71% Of BGAs, IMOs Report Success Adding Young Producers

Industry trade groups LIMRA and NAILBA released a multi-component research study to learn more about brokerage general agencies (BGAs) and independent marketing organizations (IMOs) in the United States.

"The goal was to gain a better understanding of the BGA/IMO marketplace, its composition, challenges, and opportunities," the organizations said in the study.

The study provides a revealing snapshot on where producers are two years into the COVID-19 pandemic, how the evolution with BGAs and IMOs is proceeding, and how recruitment of producers is going.

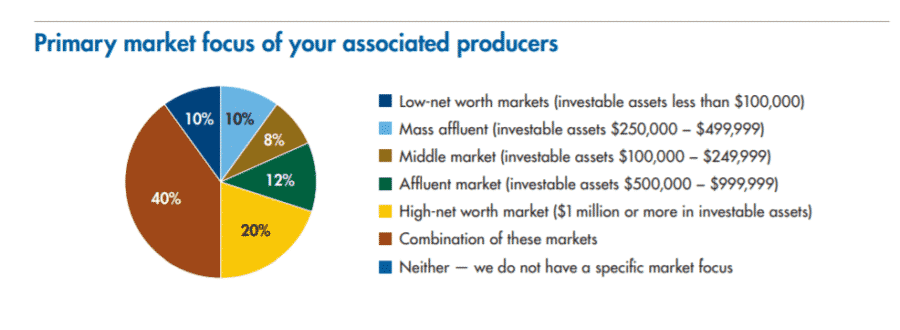

About 40% of producers said they are focused on the middle market -- $100,000 to $249,999 in investable assets:

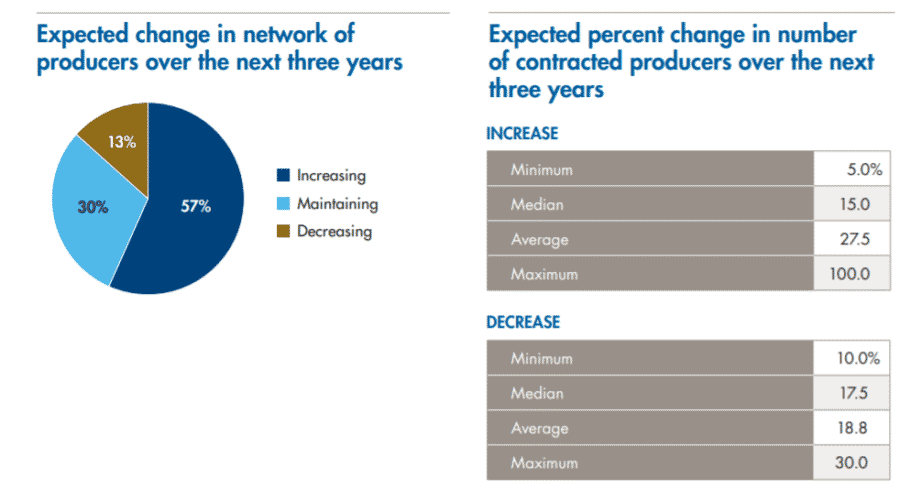

A majority of BGAs and IMOs said they expect to increase their producer force over the next three years:

