Investors Want More Comp Clarity, But 3 of 4 Don’t Get It

Fee transparency is the top want from investors across the wealth spectrum, but three in four customers do not understand how their broker or advisor is paid, according to a recent survey.

In an era when regulators are tightening standards around fee transparency and disclosure, it is clear than consumers want clarity and are not finding it, according to the Hearts & Wallets survey, “Wants & Pricing: Delivering on Customer Wants, Unpacking Pricing and Rating the Top Performer Firms.”

“Customer confusion permeates three out of four (73%) saving, investing and advice relationships,” according to the report, “with 44% of customers saying they don’t know how they pay, and 29% saying they believe financial solutions are free. (Even ‘free’ products can have underlying costs or commercialization of consumer data.)”

Consumers understand service-based pricing better than product-based, but not by a large margin. The growing pressure to provide more clarity and disclosure has not moved the needle much in the survey.

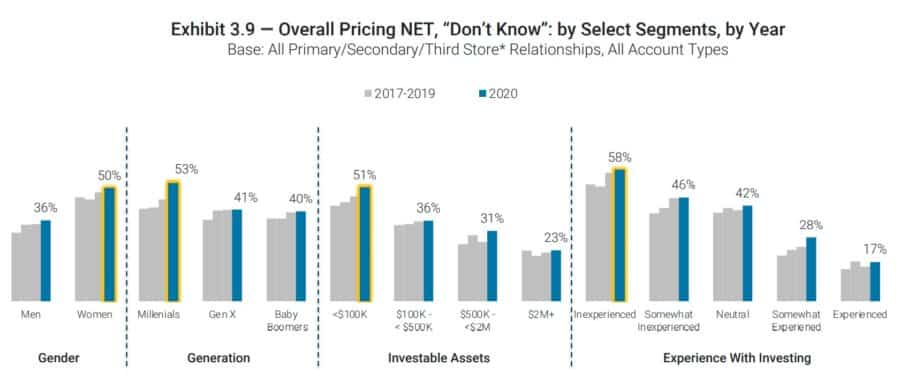

“There has been no improvement over time in understanding of how firms earn money at the national level,” according to the report, drawn from a mid-2020 survey. “Pricing confusion is higher among women, millennials and lower-asset and ‘inexperienced’ investors.”

Although the confusion around compensation has not changed over time, their demand for it has.

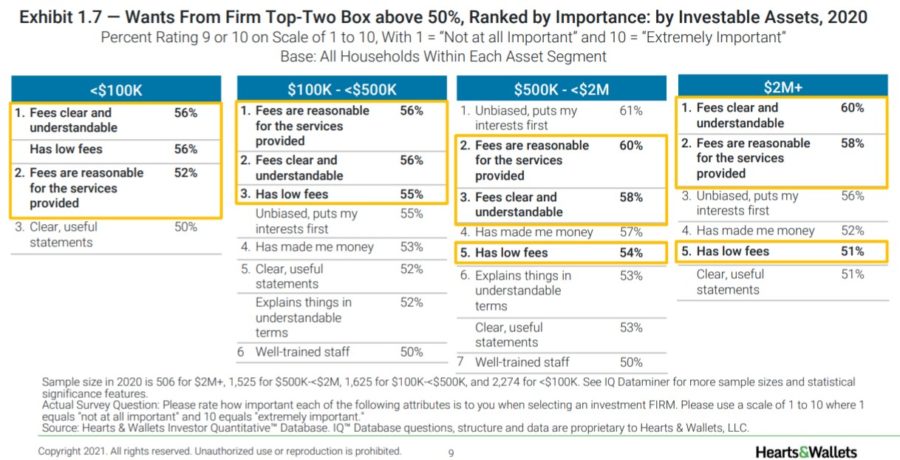

“Nationally, wants in Access & Communications shifted year-over-year, and the importance of Competence & Credibility rose,” according to the report. “ ‘Understandable’ and ‘reasonable’ fees are top wants across asset levels.”

The lack of improvement on compensation clarity is not due to the lack of competition. In fact, the tight competition has made it more difficult for firms to stand out.

“Ameriprise, Edward Jones and Merrill Lynch appear multiple times as Top Performers for customer satisfaction on top consumer wants,” according to the survey. “State Farm, T. Rowe Price, TD Bank and USAA each achieved one Top Performer designation. Tighter competition resulted in no Top Performers this year in many wants, notably in Access & Communication and Understanding & Empathy.”

