Bipartisan group introduces bill to help Americans maximize Social Security benefits

A bipartisan group of senators have introduced a bill to better inform the public about the optimal time to start claiming Social Security.

The group is also asking the Social Security Administration to research why Americans claim benefits early and how to educate the public on the optimal age to start benefits.

While some legislators are calling for cuts in Social Security, this group is saying that many retirees are already shortchanged. Most Americans claim Social Security benefits early despite longer lifespans, leaving millions of elderly with fewer resources later in life.

“By claiming early, Americans forgo a significant amount of retirement income.” Bipartisan Senators group

The senators, Bill Cassidy, R-La., Tim Kaine, D-Va., Susan Collins, R-Maine, and Chris Coons, D-Del., sponsored legislation and sent a letter to acting Social Security Administrator Kilolo Kijakazi asking the agency to change how it educates the public about when to start claiming benefits.

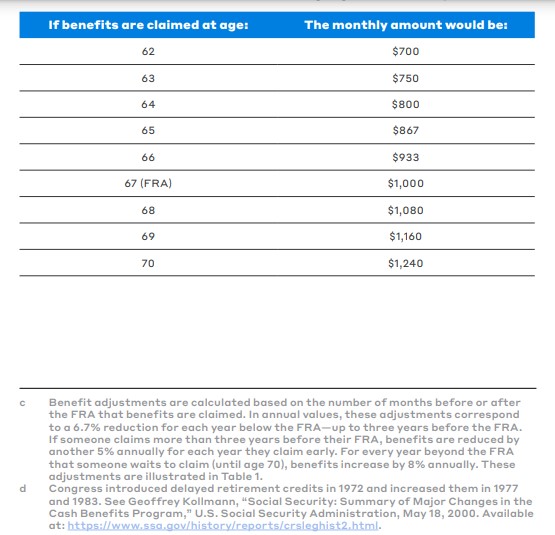

“By claiming early, Americans forgo a significant amount of retirement income,” the senators wrote. “A 2019 study estimated that today’s older Americans will lose a total of $3.4 trillion in potential income because of early claiming, with an average lifetime loss of $111,000 per household.”

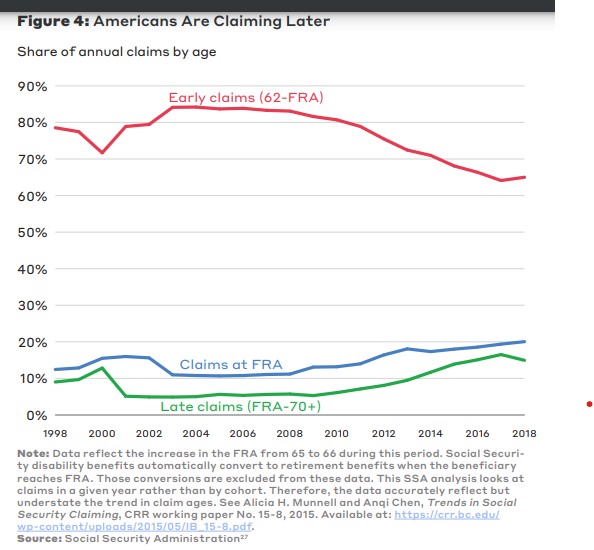

It is not a small problem, with the largest percentage of people claiming early. The second largest group claimed at the full retirement age of 66, rather than waiting for the maximum benefit age of 70.

“A large body of evidence has confirmed that delaying claiming past the Early Eligibility Age (EEA) of 62 is financially advantageous for most Americans, as it provides them with a greater monthly benefit for the remainder of their lives,” according to the letter. “Nonetheless, 62 remains the most frequent claiming age, with nearly 35 percent of men and 40 percent of women claiming at the EEA in 2018.”

The real Full Retirement Age

One of the group’s main points involves the terms describing Social Security retirement ages, which the senators say confuses the public.

“To provide additional clarity for Americans deciding when to claim their benefits, this legislation changes the Social Security Administration’s (SSA) terminology from ‘early eligibility age,’ ‘full retirement age,’ and ‘delayed retirement credits’ to ‘minimum benefit age,’ ‘standard benefit age,’ and ‘maximum benefit age’ to better reflect Social Security’s claiming design and how the program works,” according to the group’s announcement.

The legislation reflects a point that has been made by experts who say it is misleading not to call the age of maximum benefit the full retirement age, including Alice H. Munnell, director of the Center for Retirement Research at Boston College.

Munnell pointed out in a paper that calling 66 the full retirement age sets an inaccurate standard for people as they consider retirement. Simply put, retiring at the “Full Retirement Age” of 66 is in fact retiring early when the age of full benefits is 70.

“Eliminating the Full Retirement Age would dramatically clarify Social’s Security benefit structure,” Munnell wrote. “It would clearly signal that claiming at age 70 provides the appropriate benefit and would encourage people to work longer. Eliminating the concept would also force policymakers to call a cut a cut, and perhaps target reductions where they would cause less pain.”

