Low surrender charges and an opportunity for simplified underwriting? Meet PAUL.

Consumers know they need life insurance, yet they’re not buying. According to a recent LIMRA study, 65% of consumers are not buying life insurance because they have other financial priorities1 including saving for retirement, and covering the cost of long-term care and other medical expenses.2 There’s a universal life product that can open the door to new consumers who want life insurance but have other financial priorities to address as well.

Meet PAUL – MetLife’s Premier Accumulator Universal Life product.

Clients rarely consider life insurance to be an asset1, and advisors don’t consider using it to attract new customers. But PAUL challenges old assumptions and the status quo by offering the potential for early cash value. In addition, PAUL offers tax-favored cash value accumulation, growth not directly affected by market fluctuations, and a death benefit.

And unlike traditional life insurance policies, which typically provide access to lower cash value and have higher surrender charges in the first few years, PAUL flips the script by offering the opposite: high early cash value accumulation3 with low surrender charges—just 1 percent or less of typical universal life surrender charges.

The benefits clients have been waiting for

With PAUL, cash value can accumulate quickly compared to other life insurance products that—in most cases—clients on a nonguaranteed basis can have access to most or all of the money they’ve paid into the policy within the first few years.

“Often, clients see high surrender charges that hinder their ability to get money out of the contract if they have a hardship,” says Gene Lunman, executive vice president of MetLife Retail Life & Disability Insurance. “So that’s one reason why we created MetLife Premier Accumulator Universal Life, which can provide clients with access to cash value and flexibility as well as death benefit protection.”

The qualities of an asset providing death benefit protection added to low surrender charges and competitive cash value accumulation allow PAUL to appeal to a wider range of individuals, helping advisors open doors to new customers.

PAUL’s cash value accumulation, which is not directly correlated to the stock market, and its tax-favored growth are appealing benefits for clients who are concerned with the direct impact of market fluctuations and want to prepare for supplemented retirement income.

“PAUL offers protection, access to cash value, and business planning opportunities that combine to make it extremely attractive to both individuals and small business owners,” says Lunman.

A faster, simpler underwriting process

PAUL also offers MetLife Enhanced Rate PlusSM (ERP), a unique program that holds a number of benefits for eligible and qualified applicants and financial professionals.

Unlike some insurance carriers’ underwriting processes, ERP offers the opportunity for both a boost in rating class—from standard to preferred or elite—and a faster underwriting process via teleapp.4 Clients appreciate that the cases that qualify for the program require no paramedical exams or lab work and that the rating boost can result in more affordable premiums.

“ERP allows us to get a qualified client through the underwriting process in one week, which is very different from the average of 40 days that traditional life insurance underwriting takes,” says Lunman.

ERP’s streamlined underwriting decision timeline also means that financial professionals can close their cases sooner and get paid faster, and the overall underwriting process can feel less stressful and less complex for both advisors and clients.