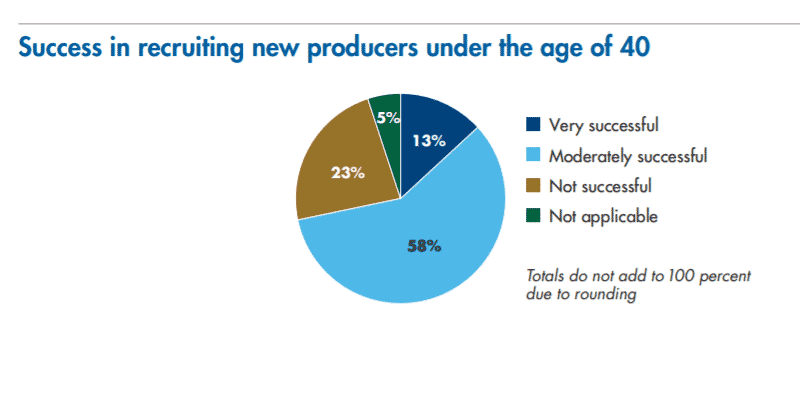

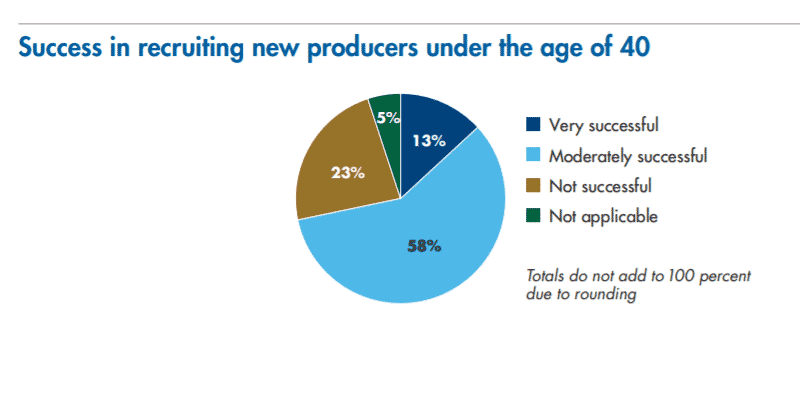

In a surprising finding, 71% of BGAs and IMOs reported success recruiting young producers to join their firms. The industry has long struggled to develop new and younger producers.

Only 17% of respondents say their expectations for producers have changed due to the pandemic. That means more virtual selling, more technical skills, or some other additional skill or license.

Extensive Survey

In September 2021, the following studies were conducted:

• A survey of 60 BGAs and IMOs

• A survey of over 400 independent life insurance and health producers

• Eight interviews with senior executives from BGAs and IMOs

The combination of quantitative and qualitative research allowed the trade groups to compare and contrast the perspectives of key stakeholders regarding the current state and future outlook of brokerage distribution.

The report is divided into six sections, covering the following:

1. Organization Profile

2. Producer Network

3. Carrier Relationships

4. Business Operations

5. Future Outlook

6. Shared Comments

Other key findings include:

77% say growing their producer network is top two business priority

67% say increasing product offering is top two business priority

57% expect to grow their producer networks in the next three years by an average of more than 25%

72% say product pricing is the primary reason they place business with a top carrier

87% added a new carrier in the past two years; 57% dropped at least one carrier

69% added a new carrier based on product features offered by that carrier

50% dropped carriers because of their non-competitive product lines

At least 5 in10 BGAs are not satisfied with the level of support provided by carriers

75% agree or strongly agree they need to invest more in IT and technology to be competitive in the future

72% agree or strongly agree M&A of BGAs and IMOs will increase over the next three years

72% agree or strongly agree differentiation among intermediaries is becoming more difficult

Medicare Beneficiaries Face Increased Out-Of-Pocket Costs, EBRI Says

Life Insurance Industry On Track For Record Premium Growth

Advisor News

- RICKETTS RECAPS 2025, A YEAR OF DELIVERING WINS FOR NEBRASKANS

- 5 things I wish I knew before leaving my broker-dealer

- Global economic growth will moderate as the labor force shrinks

- Estate planning during the great wealth transfer

- Main Street families need trusted financial guidance to navigate the new Trump Accounts

More Advisor NewsAnnuity News

- An Application for the Trademark “DYNAMIC RETIREMENT MANAGER” Has Been Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

- Product understanding will drive the future of insurance

- Prudential launches FlexGuard 2.0 RILA

- Lincoln Financial Introduces First Capital Group ETF Strategy for Fixed Indexed Annuities

- Iowa defends Athene pension risk transfer deal in Lockheed Martin lawsuit

More Annuity NewsHealth/Employee Benefits News

Life Insurance News

- The 2025-2026 risk agenda for insurers

- Jackson Names Alison Reed Head of Distribution

- Consumer group calls on life insurers to improve flexible premium policy practices

- Best’s Market Segment Report: Hong Kong’s Non-Life Insurance Segment Shows Growth and Resilience Amid Market Challenges

- Product understanding will drive the future of insurance

More Life Insurance News