A shifting credit cycle creates opportunities for insurers

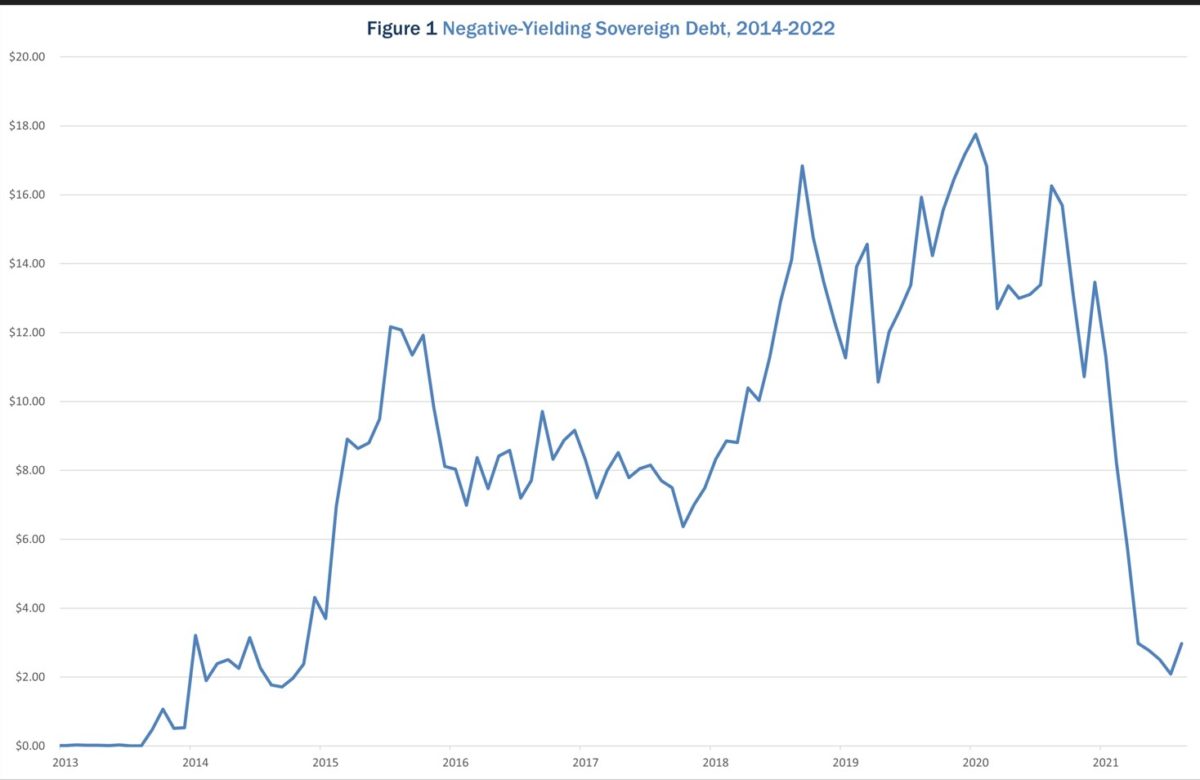

Monetary policy around the world is changing as many central banks are attempting to tighten financial conditions in order to control rampant inflation. As illustrated below, negative-yielding sovereign debt has seen a nearly 10-fold decline across the globe.

Prepared by Conning, Inc. Source: ©2022 Bloomberg Index Services Limited. Data as of July 31, 2022.

The tightening has generated recession fears and market volatility, and has contributed to wider corporate spreads. There are concerns that the Federal Reserve, in an effort to squelch inflation, ultimately will destroy demand and trigger a recession. Indeed, with two consecutive quarters of gross domestic product contraction in 2022, it appears the economy has, at a minimum, slowed meaningfully. Although corporate fundamentals are currently on solid ground, investors are weighing the impact of a possible recession on the corporate market.

