Life insurance sales continue to backslide from pandemic highs, study finds

DALLAS – Life insurance sales trends are cooling off from the COVID-19 pandemic sales bump. The question for the industry is how to stop the slide.

"When you start looking at '22 results, all have that gain that we saw in '21 has been given back," said David Levenson, president and CEO, LIMRA, LOMA and LL Global. "I think that's a little bit of a challenge for the industry, a little bit of a challenge for all of us."

Speaking Tuesday at the NAILBA41 Annual Meeting, Levenson shared updated survey data from a joint study conducted by LIMRA and the National Association of Independent Life Brokerage Agencies.

Sales are shifting among the various life insurance products as well, Levenson said. Whole life continues to do very well.

Growth rates by channel show that agency and brokerages continue to dominate the market. For all the publicity given to direct-to-consumer efforts, that channel is showing little growth in recent years, Levenson noted.

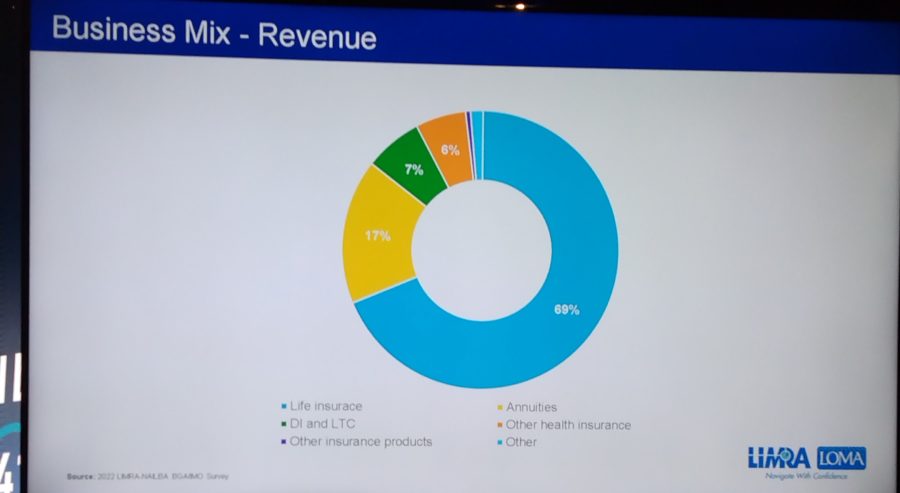

Respondents are still making a living off life insurance. Annuities, long-term care and disability insurance sales are a much smaller piece of the revenue pie, the study found.

"It's a fairly optimistic group, which sales people generally are," Levenson said, "so 68% of the group expected their '22 sales to be up over their '21 sales."

The list of concerns named by brokers and agencies began with growing sales and growing producer numbers.

"The last thing in the world that BGA wants or that IMO wants is a service problem," Levenson said. "Because then that producer will just go somewhere else."

The producer ranks continue to age, with the study showing that 51% of producers are age 55 or older, while just 10% are 34 or younger.

"One of the challenges that we continue to have as an industry, and I think it's really acute right now, is how do we get younger folks just out of college to join, especially on the distribution side."

Many producers are just not very successful, with the study data showing 23% sold no policies in the third quarter 2022, and nearly 75% sold four policies or less.

"So, about three quarters of this group, I think you might say are either part timers, or full timers who are probably going to be looking for another job soon," Levenson said.

Looking ahead three years, respondents see a strong sales outlook for most life insurance products, as well as most feature options.

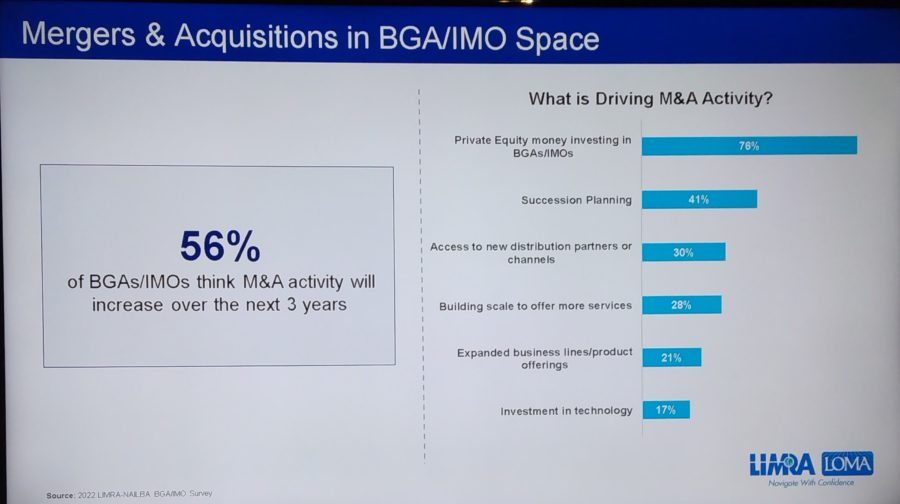

Levenson wrapped up his presentation by noting the merger and acquisition activity. Respondents expect it to continue. The reasons range from private equity interest to investment in technology.

InsuranceNewsNet Senior Editor John Hilton has covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

© Entire contents copyright 2022 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

Advisor News

- Why you should discuss insurance with HNW clients

- Trump announces health care plan outline

- House passes bill restricting ESG investments in retirement accounts

- How pre-retirees are approaching AI and tech

- Todd Buchanan named president of AmeriLife Wealth

More Advisor NewsAnnuity News

- Great-West Life & Annuity Insurance Company Trademark Application for “EMPOWER READY SELECT” Filed: Great-West Life & Annuity Insurance Company

- Retirees drive demand for pension-like income amid $4T savings gap

- Reframing lifetime income as an essential part of retirement planning

- Integrity adds further scale with blockbuster acquisition of AIMCOR

- MetLife Declares First Quarter 2026 Common Stock Dividend

More Annuity NewsHealth/Employee Benefits News

- Far fewer people buy Obamacare coverage as insurance premiums spike

- Counties worry about paying for uninsured

On the hook for uninsured residents, counties now wonder how they'll pay

- Trump announces health care plan outline

- Wipro Announces Results for the Quarter Ended December 31, 2025

- Arizona ACA health insurance enrollment plummets as premiums soar without enhanced subsidies

More Health/Employee Benefits NewsLife Insurance News