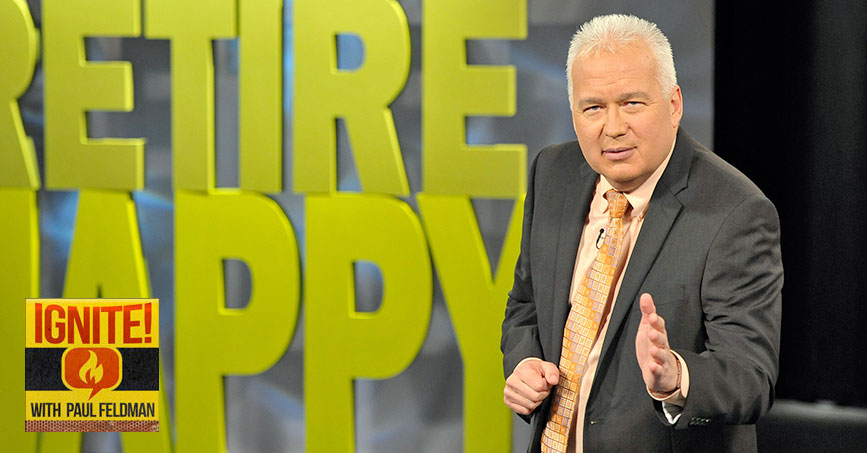

#32: Making your clients retire happy, with Tom Hegna

What are your clients doing to save for retirement? There’s a good chance the answer is “not enough.”

That’s why it’s important to actively warn customers about retirement risks. One of the best-known experts preaching this message at insurance and financial conferences in recent years has been Tom Hegna. Tom is loudly clanging the bell on the retirement crisis. He says that agents and advisors who are not talking about insurance to protect clients’ retirement are not looking after their clients’ best interests. He has a lot of great advice – so much that we’re devoting two episodes to Tom.

Tom is a popular speaker and author of several books, including his well-known Pay Checks and Play Checks and Don’t Worry, Retire Happy.

In this interview, Tom is going to sketch out some compelling strategies to help clients understand the power of insurance. He’ll also walk us through his seven steps to a happy retirement.

[powerpress]

SHOW NOTES:

2:40 Tom’s path to becoming a leading retirement expert includes almost 25 years in the insurance industry.

4:50 Tom talks about what he sees as the biggest problems with retirement today.

6:25 Tom says in order for advisors to educate their clients on the keys to retirement, they first must educate themselves.

7:50 As we dive into Tom’s “Seven Steps to Optimal Retirement,” the first step, plain and simple, is the need to have a plan.

9:25 The second step is to understand and maximize Social Security benefits.

10:55 Step three on Tom’s list is to consider a hybrid retirement.

11:20 Step four is to have a plan to protect yourself from inflation.

12:45 Step five toward a happy retirement is securing more guaranteed lifetime income. As Tom points out, there are a lot of ways to do this.

17:25 Step six is making sure you have a plan for long-term care.

19:05 A truly underappreciated aspect of life insurance in planning is how it affects the other assets.

20:55 Finally, step seven: using your home equity wisely.

23:00 Tom shares some other strategies for life insurance, which he says is the most efficient way to pass wealth to your children, grandchildren and even to charities.

#31: Productivity hacks, with Chris Bailey

#33: Reaching retirement alpha, with Tom Hegna

Advisor News

- 2025 Top 5 Advisor Stories: From the ‘Age Wave’ to Gen Z angst

- Flexibility is the future of employee financial wellness benefits

- Bill aims to boost access to work retirement plans for millions of Americans

- A new era of advisor support for caregiving

- Millennial Dilemma: Home ownership or retirement security?

More Advisor NewsAnnuity News

- Great-West Life & Annuity Insurance Company Trademark Application for “EMPOWER BENEFIT CONSULTING SERVICES” Filed: Great-West Life & Annuity Insurance Company

- 2025 Top 5 Annuity Stories: Lawsuits, layoffs and Brighthouse sale rumors

- An Application for the Trademark “DYNAMIC RETIREMENT MANAGER” Has Been Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

- Product understanding will drive the future of insurance

- Prudential launches FlexGuard 2.0 RILA

More Annuity NewsHealth/Employee Benefits News

Life Insurance News

- Baby On Board

- 2025 Top 5 Life Insurance Stories: IUL takes center stage as lawsuits pile up

- Private placement securities continue to be attractive to insurers

- Inszone Insurance Services Expands Benefits Department in Michigan with Acquisition of Voyage Benefits, LLC

- Affordability pressures are reshaping pricing, products and strategy for 2026

More Life Insurance News