Despite the macro uncertainty, Conning believes opportunities can be uncovered by applying strong analytical skills and investment discipline. Although the months ahead should feature higher volatility, they also should present distinctive opportunities as yields are at some of the highest levels in a decade.

We see potential in issuers with durable credit fundamentals that can weather an economic downturn while keeping their credit profiles largely intact. Additionally, securities that were issued recently when interest rates were lower and credit spreads tighter are now available at a meaningful discount to par. Many may be opportunities for longer-term investors - such as insurers - who can hold them to maturity.

Fundamentals: Holding up but pressure mounting

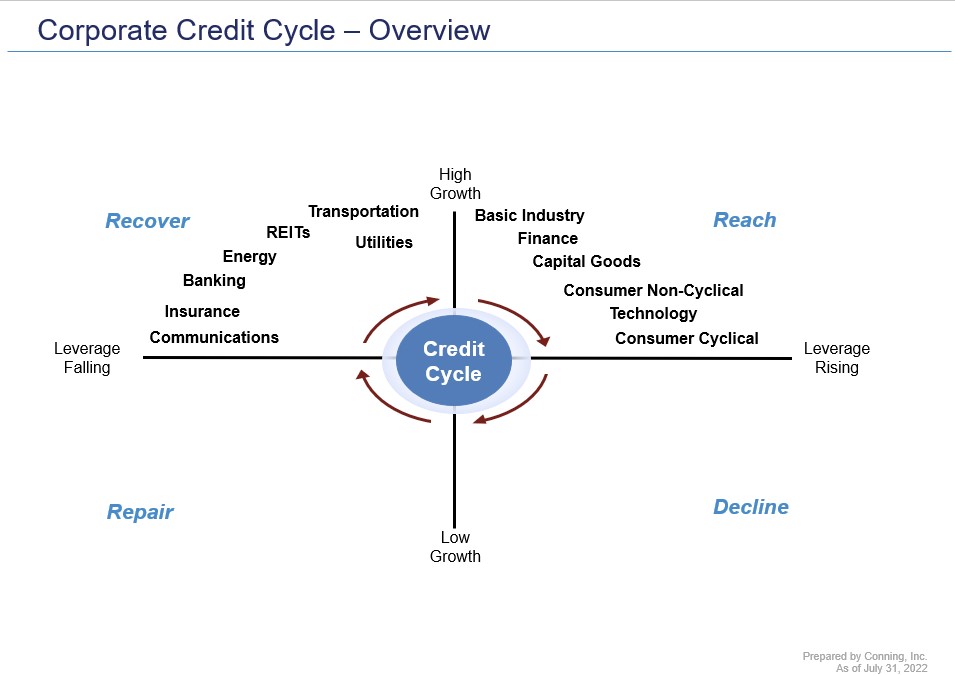

The slowing economy and rising concerns of recession contribute to Conning’s belief that the corporate market is moving into the later stages of the credit cycle.

Consumers appear less confident in the economy as well: The University of Michigan’s Index of Consumer Sentiment reading of 50.0 in June 2022 was the lowest in its 70-year history, and the 58.2 reading in August is still historically low. Manufacturing PMI data also is indicative of a slowing economy. The ISM gauge of factory activity remained at 52.8 in August, the lowest level since June 2020, although any reading over 50 suggests economic expansion. The Eurozone PMI data fell to 49.7 in August (from 49.8 in July), which suggests contraction. And since early July 2022, we have witnessed the frequently cited “recession warning” of the 2-10 inversion, when yields of 10-year U.S. treasuries slipped below yields of two-year notes.

Despite these warning signs, Conning’s view is that the strength of the current labor market - the U.S. unemployment rate was 3.7% in August - would help moderate the severity of a recession. Consumers benefited from the unprecedented fiscal spend throughout the pandemic and appear to be in an overall strong position. However, we have observed a recent reprioritization of consumer spending patterns: a shift in purchases from goods to services (goods were the predominant purchase during the pandemic). In addition, consumers have traded down in their purchases – from more expensive to less expensive items – as inflation has reduced real discretionary income.

