The Keys to Understanding Seniors’ Medicare Plan Selection and Switching Behavior

As the agent presenting Medicare options to the senior consumer, shouldn’t you be aware of the primary reason(s) they will choose to acquire or switch their coverage during open enrollment?

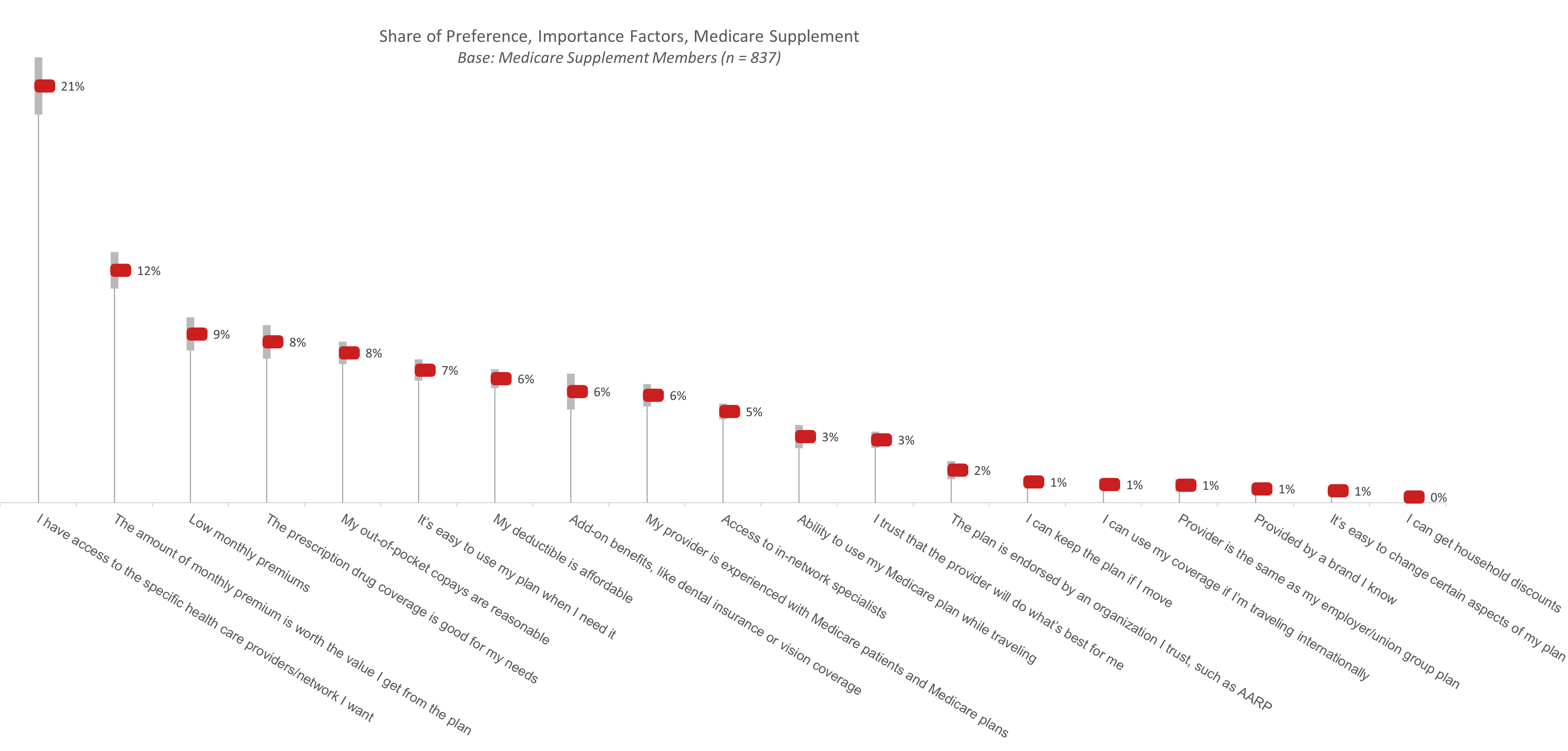

Choosing a Medicare Supplement Plan Provider

Access to specific providers and network resources was the most important factor cited for both Medicare Advantage and Supplement current members. While most important to members of both plan types, access to specific providers and network resources is, by far, the main reason Medicare Supplement members choose the plans they do. Among 19 different plan attributes and features, more than 1 in 5 Medicare Supplement members identify their network coverage as the most important one. They also want to believe that the value they receive from the plan is worth the monthly premiums they pay. These findings are backed up by MedicareFAQ, which states that the three main reasons enrollees leave their Advantage plans are inadequate additional benefits, a smaller-than-desired care provider network and high costs.1 Health Payer Intelligence goes a step further to explain that enrollees are almost twice as likely to leave their current plan when they are in poor health,2 undoubtedly realizing that their plan is not covering their needs when they need it the most.

