It’s ‘game over’ for hospital pricing, NAHU speaker says

AUSTIN, Texas - American consumers “assumed nobody would take advantage of our sickness to profiteer us but that’s what’s happening,” an author and investigative journalist said at today’s opening session of the National Association of Health Underwriters annual convention.

Marshal Allen is an investigative reporter for Pro Publica and the author of Never Pay the First Bill and Other Ways to Fight the Health Care System and Win. He spoke about ways consumers can fight back against unreasonable medical billing and what is at the root of high medical bills.

The Hospital Price Transparency Rule took effect in January 2021, and meant “it’s game over for hospital pricing,” Allen said. The rule required hospitals to provide consumers with a list of their pricing for all procedures – including Medicare pricing, cash pricing and all negotiated rate pricing.

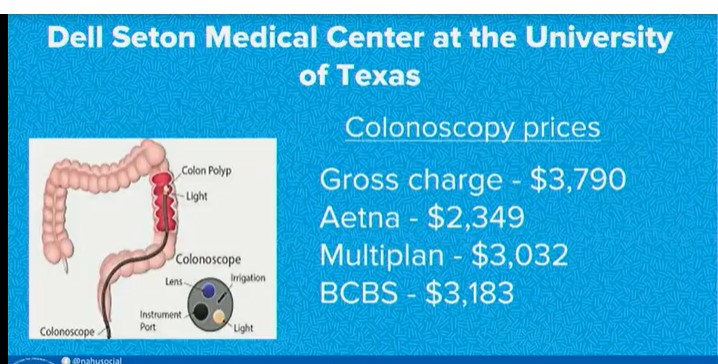

Allen provided some examples of hospital pricing. Here is one:

The cash price for a colonoscopy at this hospital? $1,591, Allen said.

“If a cash patient is paying $1,591, that should be the reasonable starting price,” he said. “The prices need to be reasonable to conform with open contract pricing, or else the hospital should post the cash price.”

Even if consumers have health insurance, they can end up paying less money for a procedure if they pay cash instead, Allen said.

“Don’t let anyone say you can’t pay cash if you have insurance. Under HIPAA, a patient has control over whether their health care provider sends information to their health insurance plan.”

Allen said another driver of high health care costs is cost shifting, where patients with employer-based or individual health insurance are charged higher amounts than Medicare patients for the same procedure.

“Why do Medicare patients pay less than working Americans? Why make working Americans pay more as a result of cost shifting? This is what’s causing working Americans to have medical debt,” he said.

Allen cited statistics from Kaiser Family Foundation that showed premiums and deductibles for employer-based health insurance have risen faster than wages since 2010.

“We have accepted price discrimination against working Americans,” he said. “We need to stop accepting something that’s wrong when we can do something that’s right. We need to work together to make that shift.”

Medical debt has become a fact of life for more Americans, Allen noted, citing KFF’s recent study that showed 100 million Americans are saddled with medical debt. The study showed:

- 1 in 8 respondents with medical debt owed $10,000 or more.

- 1 in 5 respondents said they believe they will never be able to pay off their medical debt.

- About half of those with medical debt said they had to cut back on food, return to work or skip medical care to pay down their debt.

Allen created the Allen Health Academy to teach consumers how to fight inaccurate and overpriced medical bills. He instructs consumers to:

- Get an itemized bill.

- Look up the billing codes.

- Get their medical records.

- Look up the fair price.

- Challenge any price gouging.

- Protect themselves in small claims court, if necessary.

He also instructs consumers how to apply for financial assistance from their hospital.

Allen said his vision is “to equip and empower working Americans and employers to get a reasonable deal on health care - paying a lot less and getting a lot more.

“We are too trusting of the health care system,” he said. “We trust the clinicians who care for us. But we make a big mistake in trusting the industry itself.”

Susan Rupe is managing editor for InsuranceNewsNet. She formerly served as communications director for an insurance agents' association and was an award-winning newspaper reporter and editor. Contact her at [email protected]. Follow her on Twitter @INNsusan.

© Entire contents copyright 2022 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

Advisor News

- Help your clients navigate tax regulations

- CFP Board announces CEO leadership transition

- State Street study looks at why AUM in model portfolios is increasing

- Supreme Court to look at ERISA rules in upcoming Cornell case

- FPA announces passing of CEO, succession plan

More Advisor NewsAnnuity News

Health/Employee Benefits News

- Recent Findings from Eli Lilly and Company Highlight Research in Heart Disease (Prevalence of complications and comorbidities associated with obesity: a health insurance claims analysis): Heart Disorders and Diseases – Heart Disease

- UnitedHealth rebuts Justice Department allegations in $3.3B Amedisys deal

- Universal Medicare for All bill advances in CO legislature

- Blue Cross VT CEO, Don George, announces retirement plan

- Health insurance for millions could vanish as states put Medicaid expansion on chopping block

More Health/Employee Benefits NewsLife Insurance News

- 4Q24 Investor Presentation

- 10 reasons we must embrace the Northwestern Life Insurance building in Minneapolis

- AM Best Revises Outlooks to Stable for Lincoln National Corporation and Most of Its Subsidiaries

- Aflac Northern Ireland: Helping Children, Caregivers and the Community

- AM Best Affirms Credit Ratings of Well Link Life Insurance Company Limited

More Life Insurance News