That result means that the firms at the top might want to look over their shoulder, because their competitors are catching up. Researchers said that improvement among new firms and those in the middle of the satisfaction range are narrowing the gap between moderate and distinctively high customer satisfaction.

The group that most demands “understandable and reasonable fees” are consumers with $500,000 to $2 million in assets. This group was also strongest in wanting “unbiased, puts my interest first” conduct, with 61% percent selecting that option.

In contrast, those in the top investor group, with more than $2 million in assets, selected “unbiased, puts my interest first” as No. 3, behind “fees clear and reasonable” and “fees are reasonable for the services provided."

Although the Securities and Exchange Commission and the Department of Labor has emphasized a standard of putting the client’s interest first, it was not in the top three of wants in three of the four asset groups that Hearts & Wallets tracks. Clarity and reasonableness in fees dominated the top wants.

Given the growing demands and stagnant satisfaction rates among consumers, Hearts & Wallets researchers suggested that firms:

• Recognize the potential for lasting shifts in channel usage. This is due, in part, to habits having changed during COVID-19 but also because channels offering higher service levels are desired by lower-asset consumers. At the same time, consumers with $2M+, who had to become more comfortable with technology channels during the pandemic, may stick with them.

• Develop “plain talk” for pricing communications. Reconsider terminology, prominence and frequency.

• Emphasize timely investment ideas for consumers with $2M+ proactively. Selection processes should enable combinations of “pick for me” and “help me pick.”

• Focus messaging on Tangible capabilities, like “personal financial advice” or “retirement planning,” to consumers with $500,000 to $2 million.

• Consider experimenting with messaging on Competence & Credibility attributes, if the mass market is the target.

The latest Hearts & Minds report was drawn from the firm’s Investor Quantitative Database (IQ Database) “that analyzes consumer service dimensions, the price-value dynamic and captures customer satisfaction ratings for the big banks, brokerages, employer and mutual fund firms cited most often by 5,920 survey participants in the latest IQ Database survey wave fielded in August 2020.”

Steven A. Morelli is a contributing editor for InsuranceNewsNet. He has more than 25 years of experience as a reporter and editor for newspapers and magazines. He was also vice president of communications for an insurance agents’ association. Steve can be reached at [email protected].

© Entire contents copyright 2021 by InsuranceNewsNet. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.

Steven A. Morelli is a contributing editor for InsuranceNewsNet. He has more than 25 years of experience as a reporter and editor for newspapers and magazines. He was also vice president of communications for an insurance agents’ association. Steve can be reached at [email protected].

Unum And Paul Revere Life Insurance Cos. To Pay $1.8M Penalty For Cybersecurity Violations

New Google Certification Program Required For Health Insurance Advertisers

Advisor News

- Trump proposes retirement savings plan for Americans without one

- Millennials seek trusted financial advice as they build and inherit wealth

- NAIFA: Financial professionals are essential to the success of Trump Accounts

- Changes, personalization impacting retirement plans for 2026

- Study asks: How do different generations approach retirement?

More Advisor NewsAnnuity News

- Regulators ponder how to tamp down annuity illustrations as high as 27%

- Annual annuity reviews: leverage them to keep clients engaged

- Symetra Enhances Fixed Indexed Annuities, Introduces New Franklin Large Cap Value 15% ER Index

- Ancient Financial Launches as a Strategic Asset Management and Reinsurance Holding Company, Announces Agreement to Acquire F&G Life Re Ltd.

- FIAs are growing as the primary retirement planning tool

More Annuity NewsHealth/Employee Benefits News

- Red and blue states want to lLimit AI in insurance; Trump wants to limit states

- Researchers from Boston University Report Findings in Managed Care (Unexplained Pauses In Centers for Disease Control and Prevention Surveillance: Erosion of the Public Evidence Base for Health Policy): Managed Care

- New Managed Care Study Results Reported from University of Houston (Impact of Adjuvant GLP-1RA Treatment on the Adherence of Second-Generation Antipsychotics in Nondiabetic Adults): Managed Care

- New Findings on Managed Care Reported by Lane Moore et al (State Disparities in Medicaid Versus Medicare Reimbursement for Hand Surgery): Managed Care

- New Kentucky House GOP budget fixes insurance issue, ups education spending

More Health/Employee Benefits NewsLife Insurance News