Matching money mindset with fixed index annuity (FIA) benefits

TOP THREE INCOME FEATURES CLIENTS VALUE MOST

It may seem self-evident, but there is a direct correlation between annuity awareness and annuity preference. According to the Secure Retirement Institute, 83% of annuity owners view annuities favorably; that number is cut in half (41%) for non-annuity owners.1 By and large, consumers are unaware of key benefits that annuities provide. By emphasizing the benefits unique to annuities like protecting assets from volatility while generating lifelong income can help bridge knowledge gaps and build long-term solutions.

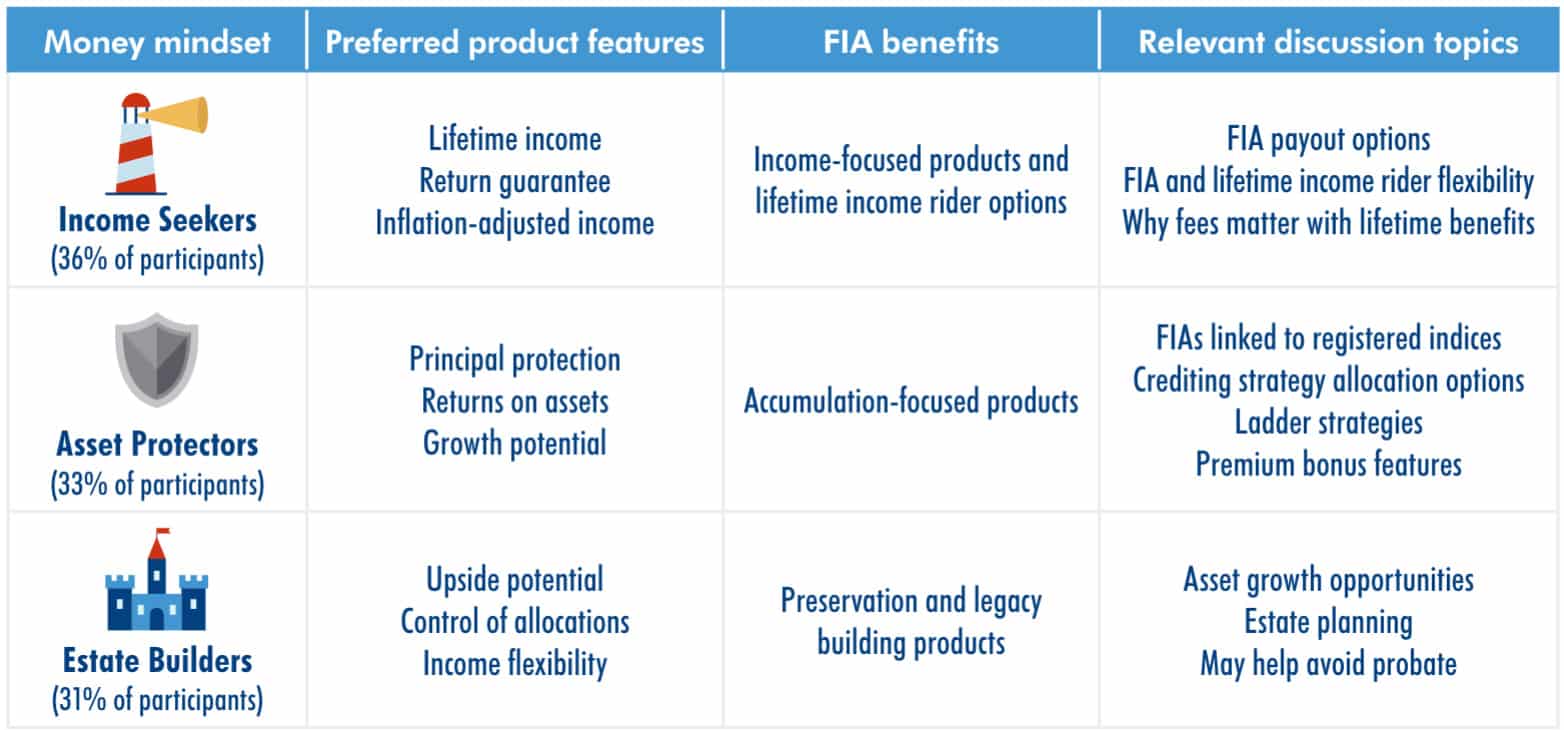

As a retirement income product, fixed index annuities bring a lot to the table. Benefits like principal protection, tax-deferral and growing assets for lifelong income reserves are all important. But, what’s of primary importance to one client may be less significant to another. By aligning your messaging to products and features relevant to your client needs, you can further your relationships and build business.

American Equity’s line of fixed index annuity products and lifetime income rider options offer a combination of benefits to meet your client’s needs, wherever they are in their journey to and through retirement.

Whether it’s building up assets for retirement or preserving income for life and securing a legacy, we’ve got you covered with our AssetShield and IncomeShield fixed index annuities. For more specific information on products and resources on features, visit our product pages.

www.american-equity.com

*LIMRA. “Behavior Finance and Retirement Income Preferences” 2020.

1 Secure Retirement Institute. “Knowledge Matters. The Impact of Financial Knowledge on Annuity Perceptions of Consumers.” 2020

Annuity contract issued under form series ICC17 BASE-IDX, ICC17 BASE-IDX-B, ICC17 IDX-11-10, ICC17 IDX-10-10, ICC17 IDX-10-7, ICC17 IDX-10-5 and state variations thereof. Availability may vary by state.This material is for informational purposes only, and is not a recommendation to buy, sell, hold or rollover any asset. It does not take into account the specific financial circumstances, investment objectives, risk tolerance, or need of any specific person. In providing this information American Equity Investment Life Insurance Company is not acting as your fiduciary as defined by the Department of Labor. American Equity does not offer legal, investment or tax advice or make recommendations regarding insurance or investment products. Please consult a qualified professional.01AD-INN-AA 05.07.21 ©2021 American Equity. All Rights Reserved.

888-221-1234 | 6000 Westown Parkway, West Des Moines, IA 50266

Annuity Myths and Their Antidotes

Why Don’t Advisors Do Annual Reviews on Annuities?

Advisor News

- TIAA, MIT Age Lab ask if investors are happy with financial advice

- Youth sports cause parents financial strain

- Americans fear running out of money more than death

- Caregiving affects ‘sandwich generation’s’ retirement plans

- Why financial consciousness is the key to long-term clarity

More Advisor NewsAnnuity News

Health/Employee Benefits News

- Expiring health insurance tax credits loom large in Pennsylvania

- Confusion muddies the debate over possible Medicaid cuts

- Trump protesters in Longview aim to protect Medicaid, democracy, due process

- Grant Cardone, Gary Brecka, settle dueling state lawsuits

- 9 in 10 put off health screenings and checkups

More Health/Employee Benefits NewsLife Insurance News

- ‘Really huge’ opportunity for life insurance sales if riddle can be solved

- Americans fear running out of money more than death

- NAIFA eyes tax reform, retirement issues in 2025

- Legislation would change tax treatment of life insurers’ debt investments

- Closing the life insurance coverage gap by investing in education

More Life Insurance News