As insurance fraud attempts rise, LIMRA beefs up FraudShare

Account takeover might be among the scariest words that investors and retirees have never heard of, but it is happening more frequently, along with many other types of fraud.

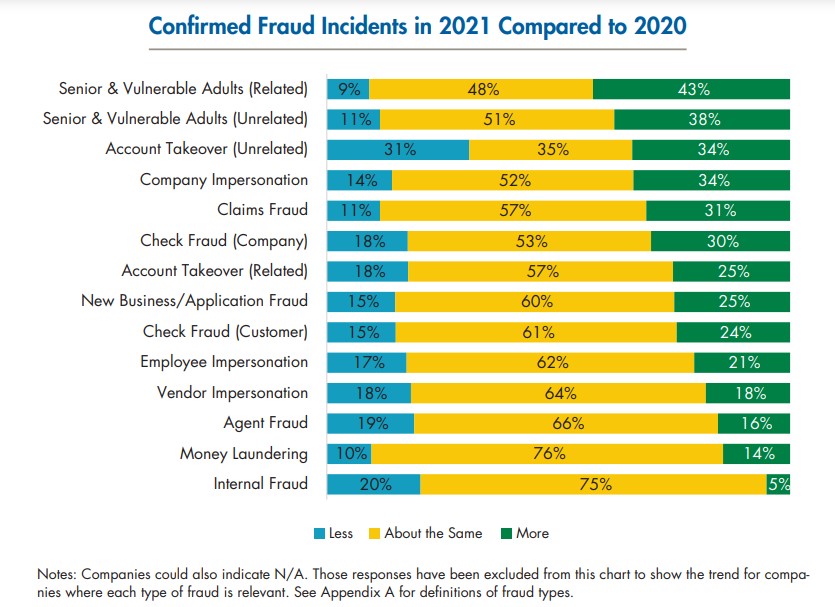

More than a third (34%) of companies reported increases in account takeover attempts in 2021 as compared to the previous year, according to LIMRA. Account takeovers occur when someone takes ownership of an online account without the owner’s knowledge, often with stolen credentials. In addition to account takeovers attempts, 34% of companies saw increases in company impersonation and 31% had increases in claims fraud.

A LIMRA report last month showed that fraud incidents increased last year in all but two categories of fraud. (Please note that fraud “incidents” shown in the chart below are attempts and do not indicate that the account takeover attempts were successful.)

The average disbursements request last year was $80,000, up 38% over prior year, and the average account value targeted was $280,000, up 30%, according to the report.

To address the increase in cybercrime, LIMRA developed the FraudShare detection system for insurance and retirement companies in 2019 and is now expanding capabilities in partnership with Verisk, a leading global data analytics company. FraudShare already serves 53 companies, representing 70% of the life insurance market, 60% of the U.S. annuity market and 25% of the retirement services market.

FraudShare users will have access to enhanced threat intelligence data, expanded data analytics and automation capabilities through Verisk. Users will be alerted to account takeover attacks with real time access to FraudShare threat detection and early warning systems, said Maroun Mourad, Verisk president of life & growth markets.

Verisk started as a multi-company cooperative for the property-casualty industry in 1971 as a one-stop shop for statistical information. ISO became a public company, Verisk, in 2009, and has expanded to the life and annuity space.

Verisk now has a 1.5 billion claims database that has relevance to the life industry, said Mourad. Besides claims, the company pulls in a wide variety of data from third-party sources, such as Yelp reviews, which help round out what typical data sources might miss. In 2020, Verisk acquired Jornaya, a well-known data company in the life industry. The system would instantly match data to see suspicious activity and patterns.

Flags for suspicious activity

“There are flags for suspicious activity and with automatic matching of the FraudShare database against the customer's own ongoing transactions as well,” Mourad said. “That could happen in real time to basically prevent or at least flag these attacks.” LIMRA CEO David Levenson said the association chose Verisk for its depth of data and analytics.

“They're a very large player, one of the largest players in predictive analytics and technology,” Levenson said, adding that FraudShare will integrate with the FAST platform that Verisk acquired in 2019.

FAST, or “Flexible Architecture, Simplified Technology,” provides a software platform of “out-of-the-box components that life insurers can use to quickly enhance or replace their legacy policy administration systems,” according to the announcement when Verisk acquired FAST. Verisk said FAST gives it a channel to deliver its analytics to support straight-through underwriting. Companies that use both FraudShare and Verisk will be able to have both on one platform.

“So, all of the fraud prevention tools become automated,” Levenson said. “They become fully integrated and fully automated and the amount that any individual has to do to assess whether or not there's fraud in the system is minimized, because the system will end up doing a lot of the work.”

Steven A. Morelli is a contributing editor for InsuranceNewsNet. He has more than 25 years of experience as a reporter and editor for newspapers and magazines. He was also vice president of communications for an insurance agents’ association. Steve can be reached at [email protected].

© Entire contents copyright 2022 by InsuranceNewsNet. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.

Steven A. Morelli is a contributing editor for InsuranceNewsNet. He has more than 25 years of experience as a reporter and editor for newspapers and magazines. He was also vice president of communications for an insurance agents’ association. Steve can be reached at [email protected].

Course correction: Insurers revisit portfolio strategies

State credit quality appears stable for now, but concerns are on horizon

Advisor News

- Global economic growth will moderate as the labor force shrinks

- Estate planning during the great wealth transfer

- Main Street families need trusted financial guidance to navigate the new Trump Accounts

- Are the holidays a good time to have a long-term care conversation?

- Gen X unsure whether they can catch up with retirement saving

More Advisor NewsAnnuity News

- Pension buy-in sales up, PRT sales down in mixed Q3, LIMRA reports

- Life insurance and annuities: Reassuring ‘tired’ clients in 2026

- Insurance Compact warns NAIC some annuity designs ‘quite complicated’

- MONTGOMERY COUNTY MAN SENTENCED TO FEDERAL PRISON FOR DEFRAUDING ELDERLY VICTIMS OF HUNDREDS OF THOUSANDS OF DOLLARS

- New York Life continues to close in on Athene; annuity sales up 50%

More Annuity NewsHealth/Employee Benefits News

Life Insurance News

- Legals for December, 12 2025

- AM Best Affirms Credit Ratings of Manulife Financial Corporation and Its Subsidiaries

- AM Best Upgrades Credit Ratings of Starr International Insurance (Thailand) Public Company Limited

- PROMOTING INNOVATION WHILE GUARDING AGAINST FINANCIAL STABILITY RISKS SPEECH BY RANDY KROSZNER

- Life insurance and annuities: Reassuring ‘tired’ clients in 2026

More Life Insurance News