1 in 3 chance of recession this year, Bloomberg says

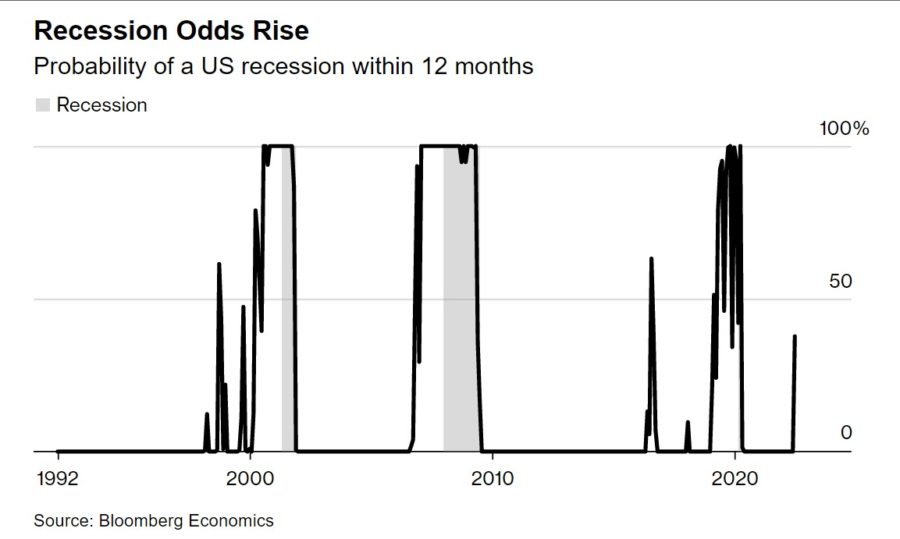

In the latest hint of a coming recession, Bloomberg’s probability index popped up for the first time since the 2020 crash.

Since May 2020, Bloomberg’s economic model has shown 0% probability of a recession occurring in the next 12 months. The probability has shot up to a 38% chance, according to an update this morning.

The change was linked to a record low in consumer sentiment and a surge in interest rates. Analysts said the gauge used factors ranging from housing permits and consumer survey data to the gap between 10-year and three-month Treasury yields.

“The risk of a self-fulfilling recession — and one that can happen as soon as early next year — is higher than before,” said Anna Wong, chief US economist at Bloomberg Economics, in a post. “Even though household and business balance sheets are strong, worries about the future could cause consumers to pull back, which in turn would lead businesses to hire and invest less.”

If a recession does not occur in the next 12 months, we are still at risk: Bloomberg economists pegged the chances of a recession by the start of 2024 as three in four.

One of the heaviest drags is consumer confidence, which is at a 45-year low, according to the University of Michigan’s consumer sentiment poll. Survey director Joanne Hsu linked the drop to soaring inflation.

“While consumers still appear relatively optimistic about the stability of their incomes, their perceptions of the economy are much more strongly influenced by concerns over inflation,” Hsu said. “As higher prices become harder to avoid, consumers may feel they have no choice but to adjust their spending patterns, whether through substitution of goods or foregoing purchases altogether. The speed and intensity at which these adjustments occur will be critical for the trajectory of the economy.”

Labor Still Strong Though

A key problem with spotting a recession is it is a backward-looking phenomenon – we don’t know we have a recession until we have had it.

Generally speaking, recession is defined as two consecutive quarters of negative economic growth. One of the confounding factors in sizing up chances for a recession is they always involve job loss, which is still at historic lows with no sign of an uptick.

Some argue that as the economy slows down, job losses will follow, providing that typical recession component. But every recession is different, and “different” is the new normal.

JP Morgan acknowledged the unemployment factor but wondered aloud if that really mattered if consumers were experiencing pain of recessionary proportions. In an article headlined “The recession everyone sees coming,” Jacob Manoukian, the U.S. Head of Investment Strategy for J.P. Morgan Private Bank & Wealth Management, said inflation is as painful as job losses and business failures.

In Manoukian’s estimation, conditions are already looking recession-like.

“Evidence is mounting that a growth slowdown is already well under way,” Manoukian said, citing a cooling housing market and Purchasing Manager Indices. “The latest data give credence to the idea that a self-reinforcing downturn may be already happening.”

Manoukian said JP Morgan was suggesting three things clients can do leading into a recession.

Core fixed income: “Given the rally in fixed income markets this week, aggregate bond prices are in their best stretch of the year. If recession red flags continue to pop up, bond yields will likely fall further.”

Quality equities: The best equities are the best way to outperform in this environment. “We are looking for fortress balance sheets, high barriers to entry, reasonable valuations and steady cash flow streams. “

Volatility advantage: Investors can lean into the volatility by using options. “As always, tactical investors can look for dislocations in volatile markets.”

Steven A. Morelli is a contributing editor for InsuranceNewsNet. He has more than 25 years of experience as a reporter and editor for newspapers and magazines. He was also vice president of communications for an insurance agents’ association. Steve can be reached at [email protected].

© Entire contents copyright 2022 by InsuranceNewsNet. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.

Steven A. Morelli is a contributing editor for InsuranceNewsNet. He has more than 25 years of experience as a reporter and editor for newspapers and magazines. He was also vice president of communications for an insurance agents’ association. Steve can be reached at [email protected].

Survey: Pandemic cracked many retirement eggs

Regulation and service excellence don’t have to be opposites

Advisor News

- Study finds more households move investable assets across firms

- Could workplace benefits help solve America’s long-term care gap?

- The best way to use a tax refund? Create a holistic plan

- CFP Board appoints K. Dane Snowden as CEO

- TIAA unveils ‘policy roadmap’ to boost retirement readiness

More Advisor NewsAnnuity News

- $80k surrender charge at stake as Navy vet, Ameritas do battle in court

- Sammons Institutional Group® Launches Summit LadderedSM

- Protective Expands Life & Annuity Distribution with Alfa Insurance

- Annuities: A key tool in battling inflation

- Pinnacle Financial Services Launches New Agent Website, Elevating the Digital Experience for Independent Agents Nationwide

More Annuity NewsHealth/Employee Benefits News

- Idaho is among the most expensive states to give birth in. Here are the rankings

- Some farmers take hard hit on health insurance costs

Farmers now owe a lot more for health insurance (copy)

- Providers fear illness uptick

- JAN. 30, 2026: NATIONAL ADVOCACY UPDATE

- Advocates for elderly target utility, insurance costs

More Health/Employee Benefits NewsLife Insurance News

- AM Best Affirms Credit Ratings of Etiqa General Insurance Berhad

- Life insurance application activity hits record growth in 2025, MIB reports

- AM Best Revises Outlooks to Positive for Well Link Life Insurance Company Limited

- Investors holding $130M in PHL benefits slam liquidation, seek to intervene

- Elevance making difficult decisions amid healthcare minefield

More Life Insurance News