2Q Life Insurance Sales Decline ‘More Severe’ Than Expected: Wink

Life insurance sales struggled mightily during a pandemic-marred second quarter, according to new data from Wink’s Sales & Market Report.

“Product repricing for 2017/PBR is definitely catching up with everyone,” said Sheryl J. Moore, president and CEO of both Moore Market Intelligence and Wink Inc. “This cyclical reduction in sales is something we see every time the mortality tables update, but this time it was definitely more severe.”

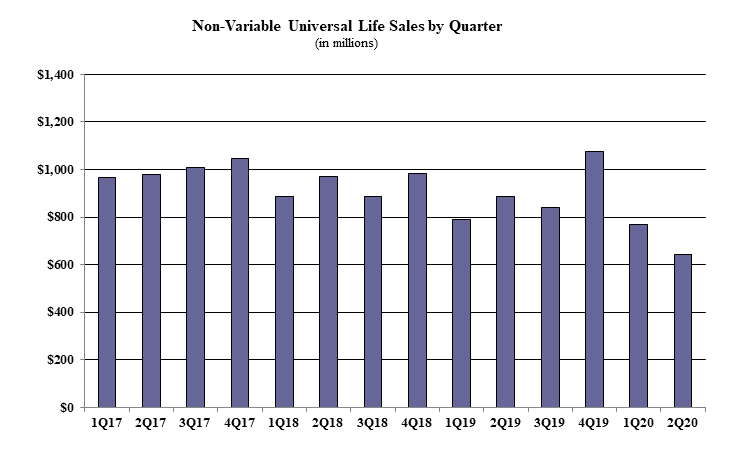

Non-Variable Universal Life

Non-variable universal life sales for the second quarter were $642 million, down 16.6% when compared to the previous quarter and down 27.5% as compared to the same period last year.

Non-variable universal life (UL) sales include both indexed UL and fixed UL product sales.

Noteworthy highlights for total non-variable universal life sales in the second quarter included Pacific Life Companies retaining the No. 11 ranking overall, for non-variable universal life sales, with a market share of 11.2%.

Pacific Life Pacific Discovery Xelerator IUL 2 was the No. 1 selling product for non-variable universal life sales, for all channels combined, for the fourth consecutive quarter.

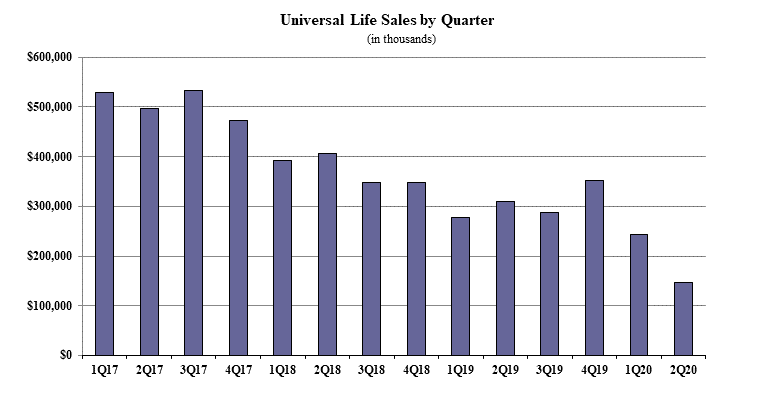

Indexed life sales for the second quarter were $494.9 million, down 6% when compared with the previous quarter, and down 14.3% as compared to the same period last year. Indexed life sales include both indexed UL and indexed whole life.

Items of interest in the indexed life market included Pacific Life Companies retaining the No. 1 ranking in indexed life sales, with a 13.9% market share. National Life Group, Transamerica, John Hancock, and Nationwide rounded-out the top five, respectively.

Pacific Life Pacific Discovery Xelerator IUL 2 was the No. 1 selling indexed life insurance product, for all channels combined, for the 4th consecutive quarter. The top pricing objective for sales this quarter was Cash Accumulation, capturing 69% of sales. The average indexed life target premium for the quarter was $10,716, an increase of more than 15% from the prior quarter.

Fixed UL second quarter sales were $147.5 million, down 39.6% when compared with the previous quarter and down 52.4% as compared to the same period last year. Noteworthy highlights for fixed universal life in the second quarter included the top pricing objective of No Lapse Guarantee capturing 65.9% of sales.

The average UL target premium for the quarter was $5,830, a decline of more than 9% from the prior quarter.

“The decline in fixed interest rates, which has plagued the life insurance industry for more than a decade, continues to drive traditional UL sales downward,” Moore said.

Whole life second quarter sales were $930 million, down 10.4% when compared with the previous quarter, and down more than 21% as compared to the same period last year. Items of interest in the whole life market included the top pricing objective of Final Expense capturing 61.7% of sales.

The average premium per whole life policy for the quarter was $3,823, a decline of nearly 9% from the prior quarter.

“With indexed life facing additional regulatory changes due to AG49-A, and fixed UL credited rates not improving, whole life insurance sales have the brightest future for next quarter’s sales.,” Moore said.

Wink currently reports on indexed universal life, indexed whole life, universal life, whole life, and all deferred annuity lines’ product sales. Sales reporting on additional product lines will follow in the future.

COVID-19 Turned More Americans Into Savers

Life/Annuity Industry’s 2020 Net Income Falls 66%, A.M. Best Finds

Advisor News

- The silent retirement savings killer: Bridging the Medicare gap

- LTC: A critical component of retirement planning

- DOL proposes new independent contractor rule; industry is ‘encouraged’

- Trump proposes retirement savings plan for Americans without one

- Millennials seek trusted financial advice as they build and inherit wealth

More Advisor NewsAnnuity News

- F&G joins Voya’s annuity platform

- Regulators ponder how to tamp down annuity illustrations as high as 27%

- Annual annuity reviews: leverage them to keep clients engaged

- Symetra Enhances Fixed Indexed Annuities, Introduces New Franklin Large Cap Value 15% ER Index

- Ancient Financial Launches as a Strategic Asset Management and Reinsurance Holding Company, Announces Agreement to Acquire F&G Life Re Ltd.

More Annuity NewsHealth/Employee Benefits News

- After enhanced Obamacare health insurance subsidies expire, the effects are starting to show

- CommunityCare: Your Local Medicare Resource

- AG warns Tennesseans about unlicensed insurance seller

- GOVERNOR HOCHUL LAUNCHES PUBLIC AWARENESS CAMPAIGN TO EDUCATE NEW YORKERS ON ACCESS TO BEHAVIORAL HEALTH TREATMENT

- Researchers from Pennsylvania State University (Penn State) College of Medicine and Milton S. Hershey Medical Center Detail Findings in Aortic Dissection [Health Insurance Payor Type as a Predictor of Clinical Presentation and Mortality in …]: Cardiovascular Diseases and Conditions – Aortic Dissection

More Health/Employee Benefits NewsLife Insurance News

- Baby on Board

- Kyle Busch, PacLife reach confidential settlement, seek to dismiss lawsuit

- AM Best Revises Outlooks to Positive for ICICI Lombard General Insurance Company Limited

- TDCI, AG's Office warn consumers about life insurance policies from LifeX Research Corporation

- Life insurance apps hit all-time high in January, double-digit growth for 40+

More Life Insurance News