd.

- Globe Life Inc. (NYSE: GL) is a Stock Spotlight on 4/1

- Sammons Financial Group “Goes Digital” in Annuity Transfers

- Somerset Reinsurance Announces the Appointment of Danish Iqbal as CEO

- Majesco Announces Participation in LIMRA 2025: Showcasing Cutting-Edge Innovations in Insurance Technology

More Annuity NewsHealth/Employee Benefits News

- Proxy Statement (Form DEF 14A)

- Idaho Senate approves Medicaid budget

- John Oliver sued by health care boss

- Pharmacy bill passes House committee

- Lowering the cost of insurance in Colorado – a new analysis of the Peak Health Alliance

More Health/Employee Benefits NewsLife Insurance News

- Annual Report 2024

- Revised Proxy Soliciting Materials (Form DEFR14A)

- Proxy Statement (Form DEF 14A)

- Exemption Application under Investment Company Act (Form 40-APP/A)

- AM Best Affirms Credit Ratings of CMB Wing Lung Insurance Company Limited

More Life Insurance News