Advisors bet on US stocks to outperform in 2023 amid tech rebound

(London, January 2023) Advisors think we are in the worst investment climate since 2008 but are betting on US stocks to outperform this year amid a tech rebound, new research shows.

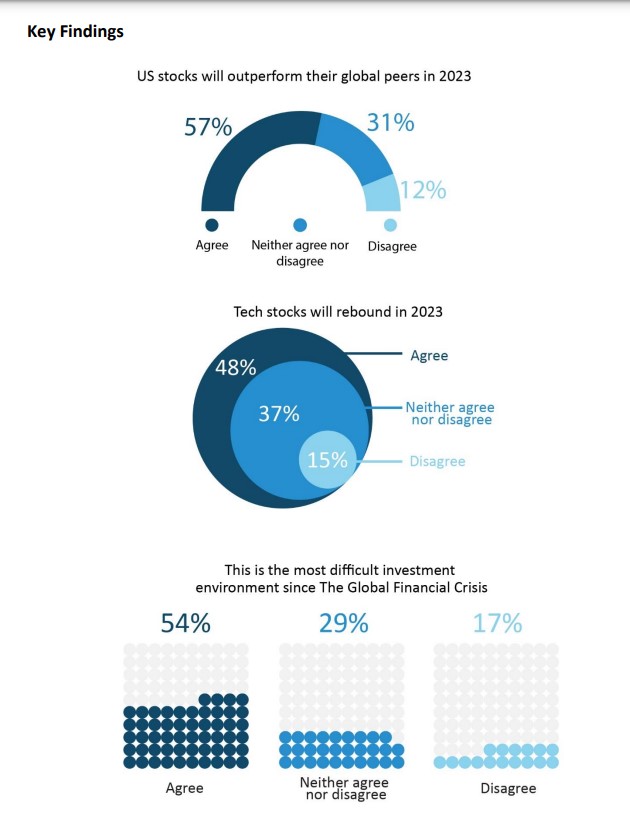

A CoreData Research study of nearly 500 US financial advisors found almost six in 10 (57%) think US stocks will outperform their global peers in 2023. Driving the home bias is an expectation that technology stocks will stage a recovery. About half (48%) say tech stocks will rebound in 2023, compared to just 15% who disagree.

While US advisors favour domestic markets, they nevertheless think this is the worst time to invest since 2008. More than half (54%) say we are in the most difficult investment environment since the Global Financial Crisis. Furthermore, advisors expect market turbulence to intensify. Four in 10 (40%) agree that volatility will increase over the next 12 months – nearly double the proportion that disagree (23%).

Adding to the gloomy outlook are expectations of more rate rises to fight inflation — raising the spectre of recession. Half (50%) of advisors think the Fed will increase rates above 5% in 2023.

The study, conducted in December, also shows these macro and market headwinds are top of mind when it comes to the greatest risks facing advice firms. Respondents say volatile markets (57%), inflation (56%) and recession (49%) present the biggest challenges to their businesses over the next 12 months.

Against this bleak macroeconomic backdrop, geopolitical challenges also loom large on the risk radars of advisors. In fact, three in 10 (30%) think US-China tensions pose more of a risk than recession.

Amid the expected uptick in volatility, more than four in 10 (42%) advisors say they are positioning client portfolios defensively. But they face challenges implementing these strategies — almost half (45%) are struggling to find safe-haven assets. This is raising questions about the suitability of the 60/40 portfolio, with nearly three in 10 (27%) saying the model no longer works.

“The 60/40 portfolio model had a year to forget in 2022,” said Andrew Inwood, founder and principal of CoreData. “We expect advisors to re-evaluate strategies based on this traditional model as they seek more innovative solutions to diversify portfolios ahead of what will likely be another bumpy year.”

Meanwhile, the challenging backdrop is propelling US advisors towards active managers.

Nearly four in 10 (38%) say they will increase client allocations to active funds over the next 12 months. A lower proportion of just over a quarter (27%) plan to raise allocations to passive funds.

Elsewhere, nearly a third (31%) of advisors will increase client allocations to ESG funds over the coming year. But a fifth (21%) do not invest client money in ESG. And enthusiasm for renewables is muted, with more advisors set to raise client allocations to oil and gas stocks (30%) than clean energy stocks (27%).

American Equity readies 2022 earnings report amid ongoing conflicts

1 in 3 Americans struggling financially but goal-setting is a game-changer

Annuity News

- Trademark Application for “EMPOWER MY WEALTH” Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

- Conning says insurers’ success in 2026 will depend on ‘strategic adaptation’

- The structural rise of structured products

- How next-gen pricing tech can help insurers offer better annuity products

- Continental General Acquires Block of Life Insurance, Annuity and Health Policies from State Guaranty Associations

More Annuity NewsHealth/Employee Benefits News

- NC Medicaid leaders seek new funding strategy as work rules loom

- Researchers to study universal health care, as Coloradans face $1 billion in medical debt

- Study Findings on Chronic Pain Are Outlined in Reports from Brody School of Medicine at East Carolina University (Associations of Source and Continuity of Private Health Insurance with Prevalence of Chronic Pain among US Adults): Musculoskeletal Diseases and Conditions – Chronic Pain

- As health insurance costs rise, locals confront impacts

- Plainfield, Vermont Man Sentenced to 2 Years of Probation for Social Security Disability Fraud

More Health/Employee Benefits NewsLife Insurance News

Property and Casualty News

- Porch Group Announces Attendance at Upcoming Investor Events

- How technology is changing personal injury auto claims

- OPINION: HB 99 must deliver real medical liability reform to protect patient access

- Homeowners insurance rates could reemerge in Illinois legislative session

- Are MS Coast homeowner insurance rate hikes easing? What experts, records say

More Property and Casualty News