Another Record-Setting Year For Indexed Annuities In 2019: Wink

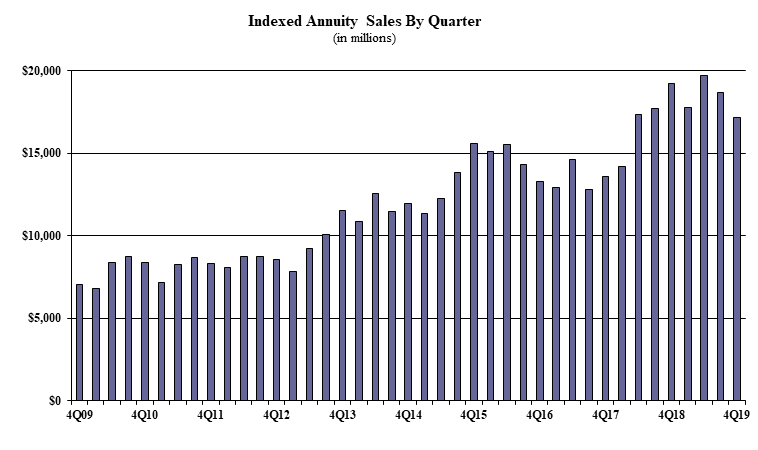

Overall 2019 indexed annuity sales were $73.2 billion, a record-setting year that ended with a downturn, reports Wink's Sales & Market Report.

Indexed annuity sales for the fourth quarter were $17.1 billion, down 8.1% when compared to the previous quarter, and down 10.6% when compared with the same period last year.

But Sheryl J. Moore, president and CEO of both Moore Market Intelligence and Wink, Inc., focused on the positives in 2019 and 2020.

“Given the recent volatility in the markets, coupled with even lower fixed interest rates, I suggest we are going to have a repeat in 2020,” she said.

Indexed annuities have a floor of no less than zero percent and limited excess interest that is determined by the performance of an external index, such as Standard and Poor’s 500®.

Noteworthy highlights for indexed annuities in the fourth quarter include Allianz Life retaining their No. 1 ranking in indexed annuities, with a market share of 9.8%. AIG held the second-ranked position while Nationwide, Jackson National Life, and Athene USA rounded out the top five carriers in the market, respectively.

Allianz Life’s Allianz 222 Annuity was the No. 1 selling indexed annuity, for all channels combined, for the twenty-second consecutive quarter.

Total fourth-quarter sales for all deferred annuities were $53.3 billion, a decline of 3.3% compared to the previous quarter. Total 2019 deferred annuity sales were $221.8 billion.

Noteworthy highlights for all deferred annuity sales in the fourth quarter include Jackson National Life ranking as the No. 1 carrier overall for deferred annuity sales, with a market share of 9.8%. Lincoln National Life followed in second place, while AIG, Equitable Financial and Allianz Life rounded-out the top five carriers in the market, respectively.

Jackson National’s Perspective II Flexible Premium Variable & Fixed Deferred Annuity, a variable annuity, was the No. 1 selling deferred annuity, for all channels combined in overall sales for the fourth consecutive quarter.

Total fourth-quarter non-variable deferred annuity sales were $26.9 billion, down 7.6% compared to the previous quarter and down 17.8% compared to the same period last year. Total 2019 non-variable deferred annuity sales were $122.8 billion.

Non-variable deferred annuities include the indexed annuity, traditional fixed annuity, and MYGA product lines.

Noteworthy highlights for non-variable deferred annuity sales in the fourth quarter include AIG ranking as the No. 1 carrier overall for non-variable deferred annuity sales, with a market share of 8.5%. Allianz Life remained in second place, while Jackson National Life, Global Atlantic Financial Group and Nationwide rounded-out the top five carriers in the market, respectively.

Allianz Life’s Allianz 222 Annuity, an indexed annuity, was the No. 1 selling non-variable deferred annuity, for all channels combined, in overall sales for the fifteenth consecutive quarter.

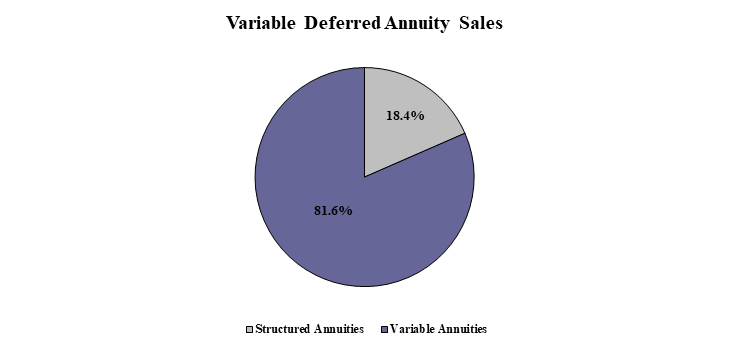

Total fourth-quarter variable deferred annuity sales were $26.3 billion, an increase of 1.3% compared to the previous quarter. Total 2019 variable deferred annuity sales were $99.0 billion.

Variable deferred annuities include the structured annuity and variable annuity product lines.