List of questions drafted

The change in terminology is one of four points the senators drafted as questions in the letter to the Social Security Administration. They are:

- What are the primary factors leading Americans to claim Social Security retirement benefits earlier than the full retirement age? What actions has SSA taken thus far to address these factors or educate the public about the tradeoffs of early versus delayed claiming?

- What further steps does SSA plan to take to help Americans make more informed decisions about when to claim Social Security retirement benefits?

- Does SSA intend to change the claiming nomenclature to improve Americans’ understanding of how the program operates?We believe that the redesigned Social Security Statement is a positive step to

- wards providing Americans comprehensive information in a digestible format and commend the agency for that work. We also believe that the refreshed statement should be distributed on a more regular basis. Has SSA seen any difference in claiming behavior because of the rollout of the new Statement?

The legislation focuses on the last point regarding the benefit statement. The bill calls for the mailing of a paper statement when someone enters the work force or starts a new job, every five years after the age of 25, every two years after 55, and every year after 60. Individuals would be able to opt out of receiving paper statements.

Hard copy for hard facts

Reinstating paper statements was one of the points raised by a report cited by the senators that was published by the Bipartisan Policy Group exploring the impact of claiming benefits early and how to help people decide on the right age.

“Reinstate the paper Social Security Statement for a wide audience so the Social Security Administration can communicate annually with Americans about their expected retirement benefits and Social Security’s rules,” according to the report. “Officials could also visually redesign the Statement and improve the information it provides to better highlight key points and correct common misconceptions.”

More than half of households headed by someone at least 65 depend on Social Security for a majority of total income, with 19% relying on it for at least 90%. The report, released in August 2020, noted the high number of older Americans who lost their jobs. In just a few months, three million people age 55 and older became unemployed, leaving those 62 and older tempted to claim Social Security early. Although those people at that time were facing a decision balancing the tradeoff in claiming early, the authors said it is a situation that would remain after the pandemic.

“Millions of Americans are anxious about their ability to afford daily necessities when retired, including growing out-of-pocket medical costs,” according to the report. “Therefore, it is important to explore how public policy could help older Americans make decisions about Social Security benefits to best serve themselves and their families — during this moment of acute financial stress and after.”

Although it is wiser for some who expect shorter lifespans to take benefits early, usually people underestimate their longevity and claim too early. The report showed that about half of pre-retirement women and two-thirds of men underestimate the actual life expectancy of a 65-year-old.

The report did point out some good news. Although most people claim Social Security early, that percentage has been dropping over the past few decades.

Although the trend is encouraging, the authors said it is not changing fast enough to help save millions of Americans from struggling later in life as health care costs weigh heavier on them. Not only does delaying claiming benefits help individuals, it would also have a broad economic impact.

“Raising awareness that more years of work can yield higher Social Security benefits — and making clearer that delayed claiming offers important security — may increase labor force participation,” according to the report. “In addition, later claiming would keep more older Americans out of poverty, reducing the need for further government assistance. Helping older worker achieve more secure retirements is, thus, both an important goal in itself and may positively impact Americans of all ages.”

Steven A. Morelli is a contributing editor for InsuranceNewsNet. He has more than 25 years of experience as a reporter and editor for newspapers and magazines. He was also vice president of communications for an insurance agents’ association. Steve can be reached at stevenamorelli@gmail.com.

© Entire contents copyright 2023 by InsuranceNewsNet. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.

Women in Retirement: Outliving Security

IRI unveils 2023 roadmap for federal legislation, policy impacting retirees

Advisor News

- Retired advisor helps others sharpen their financial literacy skills

- Retirement plans could be hit by expiring tax cuts, survey finds

- Guardian releases The 2024 Guardian Annual and record-breaking financial results

- Worker retirement confidence unchanged, retirees more optimistic

- TIAA, MIT Age Lab ask if investors are happy with financial advice

More Advisor NewsAnnuity News

Health/Employee Benefits News

- Information of more than 9,000 people potentially exposed in Blue Cross and Blue Shield of Illinois data breach

- First Quarter 2025 Financial Supplement

- Baker City woman backing bill that would help herself and other disabled workers

- UnitedHealth Group avoids shareholder vote on coverage denial audits in wake of CEO killing

- How will Congress, executive orders impact health care?

More Health/Employee Benefits NewsLife Insurance News

- Term or permanent life insurance? A new study offers guidance: Ohio State University

- Business owners need a wake-up call about life insurance

- Best's Special Report: Insurers Exceed Cost of Capital Across Segments, Despite Varying Challenges

- Insurance Fight Follows Vermont Triple Homicide

- Annual Report for Fiscal Year Ending December 31, 2024 (Form 20-F)

More Life Insurance News