All Workers Need Paid Family And Medical Leave, Prudential Says

The president of Prudential Group Insurance called for a public-private partnership to provide paid family and medical leave to all U.S. workers.

During a webinar held Wednesday, Jamie Kalamarides, president of Prudential Group Insurance, described providing paid leave as the biggest opportunity to help workers as the economy takes steps to come back after the COVID-19 shutdown.

The Families First Coronavirus Response Act was signed into law in March, establishing an emergency paid leave program for workers who take COVID-19-related work absences. However, it applies only to small businesses with fewer than 500 employees and certain public employers. It also offers certain exemptions for employers with less than 50 employees, and lasts only through the end of this year.

The pandemic and its resulting challenges for businesses and workers brought home the need for “a comprehensive solution to providing paid leave to all workers—what has come to be known generically as ‘paid family and medical leave,’” Kalamarides said.

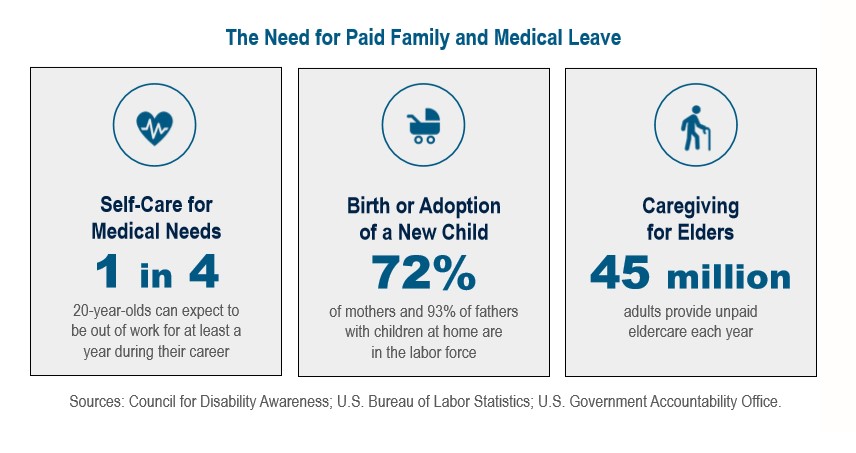

A robust PFML solution, he said, would provide partially or fully compensated time away from work for all Americans who need to attend to a personal illness or care for an ill family member or new child. “Given broad public support, the question increasingly is not whether this will happen, but when and how.”

Less than half (47%) of full-time workers have access to paid medical leave through employer-provided short-term disability insurance, according to an American Council of Life Insurers report. Only 30% of the nation’s lowest-paid private sector workers have access to paid sick days, for example, compared to 93% of the highest-paid workers, according to the National Partnership for Women & Families.

Kalamarides said a federal solution to paid leave “would help to ensure consistent access for all workers.”

“Any public solution would be enhanced by leveraging the experience and capabilities of the private sector to create cost efficiencies and improve speed to market. Public-private partnerships have a proven history of promoting financial security in the U.S.”

The lack of paid leave may harm workers’ overall wellness, according to Prudential’s research.

- Unpaid leave can push the most financially vulnerable Americans into financial insecurity.

- Being forced to take unpaid leave may cause many employees to return to work before they have adequately recovered from a medical condition.

- Many adult children struggle to balance the responsibilities of work and eldercare, often arriving at their jobs physically drained and emotionally distracted.

“For many people, the COVID-19 pandemic has been a wake-up call, amplifying the urgent message that working Americans need access to paid family medical leave on a broader and more permanent basis,” Kalamarides said. “The pandemic has made it clear that allowing financial pressures to keep sick workers in the workplace can be bad not only for them but also for society at large. Without access to paid leave, many Americans will continue to carry their illnesses into the workplace simply because they can’t afford to miss a paycheck.”

In designing a comprehensive PFML solution, four key questions must be answered, Kalamarides said. They are:

- Scope: Who will be eligible for coverage, what conditions will be covered, how long should a paid leave last, how much of an employee’s pay should be replaced, and how can employers get ill or injured employees back to work as quickly but fairly as possible?

- Funding: How should paid leave be financed?

- Mandate or no mandate: How should participation be enforced?

- Delivery: How can government and employers seamlessly and efficiently deliver on their administrative, compliance, communication, and benefit payment responsibilities?

The private sector could provide expertise in four key areas, he continued. They are:

- Risk pooling: Benefit providers in the private sector already rely on their expertise in risk pooling to support their disability insurance, life insurance, annuity, and retirement income businesses. This expertise could be applied to broader PFML programs.

- Absence management: Benefit providers routinely help employers and employees navigate absences from work while complying with the complex regulatory environment that often accompanies those absences. Many providers administer FMLA and state unpaid leave laws for their clients, as well as short-term disability and long-term disability income programs.

- Return-to-work programs: Relying on their medical and vocational expertise, benefit providers help workers and their employers reduce the duration of medical leaves by getting workers back on the job sooner. That same expertise could be applied to expanded leave programs, helping to reduce costs and get employees back to receiving regular paychecks faster.

- Administration: Benefit providers have the technology, infrastructure, and expertise to assist employers in complying with and administering state PFML programs. They can help employees, too, by providing them with a seamless benefit experience, evaluating their eligibility for multiple programs simultaneously, and ensuring their PFML leave is properly coordinated with the other benefits their employer provides.

Including the private sector in a comprehensive paid leave solution would deliver numerous benefits, Kalamarides said, starting with lessening the need to build extensive public sector administrative capabilities. Private-sector programs funded by employers also would likely lessen some public funding needs. In addition, employers can be nimble in reacting to unexpected developments.

Private paid leave programs with a public backstop should ensure full access to paid leave and a consistent base of coverage, Kalamarides said. Meanwhile, employers wishing to offer paid leave benefits that exceed the required minimum coverage would be welcome to do so.

Susan Rupe is managing editor for InsuranceNewsNet. She formerly served as communications director for an insurance agents' association and was an award-winning newspaper reporter and editor. Contact her at [email protected]. Follow her on Twitter @INNsusan.

© Entire contents copyright 2020 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

Susan Rupe is managing editor for InsuranceNewsNet. She formerly served as communications director for an insurance agents' association and was an award-winning newspaper reporter and editor. Contact her at [email protected].

COVID-19 Causing Workers To Take A Closer Look At Benefits, MetLife Says

Strategy Decides Winners, Losers In The Advisor Game: Tiburon

Advisor News

- CFP Board appoints K. Dane Snowden as CEO

- TIAA unveils ‘policy roadmap’ to boost retirement readiness

- 2026 may bring higher volatility, slower GDP growth, experts say

- Why affluent clients underuse advisor services and how to close the gap

- America’s ‘confidence recession’ in retirement

More Advisor NewsAnnuity News

- Insurer Offers First Fixed Indexed Annuity with Bitcoin

- Assured Guaranty Enters Annuity Reinsurance Market

- Ameritas: FINRA settlement precludes new lawsuit over annuity sales

- Guaranty Income Life Marks 100th Anniversary

- Delaware Life Insurance Company Launches Industry’s First Fixed Indexed Annuity with Bitcoin Exposure

More Annuity NewsHealth/Employee Benefits News

- SSI in Florida: High Demand, Frequent Denials, and How Legal Help Makes a Difference

- CATHOLIC UNIVERSITY IN ILLINOIS STILL COVERS 'ABORTION CARE' WITH CAMPUS INSURANCE

- Major health insurer overspent health insurance funds

- OPINION: Lawmakers should extend state assistance for health care costs

- House Dems roll out affordability plan, take aim at Reynolds' priorities

More Health/Employee Benefits NewsLife Insurance News