Choosing a Medicare Advantage Plan Provider

Among Medicare Advantage members, access to their preferred providers is one of three important attributes; prescription drug coverage and add-on benefits are nearly equal to network coverage in terms of importance for these consumers. In a case study presented by KFF, “Craig” chose a Medicare Advantage plan different from the one he already held after an injury, specifically so that the surgeon he wanted to see would be in the network. 3 If that sounds like a lot of work to undergo while seriously injured, it only highlights the priority this access to preferred providers is for Medicare members.

Since network options are generally more limited with Medicare Advantage plans, it’s apparent that members are willing to trade off any HMO-like restrictions associated with their plans for the additional, low- or no-cost benefits these plans offer, such as vision coverage, dental insurance and, especially, prescription drug coverage. In most situations, Medicare Supplement plans, unlike Medicare Advantage plans, offer these features only for additional premium costs.

Comparing Medicare Advantage and Supplement

There are stark differences between what’s important to Medicare Advantage members and Medicare Supplement members. One size does not fit all plans.

Provider Switching Behavior

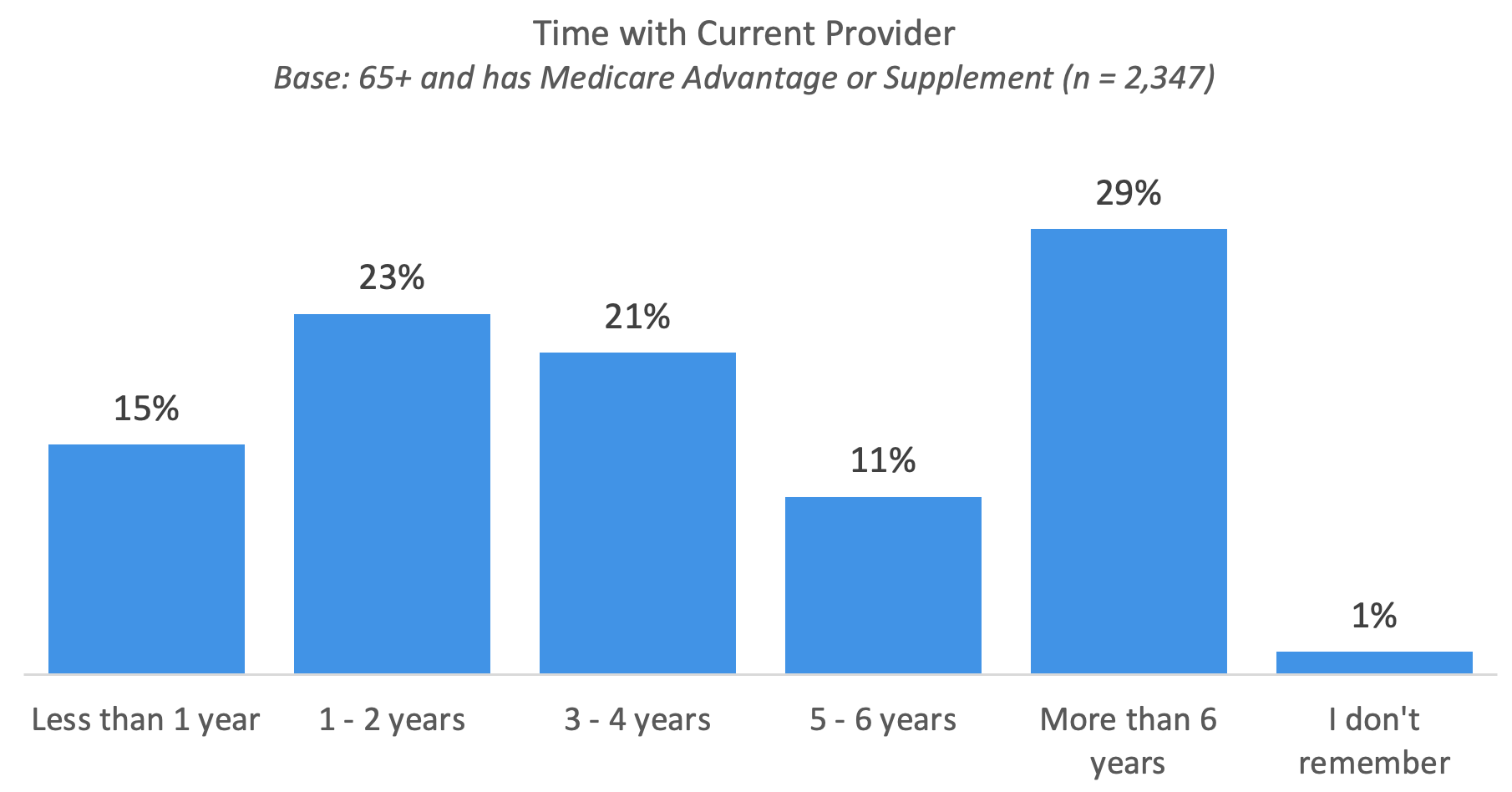

When looking at consumers who have stayed with their providers and those who have switched, about two-thirds have stayed with their current provider. Similarly, according to the Kaiser Family Foundation, only about 11% of Medicare Advantage enrollees actually switched plans between 2016 and 2017.4 This suggests that consumers, in large part, are satisfied with their plans, regardless of whether they have Medicare Advantage or Medicare Supplement.

Time With Current Provider

The largest number of consumers have spent more than six years with their current provider, followed by consumers who have been with their same plan for one to two and three to four years. This makes the average length of time a consumer has spent with their provider four years. This is good news for providers, and as we will see in the next chart, consumers do not leave their plan without reason.

