Voya Financial Launches myOrangeMoney™ Digital Experience for Retirement Plan Customers

| PR Newswire Association LLC |

To view the multimedia assets associated with this release, please click: http://www.multivu.com/players/English/7076155-voya-financial-launches-myorangemoney-digital-experience-for-retirement-plan-customers/

Serving as the new centerpiece for the plan provider's participant website, myOrangeMoney is designed to help individuals focus on what matters most — how their accumulated savings translates into estimated monthly income in retirement. The offering is the latest in

"Individuals are shouldering more responsibility than ever before for building and eventually generating their retirement income. At the same time, we know many are seeking greater support and resources so they can feel empowered, optimistic and secure about their future," said

From Accumulation to Income; Green to Orange

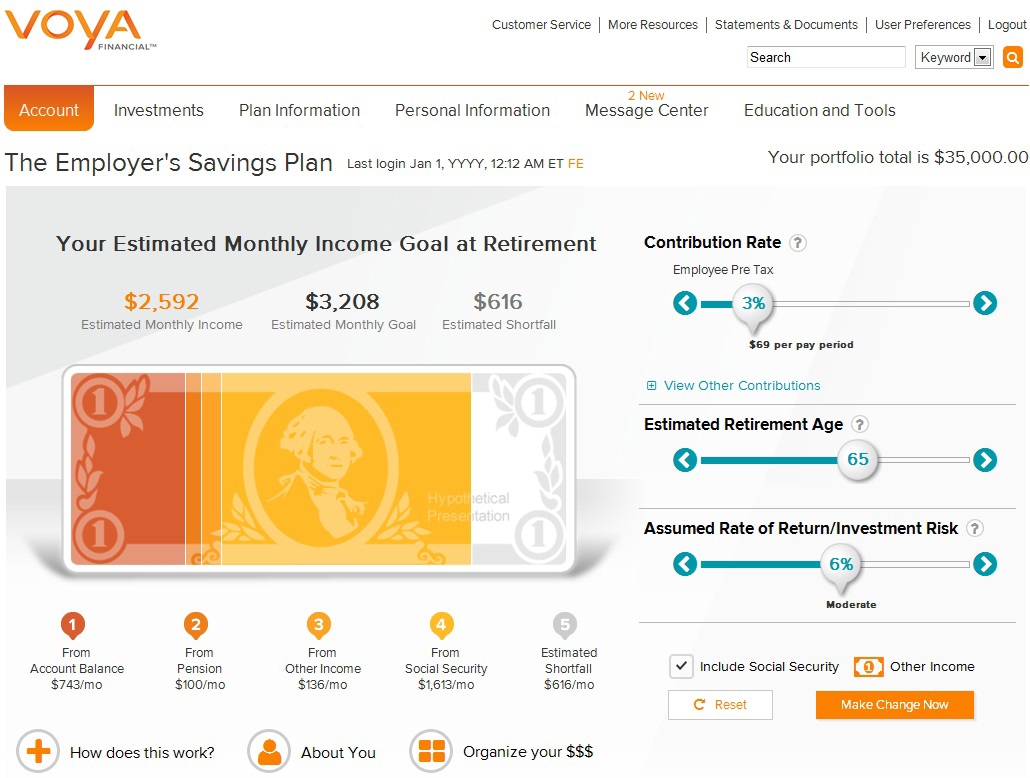

When users log into their retirement account, the first thing they are drawn to is a large and prominently positioned dollar bill, which functions as their virtual "command center" for all savings activities and decision-making on their account. While investors can still obtain their balance and other information typically associated with their savings, the content displayed first and foremost on myOrangeMoney illustrates their savings as future monthly income, and the progress made towards their personal goals. These goals are based on a few easy-to-follow assumptions that each user pre-selects. As they view and interact with myOrangeMoney, a portion will appear in orange — reflecting the amount of their retirement income goals that would be achieved based on savings and

The myOrangeMoney experience focuses on potential income generation as the foundation for every interaction an individual has with their retirement plan account. Users are able to move sliders or change their assumptions, and then instantly see how certain actions would impact the level of their orange-colored retirement income dollars. For example, if they reduce their contribution level, their orange money portion is reduced. Alternatively, if they increase their contribution level or delay their retirement date, they can see how this would improve their results. By showing front and center how every action they take today will impact their future potential monthly income in retirement, participants have the ability to visualize their retirement reality.