“A steadily-rising market and continued rate reductions for fixed annuities lent to increased sales of structured and variable annuities this quarter,” Moore said.

Noteworthy highlights for variable deferred annuity sales in the fourth quarter include Jackson National Life ranking as the No. 1 carrier overall for variable deferred annuity sales, with a market share of 13.9%. Equitable Financial maintained the second place as Lincoln National Life, Prudential and Brighthouse Financial rounded-out the top five carriers in the market, respectively.

Jackson National’s Perspective II Flexible Premium Variable & Fixed Deferred Annuity, a variable annuity, was the No. 1 selling variable deferred annuity, for all channels combined, in overall sales for the fourth consecutive quarter.

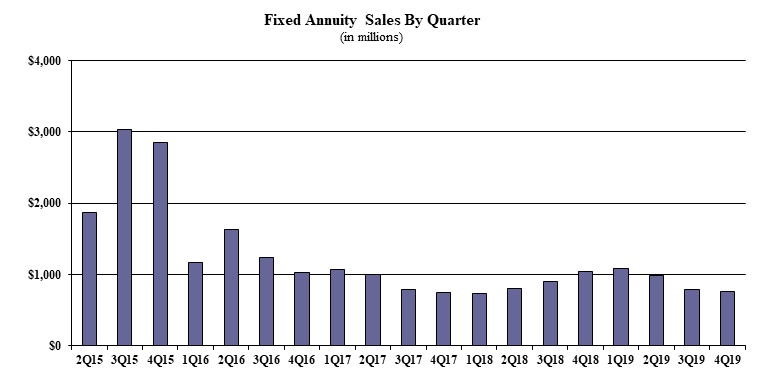

Traditional fixed annuity sales in the fourth quarter were $764.7 million, down 2.6% compared to the previous quarter, and down 26.5% compared with the same period last year.

Total 2019 fixed annuity sales were $3.6 billion. Traditional fixed annuities have a fixed rate that is guaranteed for one year only.

Noteworthy highlights for traditional fixed annuities in the fourth quarter include Great American Insurance Group ranking as the No. 1 carrier in fixed annuities, with a market share of 10.9%. Modern Woodmen of America ranked second, while Global Atlantic Financial Group, Jackson National Life, and OneAmerica rounded-out the top five carriers in the market, respectively.

Forethought Life ForeCare Fixed Annuity was the No. 1 selling fixed annuity for the third consecutive quarter, for all channels combined.

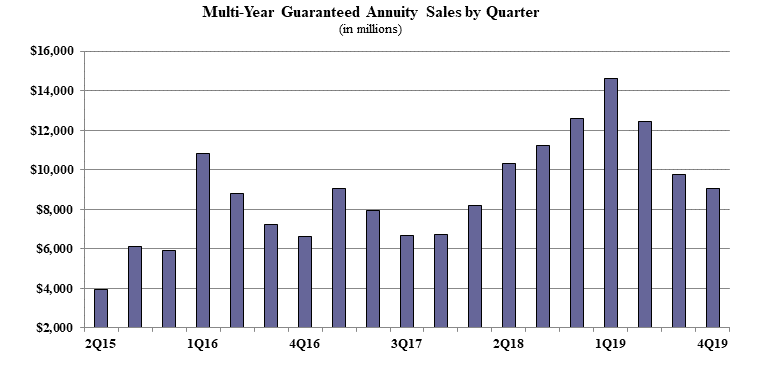

Multi-year guaranteed annuity (MYGA) sales in the fourth quarter were $9 billion, down 7% compared to the previous quarter, and down 28% compared to the same period last year.

Total 2019 MYGA sales were $45.8 billion. MYGAs have a fixed rate that is guaranteed for more than one year.

Noteworthy highlights for MYGAs in the fourth quarter include Massachusetts Mutual Life Companies ranking as the No. 1 carrier, with a market share of 13.2%. New York Life maintained the second-ranked position, as Symetra Financial, AIG and Global Atlantic Financial Group rounded out the top five carriers in the market, respectively.

Massachusetts Mutual Life’s Stable Voyage 3-Year was the No. 1 selling multi-year guaranteed annuity for the quarter, for all channels combined.

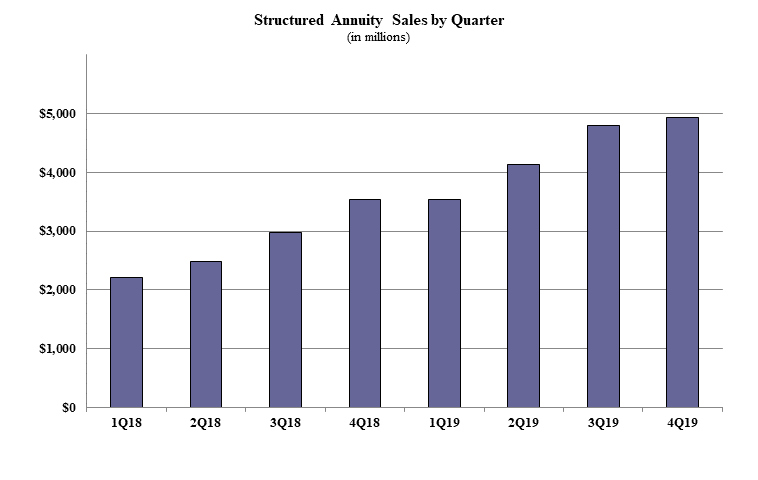

Structured annuity sales in the fourth quarter were $4.9 billion, up 2.7% compared to the previous quarter, and up 39.3% compared to the previous year.