Conning believes corporate earnings likely have peaked and could very well trend lower in a recessionary scenario, as profitability would be hampered and margins are already under pressure due to higher input and commodity costs. The war in Ukraine and supply-chain interruptions stemming from lockdowns in China per its zero-COVID-19 policy are further exacerbating supply/demand imbalances. Credit metrics are currently solid (back to pre-pandemic levels in our view) but could deteriorate depending on the magnitude of a slowdown/recession, the stickiness of inflation and the need of further monetary tightening. Although the credit rating upgrade-to-downgrade ratio has been quite favorable of late, this could potentially turn the tide and further pressure corporate valuations.

Our analysis indicates, however, that corporate behavior remains balanced – e.g., a modest amount of leveraging acquisitions, accelerated share repurchases, etc., – and is generally supportive of credit profiles. More industries have transitioned into the “Reach” phase of the credit cycle, and many could move into the “Decline” phase if the economy materially worsens. Even if corporate behavior remains status quo, a declining economy may harm earnings and weaken credit metrics.

The technical headwinds

Global central banks’ coordinated monetary tightening and the sharp rise in interest rates in 2022 have challenged the U.S. corporate bond market’s technical backdrop and pushed corporate spreads wider. Some of the main drivers include:

- The shrinking universe of negative yields. They were a rare sight until the early 2010s but weak economic growth following the 2008-2009 financial crisis drove many central banks, including the European Central Bank, to reduce yields below zero. Positive-yielding U.S. corporate bonds became a favored fixed-income option for many global investors, but today’s larger global supply of above-zero bond yields has eased demand for U.S. corporate debt.

- The Federal Reserve’s aggressive interest rate hikes, which have made U.S. corporate bonds less appealing for many non-U.S. investors on a foreign currency hedge-adjusted basis.

- The corresponding dramatic decline in U.S. bond values. The -13% total return for the Bloomberg U.S. Aggregate Bond Index (through Aug. 26, 2022) is one of the worst performances on record. Investor fund flows often follow returns and flows have been very negative so far this year.

Five investment themes

The uncertain macro backdrop and numerous technical headwinds have injected uncertainty and volatility into the markets and served to push corporate spreads wider. Conning believes this allows us to apply our deep analytical skills and market acumen to identify compelling opportunities for insurance portfolios. We are focusing on five themes.

- Credit fundamentals that can weather a downturn

Many industries – including utilities, railroads and pockets of the communications industry - and issuers are less susceptible to economic downturns and now offer fair valuations. Utilities are unique in the investment-grade bond market considering the structural seniority available in first-mortgage bonds as an up-in quality alternative. Banking is economically sensitive, but we believe strong balance sheets boosted by enhanced regulation and expanding net interest income from higher interest rates will prove a favorable fundamental tailwind.

- Capturing structural challenges

The war in Ukraine has fed structural changes in several commodity and energy markets and caused pricing to remain elevated. Many prices are off their highs but remain well above production costs. With strong cash generation and prudent capital allocation policies, this could help create opportunity in the energy and metals and mining space. We also believe aerospace and defense contractors and companies attached to infrastructure spending should benefit in this environment.

- Capitalizing on market illiquidity

Conning believes the secondary market will provide opportunities for insurers to get paid for illiquidity and we believe off-the-run, good credit names are becoming more readily available at discount prices. Insurers often can be the buyers of these securities and hold these credits through periods of market volatility for the potentially rewarding paydays when the securities come to maturity.

- A new-issue spike after Labor Day

September historically has some of the highest new-issue supply in corporate bonds and we expect many companies will emerge after Labor Day to aggressively issue debt. The current market volatility may provide attractive entry points for quality names with compelling new-issue concessions.