In addition, myOrangeMoney also seamlessly links to other comprehensive retirement readiness planning offerings, including the company's new personal financial planning and budgeting dashboard that enables users to organize, integrate and manage all of their financial information in one place. The new experience will be available to plan sponsor clients and their employees in a phased approach throughout 2014. A consumer-facing version of myOrangeMoney is also planned for

"When it comes to retirement planning, most individuals never get beyond the basics, such as logging into their account to check a balance, or to adjust their contribution levels and investment allocations. They tend to see their retirement readiness as one big pile of money, which doesn't help them make relevant planning decisions," added

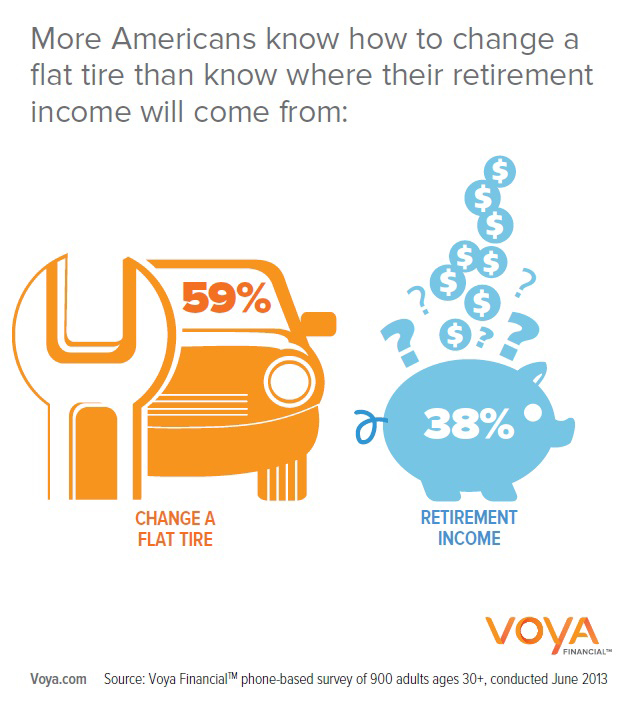

As an industry leader and advocate for greater retirement readiness,

Media Contact:

Emily Dawe

Voya Financial

Office: (860) 580-1750

Cell: (203) 589-7688

[email protected]

About

To view the multimedia assets associated with this release, please click: http://www.multivu.com/players/English/7076155-voya-financial-launches-myorangemoney-digital-experience-for-retirement-plan-customers/

SOURCE

| Wordcount: | 964 |

The race for Governor

Advisor News

- CFP Board appoints K. Dane Snowden as CEO

- TIAA unveils ‘policy roadmap’ to boost retirement readiness

- 2026 may bring higher volatility, slower GDP growth, experts say

- Why affluent clients underuse advisor services and how to close the gap

- America’s ‘confidence recession’ in retirement

More Advisor NewsAnnuity News

- Ameritas: FINRA settlement precludes new lawsuit over annuity sales

- Guaranty Income Life Marks 100th Anniversary

- Delaware Life Insurance Company Launches Industry’s First Fixed Indexed Annuity with Bitcoin Exposure

- Suitability standards for life and annuities: Not as uniform as they appear

- What will 2026 bring to the life/annuity markets?

More Annuity NewsHealth/Employee Benefits News

- Dueling pressures push employers to reinvent their benefits strategy

- Ga. Dems criticize Senate challengers for end of insurance subsidies

- Open Forum: Is that the way the ball bounces?

- Democrats criticize Georgia US Senate challengers for end of health insurance subsidies

- ICE is using Medicaid data to determine where immigrants live

More Health/Employee Benefits NewsLife Insurance News