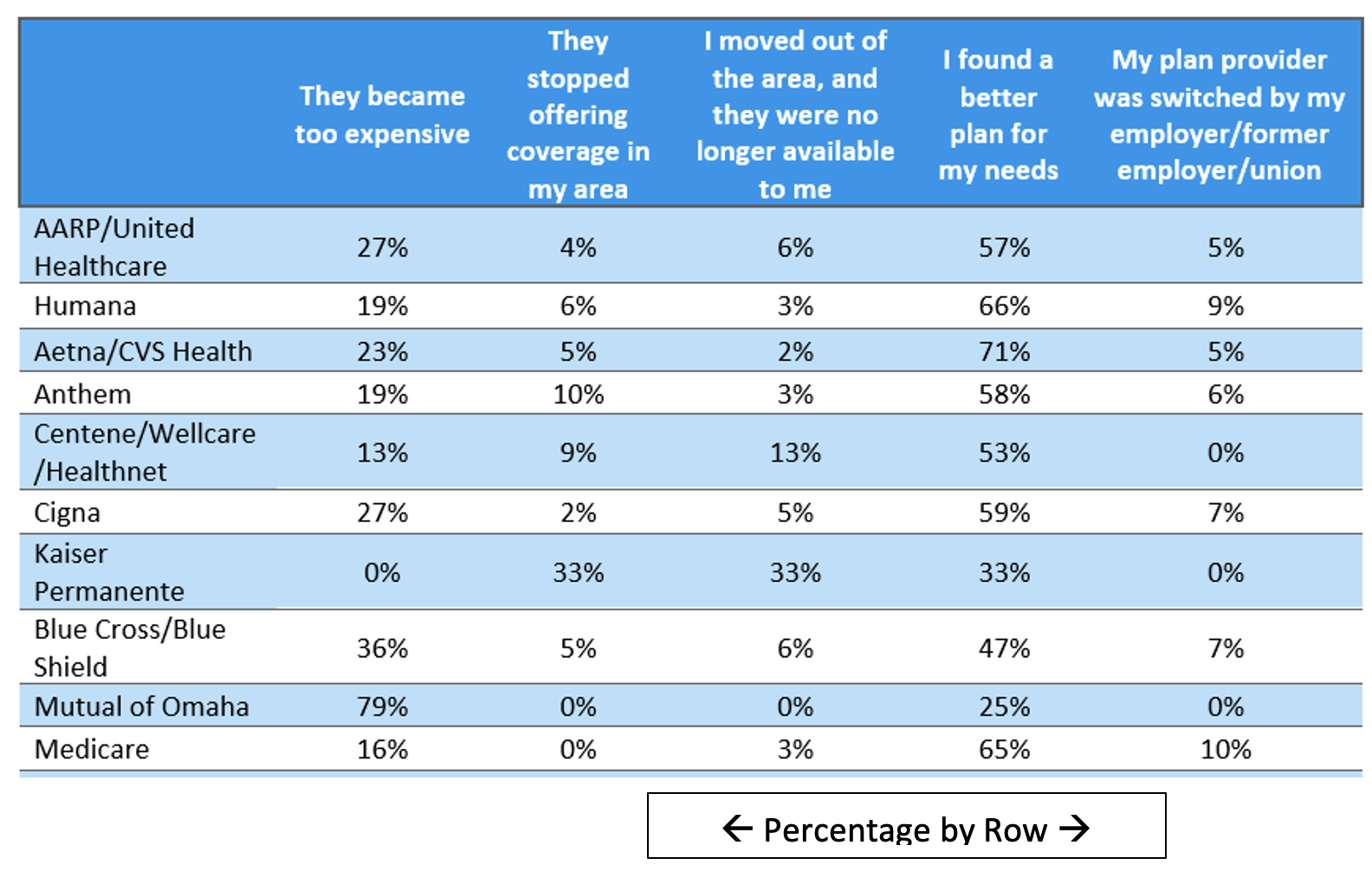

The main reason consumers switched providers is that they found a better plan for their needs, meaning that the people who are switching are doing so intentionally and proactively. This highlights the importance of providers knowing their customer base.

While most companies lost enrollees because members found a better plan for their needs, there are some exclusions to that, including Mutual of Omaha, which most consumers left because the plan became too expensive, and Kaiser Permanente, which consumers left in equal parts because the plan stopped offering coverage in their area, the consumers left the area, and they found better plans for their needs.

Medicare Supplement providers should recognize that there are a couple of unambiguous motivators for many consumers. First, access to their preferred doctors and specialists is of paramount importance, and second (related to the first), members need to believe that the premiums they pay are worth the value of that network access. You may wish to review the statistics for each provider under the heading “They became too expensive.”

** In the spring of 2022, datadecisions Group conducted the 2022 Medicare Options Consumer Key Driver Study, a large, nationwide study of Medicare Advantage and Medicare Supplement alternatives among 2,324 current Medicare-qualified consumers and 64-year-olds who would become eligible soon. The margin of error for this study is approximately ± 2.0%. The National Medicare Enumeration Survey, also conducted in spring of this year, comprised over 5,500 consumers 64+ and had a margin of error of 1.2%.

datadecisions Group is a data-driven marketing services firm that delivers full-service primary marketing research, third-party data, modeling and analytics, and data integration in the client’s martech stack. We inform both corporate strategy and marketing execution.

1. “Top 3 Reasons Why People Leave Medicare Advantage Plans.” MedicareFAQ. Top 3 Reasons Why People Leave Medicare Advantage Plans (medicarefaq.com).

