Tapping into the Medicare Gold Rush: How to differentiate in a challenging member acquisition market

Navigating the competitive market for member acquisition can be challenging, but with datadecisions Group (DDG), your Medicare marketing efforts can rise above the crowd and tap into the immense potential of the Medicare gold rush.

In 2022, an astounding 28 million individuals enrolled in a Medicare Advantage plan, comprising 48 percent of the eligible Medicare population. By 2032, the Congressional Budget Office projects that the share of all Medicare beneficiaries enrolled in Medicare Advantage plans will rise to 61 percent.¹

With an average of 39 Medicare Advantage plans available to beneficiaries in 2022, they are presented with a wide range of options. In fact, it’s the largest number of plans available in more than a decade. However, crucial details such as network limitations, out-of-pocket expenses during illnesses, and the limited value of supplemental benefits are often overlooked when seniors are informed about how Medicare Advantage “will cost them less and provide them more.”

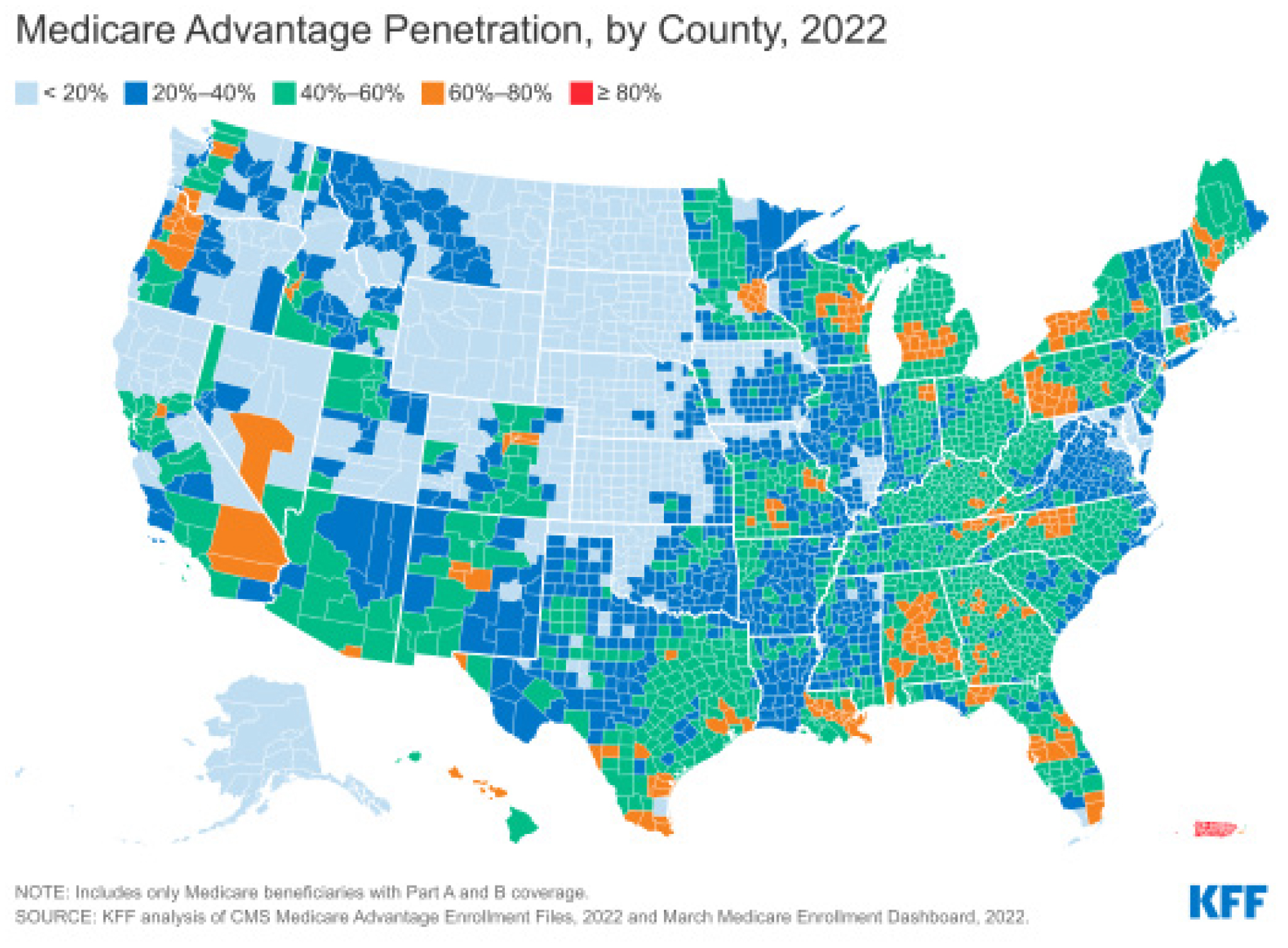

The adoption of Medicare Advantage plans varies across the country, with at least 50 percent of beneficiaries enrolled in 25 states last year. Additionally, in 2022, approximately one in five Medicare beneficiaries (21 percent) lived in counties where at least 60 percent of all beneficiaries enrolled in Medicare Advantage plans (321 counties). Furthermore, nearly 69 percent of beneficiaries were in zero-premium individual Medicare Advantage plans with prescription drug cover (MA-PDs) and paid no premium except for Medicare Part B.

Medicare Advantage plans offer various benefits, such as eye exams and/or glasses (over 99 percent coverage), hearing exams and/or aids (98 percent coverage), and dental care (96 percent coverage). Similar benefits are also provided by most Special Needs Plans (SNPs).

Implications for Medicare Marketing

The good news is that each day, a staggering 10,000 individuals become eligible for Medicare. Among them, 41 percent rely on their independent insurance agent for information, as 51 percent of new enrollees express a limited understanding of their options.² This indicates a significant opportunity for effective marketing.

However, the challenge lies in the fact that seniors often perceive that provider choice doesn’t matter, as many seemingly offer zero premiums with dental, vision, and hearing coverage.

At datadecisions Group, we empower your Medicare marketing initiatives to go beyond the status quo and position your plan as the superior choice for seniors. Here’s how we do it:

Market research: Our approach is rooted in comprehensive market research. By leveraging results from conjoint and segmentation studies, we design plans that align with desired benefits, pricing, and most importantly, address the individual consumer needs in the messaging.

