Annuity sellers need to work harder to satisfy customers, J.D. Power finds

A new J.D. Power survey finds that 43% of producers fill out annuity applications for their clients. Not surprisingly, they are the buyers least likely to understand what they bought.

The majority (59%) of current annuity customers struggle with their financial health and many do not fully understand the products they are buying, concluded the J.D. Power 2024 U.S. Individual Annuity Study.

The study measures the experiences of customers of the biggest annuity companies in the across eight core dimensions (in order of importance): trust, value for price, ability to get service, ease of doing business, people, product offerings, digital channels, and problem resolution, explained Breanne Armstrong, director of insurance intelligence at J.D. Power.

Some of these eight dimensions might come into conflict as a producer is trying to close a sale. For instance, filling out the application for the customer "seems really helpful," Amrstrong told InsuranceNewsNet, "but then ultimately they end up not understanding the product as much, because they lost that initial education component.

"So, it's a little easier to do business and you might rate the people a little higher, but then ultimately, it results in less understanding down the road and lower satisfaction."

J.D. Power repeats the survey annually but redesigned this year's version. The data on who is actually filling out the application is one of the newly refined questions, Armstrong explained. The 2024 study is based on responses from 3,914 individual annuity customers and was fielded from April through July 2024.

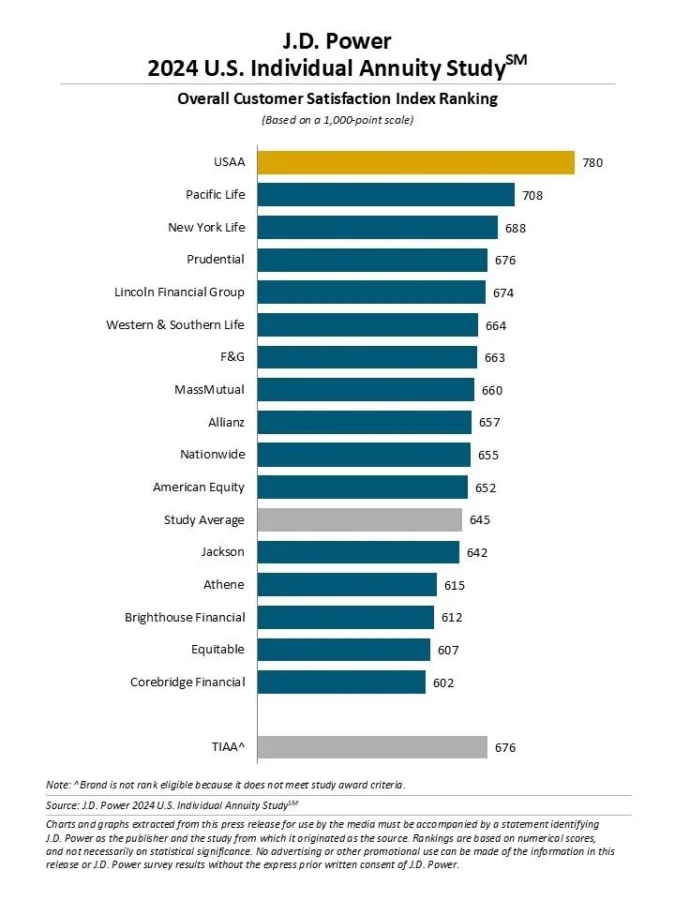

The resulting scores put USAA and Pacific Life on top.

Education is fundamental

The most satisfied annuity buyers are those who receive educational tools and attention early in the process, Armstrong said. And companies with an "exclusive agent relationship" seem to do better at this part of the process, she added.

"We do tend to see brands that have a better onboarding process and customers feel more comfortable," Armstrong said. "They feel like they understand things more during that part of the process. [Those companies] tend to have a better score, a better rating overall."

That doesn't mean those annuity companies operating in the independent channel can't keep up. They just have to work a little harder to earn a satisfied customer.

"You can counteract that by being a brand that has those additional tools available and educational materials, and helping to inform customers of the product," Armstrong said.

Annuity products vary from simple income annuities to far more complex indexed products and variable products with subaccounts and riders. The industry suffered reputational harm for decades due to product complexity and improper sales.

Increased interest in digital

Understanding of the annuity contract and costs and fees is significantly higher when the agent or advisor provides the customer with information on navigating the provider’s website and/or mobile app or directs the customer to available educational videos about the annuity during onboarding, J.D. Power said.

Recent studies reveal a "spike" in a digital commitment by annuity sellers, Armstrong said. The results are starting to show up on the satisfaction side.

"When we start cutting the data among people who have used some type of digital tool, but especially if they can access an app, we see a lot higher satisfaction overall," she said.

The growing expectations around what a website should deliver, what an app should deliver, are likely to drive continued evolution of digital.

"I think what's happening is that a lot of annuity providers are starting to realize that you can't just have that table stakes of just having an app now available, because that was just the first step," Armstrong said. "I think a lot of companies have been behind, and are still kind of behind on the digital piece for annuities."

© Entire contents copyright 2024 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

Workplace benefits: How to help workers understand and use them

AI-driven solutions to overcome insurance industry hurdles

Advisor News

- TIAA, MIT Age Lab ask if investors are happy with financial advice

- Youth sports cause parents financial strain

- Americans fear running out of money more than death

- Caregiving affects ‘sandwich generation’s’ retirement plans

- Why financial consciousness is the key to long-term clarity

More Advisor NewsAnnuity News

Health/Employee Benefits News

- Bill aimed at holding health insurance companies accountable stalls at Capitol

- Health Insurance Subsidies Set to Expire, Threatening Coverage for Millions

- Expiring health insurance tax credits loom large in Pennsylvania

- Confusion muddies the debate over possible Medicaid cuts

- Trump protesters in Longview aim to protect Medicaid, democracy, due process

More Health/Employee Benefits NewsLife Insurance News

- IUL: Offering stability amid trade tariff uncertainty

- ‘Really huge’ opportunity for life insurance sales if riddle can be solved

- Americans fear running out of money more than death

- NAIFA eyes tax reform, retirement issues in 2025

- Legislation would change tax treatment of life insurers’ debt investments

More Life Insurance News