Total 2019 structured annuity sales were $17.3 billion. Structured annuities have a limited negative floor and limited excess interest that is determined by the performance of an external index or subaccounts.

“Structured annuity sales are still setting records,: Moore said. "It will be interesting to see how low fixed interest rates, coupled with market volatility, will affect this immature product line, in terms of sales.”

Noteworthy highlights for structured annuities in the fourth quarter include Equitable Financial ranking as the No. 1 carrier in structured annuities, with a market share of 28.9%. Equitable Financial’s Structured Capital Strategies Plus was the No. 1 selling structured annuity for the quarter, for all channels combined.

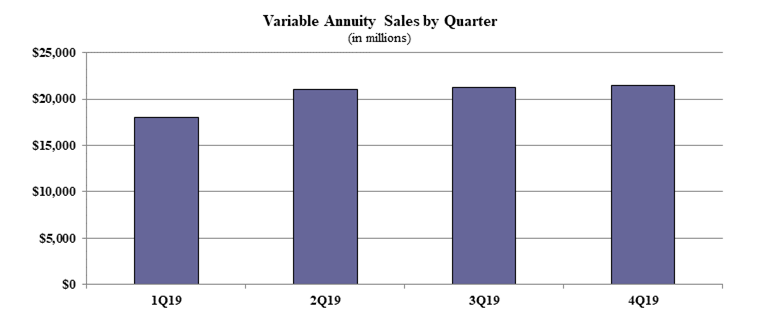

Variable annuity sales in the fourth quarter were $21.4 billion, an increase of 1% compared to the previous quarter. Total 2019 variable annuity sales were $81.6 billion.

Variable annuities have no floor, and potential for gains/losses that are determined by the performance of the subaccounts that may be invested in an external index, stocks, bonds, commodities, or other investments.

“It isn’t surprising to see an increase in variable annuity sales, given the market’s performance at the close of the year,” Moore said.

Noteworthy highlights for variable annuities in the fourth quarter include Jackson National Life holding-on to their ranking as the No. 1 carrier in variable annuities, with a market share of 17.2%.

Lincoln National ranked second, while Prudential, Equitable Financial, and Nationwide rounded-out the top five carriers in the market, respectively. Jackson National’s Perspective II Flexible Premium Variable & Fixed Deferred Annuity was the No. 1 selling variable annuity for the fourth consecutive quarter, for all channels combined.

Sixty-two indexed annuity providers, 50 fixed annuity providers, 68 multi-year guaranteed annuity (MYGA) providers, 11 structured annuity providers, and 47 variable annuity providers participated in the 90th edition of Wink’s Sales & Market Report for 4th Quarter, 2019.

Wink currently reports on indexed annuity, fixed annuity, multi-year guaranteed annuity, structured annuity, variable annuity, and multiple life insurance lines’ product sales. Sales reporting on additional product lines will follow in the future.

InsuranceNewsNet Senior Editor John Hilton has covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

COVID-19: Business Interruption Coverage May Require Creativity

Ten Tips To Guide Your Staff Through COVID-19 Crisis

Advisor News

- DOL proposes new independent contractor rule; industry is ‘encouraged’

- Trump proposes retirement savings plan for Americans without one

- Millennials seek trusted financial advice as they build and inherit wealth

- NAIFA: Financial professionals are essential to the success of Trump Accounts

- Changes, personalization impacting retirement plans for 2026

More Advisor NewsAnnuity News

- F&G joins Voya’s annuity platform

- Regulators ponder how to tamp down annuity illustrations as high as 27%

- Annual annuity reviews: leverage them to keep clients engaged

- Symetra Enhances Fixed Indexed Annuities, Introduces New Franklin Large Cap Value 15% ER Index

- Ancient Financial Launches as a Strategic Asset Management and Reinsurance Holding Company, Announces Agreement to Acquire F&G Life Re Ltd.

More Annuity NewsHealth/Employee Benefits News

- After enhanced Obamacare health insurance subsidies expire, the effects are starting to show

- CommunityCare: Your Local Medicare Resource

- AG warns Tennesseans about unlicensed insurance seller

- GOVERNOR HOCHUL LAUNCHES PUBLIC AWARENESS CAMPAIGN TO EDUCATE NEW YORKERS ON ACCESS TO BEHAVIORAL HEALTH TREATMENT

- Researchers from Pennsylvania State University (Penn State) College of Medicine and Milton S. Hershey Medical Center Detail Findings in Aortic Dissection [Health Insurance Payor Type as a Predictor of Clinical Presentation and Mortality in …]: Cardiovascular Diseases and Conditions – Aortic Dissection

More Health/Employee Benefits NewsLife Insurance News