The compensation structure you want

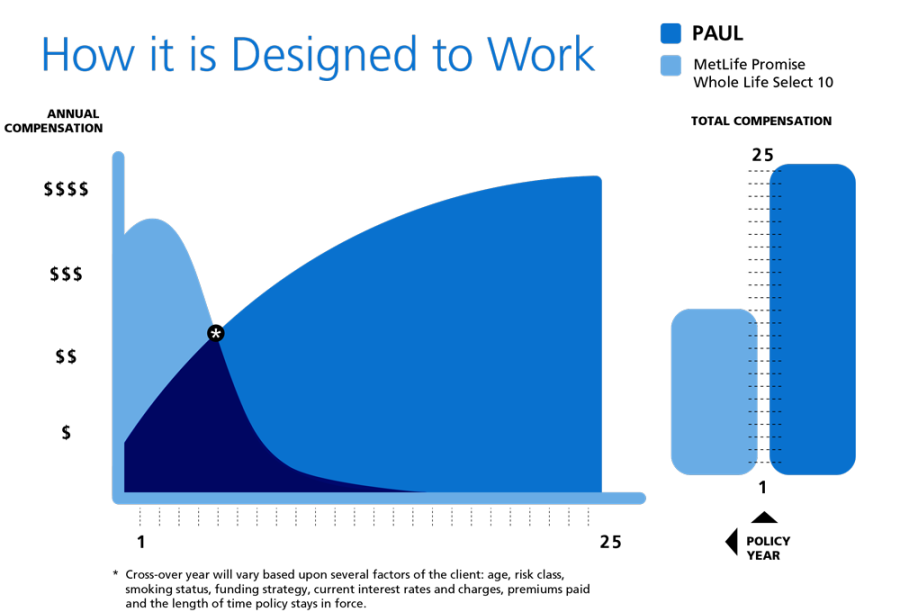

PAUL offers advisors a compensation trail that’s unique for a life insurance product. Compensation is paid over the life of the policy, which allows for PAUL’s low surrender charges.

PAUL’s compensation is based both on premiums paid and the cash value of the policy: a powerful combination that can pay more cumulative compensation over the life of an insurance policy than a typical universal life policy.

“PAUL is aligned with both the client’s lifetime needs and with the advisor serving their clients, resulting in the advisor having the potential to get paid more over a longer period of time,” says Lunman.

PAUL: an asset for advisors and clients

PAUL highlights MetLife’s commitment to creating products designed to meet the wide-ranging needs of its clients and advisors. With PAUL, concepts like life insurance as an asset and opening doors to new customers are spurring advisors to take a new look at universal life.

With its death benefit protection, low surrender charges, faster access to more cash value, a simplified, faster underwriting process, and the compensation structure advisors want, PAUL has the potential to support existing clients in new ways and grow advisors’ businesses by reaching new clients.

For advisors interested in new opportunities and reaching new customers, MetLife makes it easy to get to know PAUL. In just three minutes, advisors can get the basics of PAUL’s compensation structure and its unique features and benefits.

Even more details about opening new doors with PAUL are available by calling 1.844.378.3361 or visiting PAUL’s website.

1 Source: 2015 LIMRA/Life Happens Barometer Study

2 Source: 2013 Insurance Barometer Study, LIMRA & LIFE

3 Based on current interest rates and charges which are not guaranteed. Cash value is accessed through withdrawals and loans which will reduce the policy's cash value and death benefit.

4 All eligible clients who qualify for Standard Rates without an extra premium will receive the upgrade. Clients with certain factors – including, but not limited to, ratable medical impairments and other health or lifestyle risks that require an extra premium - do not qualify for Standard Rates or program upgrades and will proceed through traditional underwriting.

Any discussion of taxes is for general informational purposes only, does not purport to be complete or cover every situation, and should not be construed as legal, tax or accounting advice. Clients should confer with their qualified legal, tax and accounting advisors as appropriate.

MetLife Premier Accumulator Universal Life is issued by MetLife Insurance Company USA on Policy Form 5E-37-14 and in New York only by Metropolitan Life Insurance Company on Policy Form 1E-37-14-NY. All product guarantees are subject to the financial strength and claims-paying ability of the issuing insurance company. L0915437423[exp0916][All States]

TIME to Consider Permanent Life Insurance

New MetLife Dental Program Helps Employers Meet the Needs of More Employees

Advisor News

- TIAA, MIT Age Lab ask if investors are happy with financial advice

- Youth sports cause parents financial strain

- Americans fear running out of money more than death

- Caregiving affects ‘sandwich generation’s’ retirement plans

- Why financial consciousness is the key to long-term clarity

More Advisor NewsAnnuity News

Health/Employee Benefits News

- Immigration cooperation, IEDC limits and more nab concurrence votes, head to governor

- Ending Medicaid expansion would devastate Ohio’s economy

- Alfa health plan bill 1 vote from final passage

- Business Briefs 0424

- Bill aimed at holding health insurance companies accountable stalls at Capitol

More Health/Employee Benefits NewsLife Insurance News

- Annual Report for Fiscal Year Ending December 31, 2024 (Form 20-F)

- Ameriprise Financial Reports First Quarter 2025 Results

- IUL: Offering stability amid trade tariff uncertainty

- ‘Really huge’ opportunity for life insurance sales if riddle can be solved

- Americans fear running out of money more than death

More Life Insurance News