Building Trust in Uncertain Times: Strong Partners Key for Independent Agents

Are you up for a challenge in 2025? And as important, do you have a choice?

Independent insurance agents face a formidable task in guiding clients to trusted carriers, ones which can be counted upon to help safeguard hard-earned legacies.

Our Business Doesn’t Exist in a Bubble

The insurance industry is no exception. The past decade has brought surges of new business to our industry as well as unfortunate casualties in carriers experiencing weakening levels of capital, a few even so far as to requiring rehabilitation by their departments of insurance. Newcomers to our business — those perhaps more focused on short-term investor profits than long-term policyholder benefits — meanwhile have emerged to begin acquiring a number of carriers.

Against this backdrop, it’s more important than ever for agents to consider the financial strength and performance record of their insurance partner in order to provide clients with a greater sense of security.

Building on Bedrock Since 1888

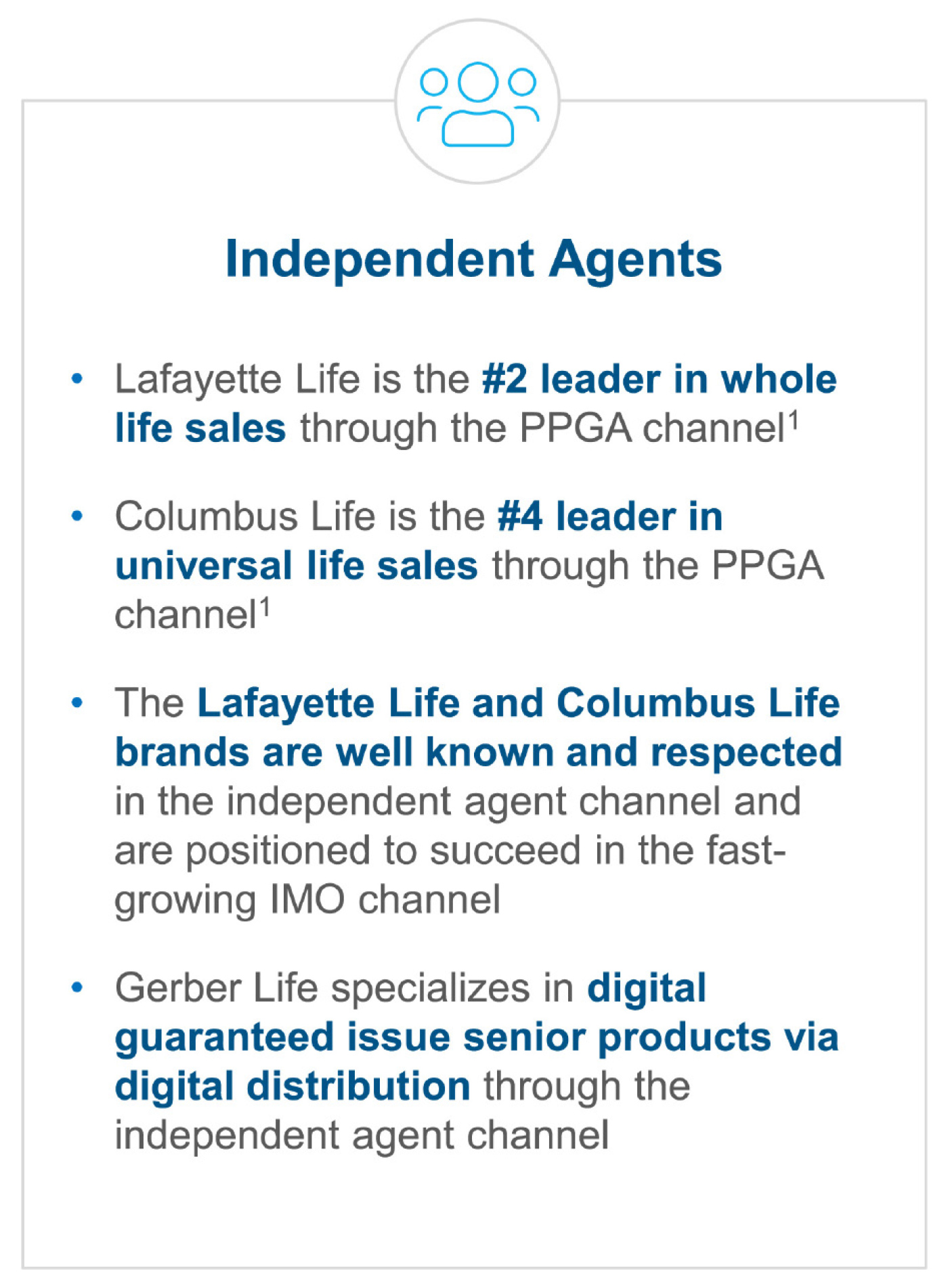

Western & Southern Financial Group offers independent agents a family of companies carrying some of the industry’s strongest ratings. Together they provide a comprehensive portfolio of key life insurance products for independent agents.

Independent agents benefit from three critical life insurance product lines provided by Columbus Life, Lafayette Life, and Gerber Life, all strengthened and secured by their common heritage with Western & Southern. Drawing on a legacy dating to 1888, Western & Southern today stands as one of the strongest mutually held insurance groups in the world. Our individual brands help provide assurance bolstered by our parent organization’s phenomenal capital-to-asset ratio of 14.9%2, one that far surpasses the average of the 15 largest publicly traded life insurers doing business in the U.S. Our enterprise now serves some 6.4 million clients, policyholders and account owners and in 2023 (as 2024 numbers are still being finalized) we paid $7.4 billion in total claims, benefits and dividends.

