Short, Sweet, Simple – What Annuity Clients Want

New Indexed Annuity Offers Clarity, Simplicity to Clients

When considering financial protection in retirement, most people want to keep it simple.

In that spirit, Great American Life® now offers American Landmark℠ 3, a fixed-indexed annuity that features penalty-free access to the account value after only 36 months, minimizing one of the major apprehensions that many retired clients have about annuities.

“Let’s say a 67-year-old man is considering how to protect his retirement savings. He might not want his money tied up in an annuity for 10 years. With American Landmark 3, he can access his entire account value without penalty after only three years,” Maringer explains, adding that the simplicity of American Landmark 3 helps financial professionals overcome the “annuities are too complex” objection.

In addition, this product provides your older prospects the opportunity to preserve their principal and enjoy growth potential while being comfortably secure with their retirement income guarantee.

And where does the excitement come in? With two new indexes that connect clients to the most enticing financial sectors today — real estate and international developed markets.

After 3 Years, No Withdrawal Fees

Although more clients are asking for a retirement income solution, a traditional 10-year, or even seven-year, annuity may not work if those clients are near retirement.

“People are telling us, ‘I don’t know where I’m going to be in five years, much less 10,’” Maringer points out. “Now, these folks can purchase an annuity that gives them full access to their money after three years, and because it’s a fixed-indexed annuity, there are no fees or contract charges.”

Growth Opportunity

Many indexed annuities offer interest strategies linked to the S&P 500 as a way to grow the capital of investors. American Landmark 3 offers strategies linked to two exchange-traded funds, along with the S&P 500, to encourage growth in today’s economic environment.

The interest strategies include ETF exposure in developed (as opposed to emerging) international markets and the U.S. real estate market. Maringer says that using the ETF strategies allows the opportunity for cost-efficient growth while providing good value for the end consumer. By including a real estate ETF, annuity owners can take advantage of the vibrant real estate market without being tied to hard assets like property or buildings.

“It’s an uncomplicated way to get exposure to different types of asset classes and still protect the client’s principal,” Maringer explains.

Later Issue Age and Health Riders Available

According to the LIMRA Secure Retirement Institute, 67% of consumers age 50 and over say one of their top concerns is having enough money to last their lifetime.1 Because American Landmark 3 is a fixed-indexed annuity, clients’ assets are protected from loss regardless of market conditions. When it’s time to turn clients’ savings into retirement income, they have a variety of payout options, including a lifetime income stream.

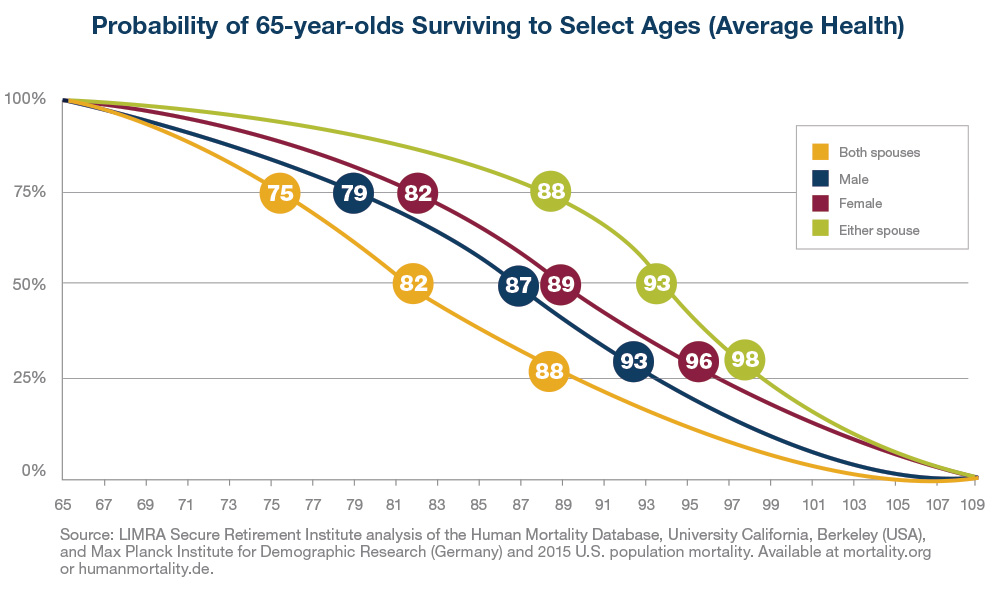

Maringer also pointed out that American Landmark 3 takes longevity into consideration. Because people are living longer, they need to fund a retirement that can exceed three decades. The issue age for American Landmark 3 extends to age 90, so retirees who think they might have missed the chance to secure their assets with an annuity still have an opportunity to purchase one.

To help ensure peace of mind, American Landmark 3 includes two waiver riders that can be accessed after the first contract year. If clients are confined to a nursing home or long-term care facility for at least 90 days, they have the option to withdraw from the annuity without penalty. A similar waiver rider is offered for terminal illness.

The Great American Experience Keeps Things Simple

The desire to listen to its customers and then offer what they want in retirement products is the cornerstone of what Maringer calls the Great American experience.

“We pay a great deal of attention to taking care of our customers because we want to keep them as customers. If they like the Great American experience, they’re probably going to stay with us when their needs change or if they want another product,” Maringer states.

“This results in customers who are confident they can protect and grow their money, as well as financial professionals who are happy to have satisfied clients for the long term when they write with Great American,” he continues.

American Landmark 3 offers different exposure opportunities through low-cost, diversified investments within a principal-protected framework.

He adds, “We believe it’s a unique proposition for our market, and it does something vitally important for our clients — keeps things simple.”

Learn more about the product that’s keeping it simple.

Visit www.AmericanLandmark3.com to download a complete sales kit, including rates.

1. 2017 Consumer Survey, LIMRA Secure Retirement Institute, 2017. Based on 1,107 consumers between the ages of 50 and 75, and with household investable assets of $100,000 or more.

Is Your Company Secretly Losing a Fortune?

Protecting What We Work To Provide

Advisor News

- Americans increasingly worried about new tariffs, worsening inflation

- As tariffs roil market, separate ‘signal from the noise’

- Investors worried about outliving assets

- Essential insights a financial advisor needs to grow their practice

- Goldman Sachs survey identifies top threats to insurer investments

More Advisor NewsAnnuity News

- AM Best Comments on the Credit Ratings of Talcott Financial Group Ltd.’s Subsidiaries Following Announced Reinsurance Transaction With Japan Post Insurance Co., Ltd.

- Globe Life Inc. (NYSE: GL) is a Stock Spotlight on 4/1

- Sammons Financial Group “Goes Digital” in Annuity Transfers

- Somerset Reinsurance Announces the Appointment of Danish Iqbal as CEO

- Majesco Announces Participation in LIMRA 2025: Showcasing Cutting-Edge Innovations in Insurance Technology

More Annuity NewsHealth/Employee Benefits News

- Thousands of Missouri construction workers with Anthem health insurance left scrambling

- Don't let death penalty turn Luigi Mangione into a martyr

- More than 5M could lose Medicaid coverage if feds impose work requirements

- Don't make Mangione a martyr

- Boston Herald: Don’t make Luigi Mangione a martyr

More Health/Employee Benefits NewsLife Insurance News

- 2024 ModeSlavery Report (bpcc modeslavery report 2024 en final)

- Exemption Application under Investment Company Act (Form 40-APP/A)

- Annual Report 2024

- Revised Proxy Soliciting Materials (Form DEFR14A)

- Proxy Statement (Form DEF 14A)

More Life Insurance News