2. Beaton, Thomas. (July 26, 2018). “How to Address Medicare Advantage Beneficiary Disenrollment.” Health Payer Intelligence. How to Address Medicare Advantage Beneficiary Disenrollment (healthpayerintelligence.com).

3. Neuman, Tricia. (March 31, 2016). “Traditional Medicare…Disadvantaged?” Kaiser Family Foundation. Traditional Medicare…Disadvantaged? | KFF.

4. Koma, Wyatt. (Dec. 2, 2019). “No Itch to Switch: Few Medicare Beneficiaries Switch Plans During the Open Enrollment Period.” Kaiser Family Foundation. No Itch to Switch: Few Medicare Beneficiaries Switch Plans During the Open Enrollment Period | KFF.

Introducing Prestige Indexed 10 Pay, a whole life policy … that’s indexed

Research Reveals a Rougher Road Ahead for Medicare Plan Sales

Advisor News

- CFP Board announces CEO leadership transition

- State Street study looks at why AUM in model portfolios is increasing

- Supreme Court to look at ERISA rules in upcoming Cornell case

- FPA announces passing of CEO, succession plan

- Study: Do most affluent investors prefer a single financial services provider?

More Advisor NewsAnnuity News

Health/Employee Benefits News

- Nebraska senators Brian Hardin, Mike Jacobson pitch Unicam bills on federal help for rural health care

- Jacobson, Hardin pitch Unicam bills on help for rural health care

- State Comptroller's audit reveals $16.2 million in improper Medicaid claim payments

- Recent Research from University of the North Highlight Findings in Opioids (Long-term Opioid Therapy and Risk of Opioid Overdose By Derived Clinical Indication In North Carolina, 2006-2018): Opioids

- Health centers brace for chance of limited funds

More Health/Employee Benefits NewsLife Insurance News

- 59% of insurance sector breaches caused by third-party attacks.

- Pacific Life Announces Promotions of Karen Neeley and Patricia Thompson to Senior Vice President

- Lincoln Financial Reports 2024 Fourth Quarter and Full Year Results

- 2024 Annual Information Form

- 4th Quarter 2024 Results 2024 Management's Discussion and Analysis

More Life Insurance News