3Q Life Insurance Sales Sag Amid Low Rates, Persistent Regulation

Low rates and regulation combined to keep life insurance sales down in the third quarter, one leading analyst says.

The new data was compiled by Wink, Inc. in its 89th edition of Wink’s Sales & Market Report.

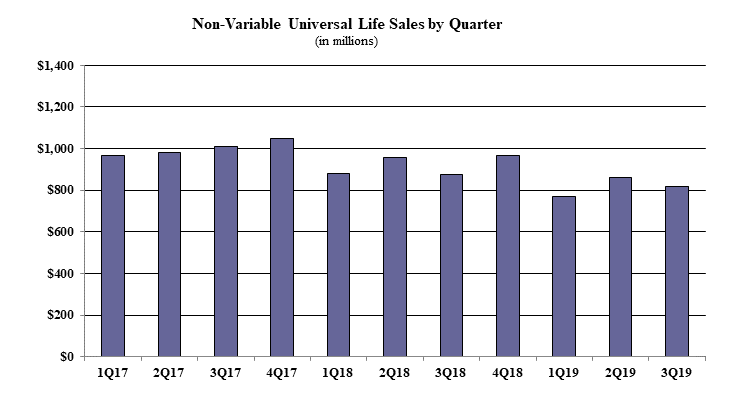

Non-variable universal life sales for the third quarter were over $816.1 million, down 5.2% when compared to the previous quarter and down 6.7% as compared to the same period last year.

Non-variable universal life sales include both indexed UL and fixed UL product sales. Noteworthy highlights for total non-variable universal life sales in the third quarter included Pacific Life Companies retaining the No. 1 ranking overall for non-variable universal life sales, with a market share of 10.7%.

Pacific Life Pacific Discovery Xelerator IUL 2 was the No. 1 selling product for non-variable universal life sales, for all channels combined.

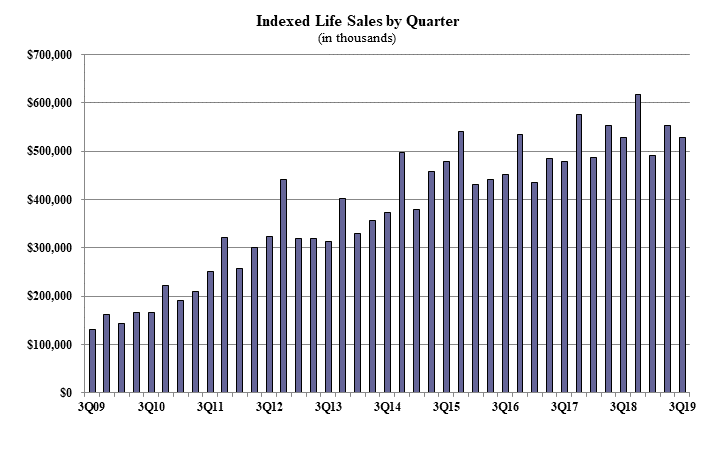

Indexed life sales for the third quarter were $529.1 million, down 4.2% when compared with the prior quarter, and down more than 0.1% as compared to the same period last year. Indexed life sales include both indexed UL and indexed whole life.

“While third quarter is typically a crummy quarter for life sales, this one was particularly challenging," said Sheryl Moore, president and CEO of Wink, Inc. "It is going to be interesting to see how pending regulation on AG49 will affect indexed life sales next year.”

Items of interest in the indexed life market included Pacific Life Companies retaining the No. 1 ranking in indexed life sales, with a 16% market share. National Life Group, Transamerica, Lincoln National Life, and Nationwide rounded-out the top five, respectively.

Pacific Life Pacific Discovery Xelerator IUL 2 was the No. 1 selling indexed life insurance product, for all channels combined. The top pricing objective for sales this quarter was Cash Accumulation, capturing 76.6% of sales. The average indexed life target premium for the quarter $13,374, an increase of nearly 35% from the prior quarter.

Fixed UL third-quarter sales were $287.7 million, down 7.2% when compared with the previous quarter and down 17% as compared to the same period last year. Noteworthy highlights for fixed universal life in the third quarter included the top pricing objective of No Lapse Guarantee capturing 68% of sales.

In addition, the average UL target premium for the quarter was $4,255, a decline of 23% from the prior quarter.

Whole life third-quarter sales were over $1.1 billion, down 0.5% when compared with the prior quarter, and up 7.2% as compared to the same period last year. Items of interest in the whole life market included the top pricing objective of Cash Accumulation capturing 74.3% of sales.

The average premium per whole life policy for the quarter was $2,901, a decline of 6% from the prior quarter.

“I am anticipating that the fourth quarter will be stronger for all life insurance sales,” Moore said. “With all the old products for PBR and 2001 CSO sunsetting, along with salespeople's’ efforts to qualify for production bonuses and incentives, the last leg of the year should yield strong life sales.”

Wink currently reports on indexed universal life, indexed whole life, universal life, whole life and all deferred annuity lines’ product sales. Sales reporting on additional product lines will follow at some point in the future, Moore said.

Variable Annuities Show Slight Gains In 3Q, Wink Reports

Industry, Consumer Reps Take Final Whack At NAIC Annuity Sales Rule

Advisor News

- Investors worried about outliving assets

- Essential insights a financial advisor needs to grow their practice

- Goldman Sachs survey identifies top threats to insurer investments

- Political turmoil outstrips inflation as Americans’ top financial worry

- What is the average 55-year-old prospect worth to an advisor?

More Advisor NewsAnnuity News

- AM Best Comments on the Credit Ratings of Talcott Financial Group Ltd.’s Subsidiaries Following Announced Reinsurance Transaction With Japan Post Insurance Co., Ltd.

- Globe Life Inc. (NYSE: GL) is a Stock Spotlight on 4/1

- Sammons Financial Group “Goes Digital” in Annuity Transfers

- Somerset Reinsurance Announces the Appointment of Danish Iqbal as CEO

- Majesco Announces Participation in LIMRA 2025: Showcasing Cutting-Edge Innovations in Insurance Technology

More Annuity NewsHealth/Employee Benefits News

- Independent Health reports a $66 million loss for last year, a big improvement from 2023

- Findings on Managed Care Reported by Investigators at University of Pennsylvania (Awaiting Insurance Coverage: Medicaid Enrollment and Post-acute Care Use After Traumatic Injury): Managed Care

- New Findings on CDC and FDA from Department of Emergency Medicine Summarized (The Long-term Trend of the Affordable Care Act On Health Insurance Marketplace Enrollment): CDC and FDA

- Proxy Statement (Form DEF 14A)

- More than 5M could lose Medicaid coverage if feds impose work requirements

More Health/Employee Benefits NewsLife Insurance News

- SC regulators ‘reviewing’ rehab strategy for Atlantic Coast

- AM Best Comments on the Credit Ratings of Talcott Financial Group Ltd.’s Subsidiaries Following Announced Reinsurance Transaction With Japan Post Insurance Co., Ltd.

- Globe Life Inc. (NYSE: GL) is a Stock Spotlight on 4/1

- 2025 Proxy Statement

- New York Life Appoints Christopher D. Kastner to Board of Directors

More Life Insurance News