- Shorter duration amid flat credit curves

We also think select shorter-duration credits may be good for some insurers, which are normally longer-term investors. However, the flat yield curve has created relatively higher yields at the front end and some of these securities may be good opportunities.

Tactical opportunities within a larger strategy

The challenges of navigating the current investment environment are different from those of the pandemic but they are no less difficult. The foremost concern on the minds of many insurers today is how to manage their businesses, not just their portfolios, with inflation levels not seen in 40 years.

All eyes are on Federal Reserve Chair Jerome Powell and his rate-setting team as they remain laser-focused on fighting inflation. The commitment to raising interest rates to help tamp inflation is a welcome sign for insurers and other fixed-income investors who have been starved for income in the low-rate environment. Raising rates too far and/or too fast could lead to recession, but not raising them enough could mean inflation remains in the economy as a so-called “tax on everyone” via higher prices. Negotiating a “soft landing” on this issue is no simple task.

Regardless, we are reminded that opportunities exist in just about every market, provided you have the analytical skills, insights and experience to identify them. As we have discussed previously, Conning sees five themes that we think will aid insurers in meeting the demands of the evolving market. They are generally tactical in nature and shorter term in impact and each insurer must assess these ideas within the scope of their larger investment strategy. We remain steadfast in our view that insurers are best served by following investment strategies that meet their distinct long-term needs while managing within their tolerance for risk.

Risks

Market risk - Market, or systematic, risk is the risk that individual securities may be correlated with general market downturns regardless of the particular business conditions and outlook for the individual companies.

Credit risk – Eroding fiscal health in issuing companies resulting in inability to meet debt obligations.

Inflation risk - Inflation erodes the purchasing power of future cash flows from investments. In times of high inflation, the value of securities may be reduced.

Liquidity risk - Liquidity risk can occur when market conditions do not allow transactions to be made in a quick and orderly fashion in relation to indicative market prices.

Matthew Daly, CFA, is a managing director and head of corporate and municipal teams and a member of Conning’s Investment Policy Committee. He may be contacted at [email protected].

© Entire contents copyright 2022 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

Financial wellness program evolution, challenges discussed

MassMutual dedicates additional $100M to invest in diverse, first-time fund managers

Advisor News

- Finseca and IAQFP announce merger

- More than half of recent retirees regret how they saved

- Tech group seeks additional context addressing AI risks in CSF 2.0 draft profile connecting frameworks

- How to discuss higher deductibles without losing client trust

- Take advantage of the exploding $800B IRA rollover market

More Advisor NewsAnnuity News

- Somerset Re Appoints New Chief Financial Officer and Chief Legal Officer as Firm Builds on Record-Setting Year

- Indexing the industry for IULs and annuities

- United Heritage Life Insurance Company goes live on Equisoft’s cloud-based policy administration system

- Court fines Cutter Financial $100,000, requires client notice of guilty verdict

- KBRA Releases Research – Private Credit: From Acquisitions to Partnerships—Asset Managers’ Growing Role With Life/Annuity Insurers

More Annuity NewsHealth/Employee Benefits News

- As ACA subsidies expire, thousands drop coverage or downgrade plans

- Findings from Centers for Disease Control and Prevention Provides New Data about Managed Care (Association Between Health Plan Design and the Demand for Naloxone: Evidence From a Natural Experiment in New York): Managed Care

- Medicare is experimenting with having AI review claims – a cost-saving measure that could risk denying needed care

- CMS proposed rule impacts MA marketing and enrollment

- HUMAN RIGHTS CAMPAIGN FOUNDATION TAKES NEXT STEP IN CLASS ACTION LITIGATION AGAINST TRUMP ADMINISTRATION, FILES COMPLAINT WITH EEOC OVER PROHIBITION ON GENDER-AFFIRMING HEALTHCARE COVERAGE FOR FEDERAL EMPLOYEES

More Health/Employee Benefits NewsLife Insurance News