Modeled audiences: Simply relying on age and income-based targeting is no longer sufficient. Our sophisticated acquisition models analyze hundreds of variables to identify seniors who are genuinely interested in purchasing Medicare Supplemental policies, not just Medicare Advantage plans.

Our platform has doubled premium production within a 12-month period for field forces.

MarTech platform: Our cutting-edge MarTech platform is designed to supercharge your marketing efforts. It creates custom models tailored to your local market, taking into account factors like Medicaid expansion status. It highlights the best available audiences for the specific plan being promoted i.e. Dual-Eligible Special Needs Plan (D-SNP). The platform also provides audience counts based on geography, including zip code, county, and designated market areas (DMA). Additionally, it ensures efficient follow-up by archiving order records and managing contact frequency. Rest assured, the platform securely delivers audience data to your production vendor.

Visit datadecisionsgroup.com/medicare-goldrush to learn more about better Medicare audiences, then give us a call to schedule a demonstration and receive 1,000 free contact names.

(Marketing materials must be reviewed and approved by datadecisions Group. Deadline: August 15, 2023)

1. KFF analysis of CMS Medicare Advantage Enrollment Files, 2010-2022

2. DDG Medicare Options Consumer Key Driver Analysis, 2022

How to Win the “Great Wealth Transfer”: The Growing Demand for Next Gen Advisors

Don’t Let the Unforeseen Go Unplanned

Advisor News

- CFP Board appoints K. Dane Snowden as CEO

- TIAA unveils ‘policy roadmap’ to boost retirement readiness

- 2026 may bring higher volatility, slower GDP growth, experts say

- Why affluent clients underuse advisor services and how to close the gap

- America’s ‘confidence recession’ in retirement

More Advisor NewsAnnuity News

- Insurer Offers First Fixed Indexed Annuity with Bitcoin

- Assured Guaranty Enters Annuity Reinsurance Market

- Ameritas: FINRA settlement precludes new lawsuit over annuity sales

- Guaranty Income Life Marks 100th Anniversary

- Delaware Life Insurance Company Launches Industry’s First Fixed Indexed Annuity with Bitcoin Exposure

More Annuity NewsHealth/Employee Benefits News

- Why health care costs hit harder in Alaska

- Dozens laid off at Blue Cross of Idaho amid organizational changes

- Rising health care costs will hurt Main St.

- House committee advances bill aimed at curbing Medicaid costs, expanding access for elderly Hoosiers

- OHIO CAPITAL JOURNAL: 'HUSTED TOOK THOUSANDS FROM COMPANY THAT PAID OHIO $88 MILLION TO SETTLE MEDICAID FRAUD ALLEGATIONS'

More Health/Employee Benefits NewsLife Insurance News