Annual family premiums for employer coverage average $22,463 this year

Annual family premiums for employer-sponsored health insurance average $22,463 this year, similar to last year ($22,221), the 2022 benchmark KFF Employer Health Benefits Survey finds. On average, workers this year are contributing $6,106 toward the cost of family premium, with employers paying the rest.

Among workers who face an annual deductible for single coverage, the average this year stands at $1,763, similar to last year ($1,669) but up 61% since 2012 ($1,097).

“Employers are already concerned about what they pay for health premiums, but this could be the calm before the storm, as recent inflation suggests that larger increases are imminent,” KFF President and CEO Drew Altman said. “Given the tight labor market and rising wages, it will be tough for employers to shift costs onto workers when costs spike.”

The report reveals ongoing disparities in the burden of health care costs on workers at smaller and large employers. Workers at small firms (with less than 200 workers) on average pay $7,556 out of their paychecks annually for family coverage – nearly $2,000 more than workers at larger firms ($5,580).

For single coverage, workers at small and large firms contribute similar amounts toward their coverage, though small-firm workers face much larger deductibles on average ($2,543 vs. $1,493). Viewed another way, nearly half (49%) of workers at small firms face an average deductible of at least $2,000, while just a quarter (25%) of workers at large firms do.

Almost 159 million Americans rely on employer-sponsored coverage, and the 24th annual survey of more than 2,100 small and large employers provides a detailed picture of the trends affecting it. In addition to the full report and summary of findings released today, the journal Health Affairs is publishing an article with select findings online. The article will also appear in its December issue.

Modest change in premiums may not continue

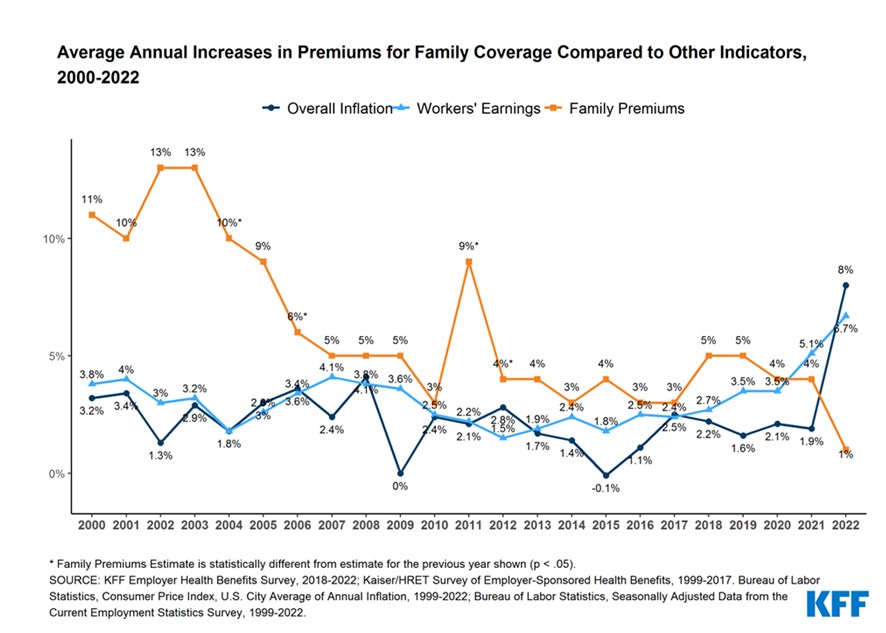

The modest change in premiums this year is unusual in that it is less than the increase in inflation (8%) or workers’ wages (6.7%) during the same period. Even with this year’s minimal change, average premiums for family coverage have risen 43% since 2012, more than the shift in inflation (25%) and a little more than wages (38%) over the same period.

Employer costs for this year were largely set last year, before inflation became a major economic concern and after the COVID-19 pandemic led to a temporary slowdown in utilization of health care services.

Large firms see growing mental health need

Following the COVID-19 pandemic, which brought new attention to mental health needs, the survey finds that almost half (48%) of large employers report an increase in the share of workers using mental health care services, and more than a quarter (29%) say more workers are asking for family leave due to mental health issues.

A smaller share of large employers say they have seen an increase in the share of workers using substance use services (14%), while more than four in ten (43%) say that they are at least somewhat concerned about the growth of substance-use conditions among their workers.

The survey finds that more than a quarter (27%) of large employers this year added mental health providers – either in physical offices or virtually through telehealth – to their plan’s networks to expand access. Even with those additions, three in ten (30%) large employers say their networks do not have enough behavioral health providers to ensure their workers have timely access to care.

Nearly half (47%) of large firms say telemedicine matters “a great deal” in providing access to mental health services.

Almost all large firms (96%) now cover some form of telemedicine services, either directly through their health plan (46%), through a specialized telemedicine provider (32%), or both (20%).

More than half expect telemedicine to be “very important” in providing behavioral health services (55%) and serving enrollees in remote areas (54%). Smaller but still significant shares say telemedicine will be “very important” in providing primary care (35%) and specialty care (24%).

“Many large employers are struggling to add enough mental health and substance use providers to meet their workers’ growing needs,” said Gary Claxton, a KFF senior vice president and director of the Health Care Marketplace Project, the lead author of the study and also of the Health Affairs article. “Most consider telemedicine to be an important part of the solution.”

Other findings include:

- Offer rate. Nearly all (99%) large employers offer health benefits to at least some of their workers, though smaller firms are increasingly less likely to offer health benefits as they get smaller. For example, two thirds (67%) of firms with 10 to 199 employers offer health benefits to at least some of their workers, while just 39% of firms with three to nine workers do so.

- Spousal coverage restrictions. While most employers allow a worker’s spouse to enroll in coverage even if they are offered other coverage, 16% do not allow spouses to enroll in such circumstances, and another 14% place restrictions on the spouses’ enrollment. Some (5%) charge spouses more for coverage if they have access to other coverage.

- Helping employees buy non-group coverage. The survey finds 11% of firms that offer health benefits to at least some workers and 7% of those who don’t offer funds for some employers to purchase non-group coverage, such as that offered on the Affordable Care Act marketplaces. Such assistance can be provided in a tax-preferred way though Individual Coverage Health Reimbursement Arrangements.

- Coverage for insulin and statins. Most covered workers are in plans that cover the cost of at least some insulin products (70%) and statins for treating high cholesterol (71%) before they meet their general annual deductible. This follows a 2019 change in policies that allowed plans eligible for use with a Health Savings Account plans to cover these expenses as preventive services.

LIMRA exec: Annuity sales can go even higher than record 3Q sales

Ransomware remains a top cyber risk for businesses

Advisor News

- How is consumers’ investing confidence impacting the need for advisors?

- Can a balance of withdrawals and annuities outshine the 4% rule?

- Economy ‘in a sweet spot’ but some concerns ahead

- Trump, Capitol allies likely looking at quick cryptocurrency legislation

- SEC panel reviews mandatory arbitration clause in investment advisory agreements

More Advisor NewsAnnuity News

Life Insurance News

Property and Casualty News

- As Louisiana insurance rates keep climbing, Jeff Landry 'frustrated' with lack of progress

- Earthquake policyholders few despite quake risk

- Nio Inc. Sees 4,400 of its New EVs Get Auto Insurance in China in One Week

- CCC Intelligent Solutions Announces the Acquisition of EvolutionIQ, the Leading AI Guidance Platform for Disability and Injury Claims Management

- NY Attorney General secures $500K against insurance company for data breach

More Property and Casualty News