Women double life sales, advisor study finds

More financial advisors are getting into insurance and women are outpacing men in business growth, both because of a broader scope of services, according to the latest edition of the experienced advisor study conducted by LIMRA and EY.

Those are two high-level findings in the study updated from 2018, said Laura Murach, LIMRA and LOMA research director, who is moderating a presentation Sunday with Avril Castagnetta, EY marketing transformation leader, and Bryan Hodgens, LIMRA and LOMA head of distribution research and annuity research. The advisors had at least three years of experience, with an average of 21 years in the business and an average of 51 years old.

“Our key theme, when we did this survey in 2018, was we really started seeing the blurring of distribution channels,” Murach said. “And we're really seeing now that it is not as blurry anymore. We're seeing more top performers across all channels that really have more of a holistic, planning-centric model.”

Although the survey included a wide array – insurance producers, broker/dealer representatives, registered investment advisors and bank representatives – the blurring of lines was mostly financial advisors into the insurance space.

Murach attributed part of the shift to COVID wake-up call. “The pandemic gave people pause and they wanted to protect,” Murach said. “So we're seeing advisors shifting to those protection products.”

Murach could not provide specific numbers from the survey because researchers are still pulling together the final report and presenters on Sunday plan to touch on high-level findings.

Women leap ahead

But Murach was able to say that female advisors more than doubled the number of life insurance policies sold from 2019 and 2021. Women also outpaced men in the number of annuity contracts. The ratio of women vs. men was roughly equal in both surveys, she said, with women being about 10% of the sample.

“Our results are suggesting that the female advisors may take more of a holistic view of their client's needs because they do offer a broader range of services like retirement planning, insurance planning and budgeting,” Murach said. “Just the breadth of services helps explain their rising numbers of policy life insurance policies and annuity contracts.”

Women tended to focus on the client relationship more than products. “Female advisors seem more willing to invest in services that may not pay off in the near term,” Murach said. “They're not about sell that product. They're more, let's build a relationship because it's going to be stronger over time.”

Product preference

When it comes to life products, particularly annuities, advisors said their clients are confused about the products and their fit into their overall portfolio.

“They're saying if we can make the product simpler, and really show the value that they bring to our clients, that would help with growth,” Murach said. “For three in 10 of the advisors, the most difficult aspects of the life insurance sales process is for clients to understand how insurance products fit in with other financial products.”

Clients had difficulty understanding aspects such as life illustrations and guarantees vs. market returns, Murach said. Product is the top concern with insurance sales. But it went hand-in-hand with service and the sales experience.

“If you don't have the product, they're not going to come to you,” she said. “But if you if you have the product but not the experience, you're not going to get repeat business.”

Murach said the sales experience included an efficient, consistent application process as well as the integration of advisor platforms and illustrations.

“What was interesting was experience was really a key differentiator for life insurance,” Murach said. “But with annuities, you really have to have the right product with the right features, and competitive costs and fees associated with it.”

Becoming social

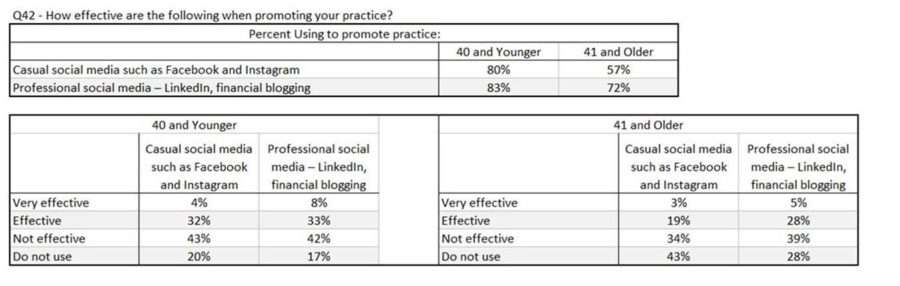

Using social media for prospecting also increased moderately since 2018, especially for those under 40.

The use has grown mostly by insurance producers in both the independent and career channels.

“They're really the most bullish on future social media use,” Murach said. “And we think that comes from recruiting social media talent. We found that advisors realize the need to invest in social media talent and they typically have high higher growth practices. And they really expect to see a significant acceleration in the number of clients that they acquire through social media in the near future.”

Steven A. Morelli is a contributing editor for InsuranceNewsNet. He has more than 25 years of experience as a reporter and editor for newspapers and magazines. He was also vice president of communications for an insurance agents’ association. Steve can be reached at [email protected].

© Entire contents copyright 2022 by InsuranceNewsNet. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.

Advisor News

- Goldman Sachs, others weigh in on what’s ahead for the market in 2025

- How is consumers’ investing confidence impacting the need for advisors?

- Can a balance of withdrawals and annuities outshine the 4% rule?

- Economy ‘in a sweet spot’ but some concerns ahead

- Trump, Capitol allies likely looking at quick cryptocurrency legislation

More Advisor NewsAnnuity News

Health/Employee Benefits News

- Former Bright Health, once a Minnesota IPO darling, goes private in $1.3B deal

- Ask the Medicare Specialist

- Murphy, safely re-elected, attacks medical insures

- Office of Medicaid Policy and Planning Director to step down

- 5 of the most frustrating health insurer tactics and why they exist

More Health/Employee Benefits NewsLife Insurance News