Annuity Sales ‘On An Upswing’; Second Quarter Data Confirms

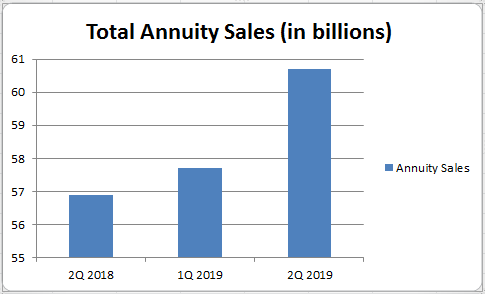

Overall annuity sales rose 5.2 percent in the second quarter of 2019, according to the Insured Retirement Institute.

The combined sales of fixed and variable annuities totaled $60.7 billion, compared to sales of $57.7 billion in the first quarter of 2019, according to data reported by Beacon Research and Morningstar.

Sales were also higher than year ago levels, up 6.7 percent from total annuity sales of $56.9 billion in the second quarter of 2018.

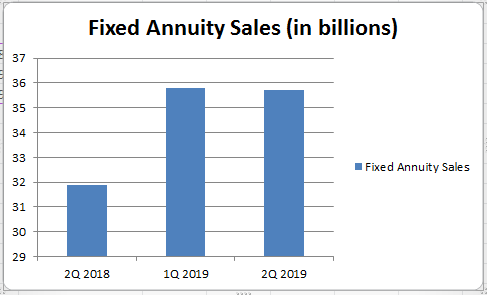

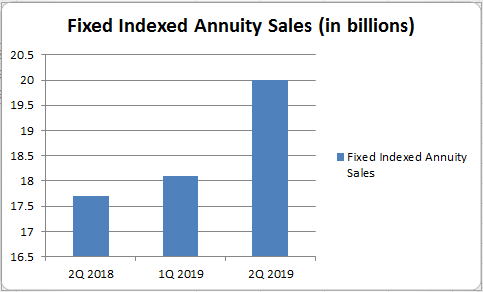

The following graphs were created using data reported by IRI and compiled by Beacon and Morningstar.

“Annuity sales appear to be on an upswing, driven by consumer need and a growing awareness of the importance of allocating a portion of savings to annuity products, which can guarantee lifetime income and protect against market downturns," said IRI President and CEO Wayne Chopus.

According to Beacon Research, fixed annuity sales continue their long-term upward trend, albeit with some product types showing lower sales versus the fourth quarter of 2018.

For the entire fixed annuity market, there were approximately $20.7 billion in qualified sales and $15 billion in non-qualified sales during the second quarter of 2019.

“Fixed indexed annuity sales reached a new record high in the second quarter,” said Beacon Research CEO Jeremy Alexander. “As Americans increasingly seek higher potential yields, safety of principal, and the ability to create an income stream they cannot outlive, we expect fixed indexed sales to continue to grow and product issuers to innovate in order to deliver the protection, growth and income consumers demand.”

According to Morningstar, variable annuity net assets rose in the second quarter on continued positive returns in equity markets and a modest improvement in net cash flow. Additional highlights:

- Variable annuity assets rose 1.5 percent from $1.93 trillion to $1.96 trillion in the first quarter of 2019.

- Allocation funds held $806.5 billion in VA assets, or 41.1 percent of the total, surpassing the $800 billion mark for the first time.

- Equity funds held $607.9 billion, or 31 percent of total VA assets.

- Fixed accounts held $347.5 billion, or 17.7 percent.

Net asset flows in variable annuities were -$20.4 billion in the second, an improvement over outflows of $24.8 billion in the first quarter and $21.1 billion in the second quarter of 2018.

Within the variable annuity market, there were $16.6 billion in qualified sales and $8.4 billion in non-qualified sales during the second quarter of 2019.

“Variable annuities saw a significant sales increase in the second quarter relative to Q1, with structured annuities experiencing rapid growth,” said Michael Manetta, Senior Quantitative Analyst at Morningstar. “Structured annuities, with returns based on index option strategies and a measure of downside protection, share some of the characteristics of fixed indexed annuities and appear to be resonating with investors. In fact, of the 13 VA products with sales of $500 million or more in the second quarter, the two fastest growing were structured products.”

Both Morningstar and Beacon report sales for certain structured annuities filed with the SEC. In order to avoid confusion between fixed and variable and eliminate overstatement, sales data for these products is consolidated within the VA universe, resulting in sales totals that are slightly higher than sales reported by Morningstar, Inc. and slightly lower than sales reported by Beacon.

Fed Cuts Interest Rates, Trump Blasts Powell Anyway: ‘No Guts!’

NAIFA/ACLI Focusing Advocacy Efforts On The State Level

Advisor News

- The best way to use a tax refund? Create a holistic plan

- CFP Board appoints K. Dane Snowden as CEO

- TIAA unveils ‘policy roadmap’ to boost retirement readiness

- 2026 may bring higher volatility, slower GDP growth, experts say

- Why affluent clients underuse advisor services and how to close the gap

More Advisor NewsAnnuity News

- Protective Expands Life & Annuity Distribution with Alfa Insurance

- Annuities: A key tool in battling inflation

- Pinnacle Financial Services Launches New Agent Website, Elevating the Digital Experience for Independent Agents Nationwide

- Insurer Offers First Fixed Indexed Annuity with Bitcoin

- Assured Guaranty Enters Annuity Reinsurance Market

More Annuity NewsHealth/Employee Benefits News

- UnitedHealth Group shares fall nearly 20% on Medicare Advantage woes

- UnitedHealth earnings plunge 41%, issues soft 2026 guidance

- WMATA TRAIN OPERATORS PLEAD GUILTY IN HEALTH CARE FRAUD SCHEME

- UnitedHealth Group shares falling on Medicare Advantage woes

- Californians encouraged to join Covered California, enroll in health insurance by Jan. 31 deadline

More Health/Employee Benefits NewsLife Insurance News