AIG back on top of first-quarter annuity sales, LIMRA reports

American International Group roared to the top of first-quarter annuity sales, according to LIMRA’s U.S. Individual Annuity Sales Survey.

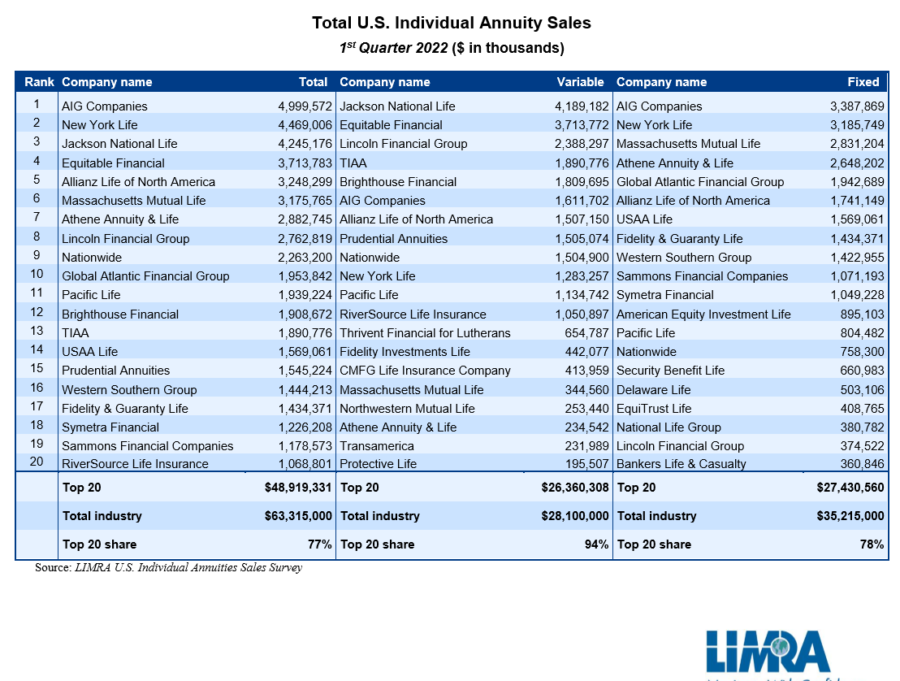

Total first-quarter annuity sales increased 4% to $63.3 billion, driven by fixed indexed annuity and fixed-rate deferred sales growth, LIMRA reported earlier this month. AIG led all insurers with nearly $5 billion in sales.

AIG benefited from a surge in fixed annuity business in the first quarter, executives reported earlier this month, even while it continues a plan to split off its Life & Retirement business.

The company's plan for Life & Retirement is into its second year and remains on track, CEO Peter Zaffino said during the insurer's first quarter earning's call, despite rising interest rates. The business segment was recently rebranded as Corebridge Financial and will go public during the second quarter.

In the first-quarter 2021, AIG ranked third in overall sales behind Jackson National Life and New York Life. Jackson and AIG swapped places in the latest quarterly sales report:

LIMRA researchers say changing economic dynamics are behind the annuity sales shifts.

“FIA and FRD sales benefited from rising interest rates and increased market volatility, as investors sought protected growth options,” said Todd Giesing, assistant vice president, LIMRA Annuity Research. “LIMRA is forecasting these products to thrive under current market conditions, growing 5-10% year end.”

Overall, fixed annuity sales rose 14% in the first quarter to $35.2 billion. All fixed products except income annuities recorded positive growth:

• FIA sales were $16.3 billion, 21% higher than first quarter 2021 results. LIMRA is predicting FIA sales to grow as much as 10% by the end of 2022.

• Fixed-rate deferred annuity sales increased 9% in the first quarter, year-over-year, to $15.9 billion. LIMRA is forecasting as much as 7% growth in 2022.

• Immediate income annuity sales were $1.5 billion in the first three months of 2022, equal the results from prior year.

• Deferred income annuity sales totaled $365 million in the first quarter, down 14% year-over-year.

With interest rates expected to continue to rise throughout 2022, LIMRA has forecast as much as 15% growth collectively for immediate and deferred income annuity sales.

Total variable annuity sales fell 6% in the first quarter to $28.1 billion:

• Traditional variable annuity (VA) sales were $18.5 billion in the first quarter, down 11% year-over-year. By the end of 2022, LIMRA has predicted traditional VA sales to grow by as much as 8%.

• Registered index-linked annuity (RILA) sales grew 5% to $9.6 billion in the first quarter. LIMRA expects RILA sales to increase as high as 30% by year-end 2022. To view first quarter sales results visit First Quarter 2022 Annuities Industry Estimates in LIMRA’s Fact Tank.

First quarter 2022 annuities industry estimates are based on LIMRA’s quarterly annuity sales survey, which represents 91% of the total market.

NAIFA foundation will support the next generation of financial professionals

Retirement savings legislation ‘cool,’ NAIFA members told

Advisor News

- Athene Enhances Flagship Annuity Products, Expands Innovative Preset Allocation Feature

- Advisor gives students a lesson in financial reality

- NC Senate budget would set future tax cuts, cut state positions, raise teacher pay

- Americans believe they will need $1.26M to retire comfortably

- Digitize your estate plan for peace of mind

More Advisor NewsHealth/Employee Benefits News

- Keeping insurers in check while assisting consumers

- New lawsuit challenges state's Medicaid eligibility rules

- In defiant speech, Lawson-Remer calls for bigger county spending, unity against federal cuts

- Editorial | Why Medicaid funding crisis matters here

- Recent Findings in Liver Cancer Described by Researchers from Kaohsiung Chang Gung Memorial Hospital (Comparing Health Insurance-reimbursed Lenvatinib and Self-paid Atezolizumab Plus Bevacizumab In Patients With Unresectable Hepatocellular …): Oncology – Liver Cancer

More Health/Employee Benefits NewsLife Insurance News

- MIB Group introduces first e-signature platform specifically for life insurance

- $184.2M financing secured for Seagis East Coast industrial portfolios

- AFBA and 5Star Life Insurance Company Name Erica L. Jenkins Senior Vice President, General Counsel, and Corporate Secretary

- Athene Enhances Flagship Annuity Products, Expands Innovative Preset Allocation Feature

- Empathy Collaboration with Voya Financial Brings Industry-First Legacy Planning to Millions

More Life Insurance NewsProperty and Casualty News

- All Talentz Showcases Excellence in Claims Support Services at the 2025 PLRB Claims Conference & Insurance Services Expo

- Mercury Insurance Named to Forbes' America's Best Employers 2025 List

- Flood risk rises as coverage declines in KY, TN & WV

- General Indemnity Group Announces Impressive FY 2024 Results

- First Quarter 2025 Earnings Release

More Property and Casualty News