Yet each brand stands uniquely positioned to bring independent agents advantages for their own businesses.

Complementary Suites of Solutions from Superior Issuers

Columbus Life, founded in 1906, specializes in indexed universal life insurance as well as offering term life and fixed indexed annuities. We offer a portfolio of products ranging from IULs for individuals and survivorships, traditional or rapid-issue underwriting. While many carriers focus on overly optimistic projections, “Real Life” is the rule here. Columbus Life prioritizes transparency and realistic outcomes, ensuring agents don’t need to revisit policies burdened by unmet expectations.

Timeless values guide modern design at Lafayette Life. Here whole life insurance stands foremost. We offer some eight individual whole life policies and we prize an unbroken history of paying dividends since the company’s 1905 inception.3

Lafayette Life’s portfolio also includes term life and fixed indexed annuities. Our variety of base policies and riders equip agents with a versatile toolbox for modern life, one ready to be tailored to individual needs and as necessary adapted to changing requirements. When life calls for new plans, our policies offer non-direct recognition loans for access to cash value. All life insurance products at Lafayette Life (as well as Columbus Life) automatically include our accelerated death benefit rider for eligible clients, providing competitive benefits to be used for any reason in the event of a claim. We are also home to Lafayette Life Retirement Services. It offers an experienced, responsive single shop for qualified retirement plan sales and administration, helping agents grow their business by serving other small business owners.

Finally, consider Gerber Life. Famously known for providing juvenile coverage direct to the consumer, it also offers independent agents guaranteed issue life coverage for older individuals. For more than half a century, Gerber Life has been dedicated to providing everyday families with access to life insurance coverage under one of America’s most recognizable brands. Clients and agents alike appreciate a quick, simple application with no exams or complex questions. Guaranteeing coverage for individuals aged 50 and older, it helps provide financial relief for final expenses, medical bills and outstanding debts. The confidence inspired by Gerber Life’s widely recognized identity is further enhanced by the strength of our parent enterprise, conservatively managed to better assure delivery of its more than $65 billion of life insurance in force.4

Better Position Your Business for Continued Success

Life insurance is complicated. The products and concepts are unfamiliar to most consumers. Agents meanwhile are under enormous pressure to stay current as expert resources while managing their business as well.

Success-minded agents can streamline their business model by partnering with a carrier equipped to provide as much as possible under one roof. Recognized and respected issuers — Columbus Life, Lafayette Life and Gerber Life — each possess unique product portfolio strengths. Yet all are unified under the shared financial wherewithal and operational proficiency of Western & Southern. Moreover, other units specializing in investments, real estate and institutional markets provide enhanced diversification that in turn helps Western & Southern better weather economic downturns and ultimately serves as added ballast for its life insurance obligations. This time-proven business profile should give agents confidence that they’ll never need to apologize for representing our products and their issuers.

As President and CEO of Columbus Life and Lafayette Life, I’m proud we encourage direct access for independent agents to our Home Office teams, including Underwriting, New Business and executive leadership. Together our operations function as a cohesive team with the common goal of an exceptional customer experience. Moreover, we offer shared services such as our Advanced Markets professionals to support complex planning and sales — providing complimentary resources from industry specialists for an agent’s own practice. And because each agent’s business is unique and valuable, our sales teams deliver world-class service in helping agents excel.

If you’re an independent agent yet to work with any of our solutions, then I encourage you to learn more about how we can better support your business. We understand the challenges confronting independent agents. Come work with a company with which you can build a long-term relationship, a company that provides solutions where you won’t have to explain unmet or unexpected outcomes. As time marches forward in this unknowable world, we want to provide you and your clients with as much stability as we can. Doing so helps make you more productive and better able to serve more clients. Allow us to help you soon.

Visit www.WesternSouthernBrands.com to contact Columbus Life, Gerber Life, or Lafayette Life and learn more.

1 LIMRA, U.S. Retail Individual Life Insurance Sales Reports (Annualized Premium) as of 12/31/23.

2 As of 12/31/24.

3 Dividends are not guaranteed and may be changed by the company at any time.

4 As of 12/31/23.

Life insurance products are not bank products, are not a deposit, are not insured by the FDIC, nor any other federal entity, have no bank guarantee, and may lose value.

Payment of the benefits under the contract is the obligation of, and is backed by, the product issuer. Columbus Life Insurance Company and The Lafayette Life Insurance Company are domiciled in Cincinnati, OH and operate in DC and all states except NY. Gerber Life Insurance Company is domiciled in White Plains, NY and operates in DC and all states. Gerber Life Insurance is a trademark used under license from Société des Produits Nestlé S.A. and Gerber Products Company.

© 2025 Western & Southern Financial Group. All rights reserved.

WSFG-INN (02/25)

Navigating Medicare with Confidence: LifeShield Empowers Agents with Stability and Service

The Most Important Word in Annuities is TRUST

Advisor News

- Retirement Reimagined: This generation says it’s no time to slow down

- The Conversation Gap: Clients tuning out on advisor health care discussions

- Wall Street executives warn Trump: Stop attacking the Fed and credit card industry

- Americans have ambitious financial resolutions for 2026

- FSI announces 2026 board of directors and executive committee members

More Advisor NewsAnnuity News

- Retirees drive demand for pension-like income amid $4T savings gap

- Reframing lifetime income as an essential part of retirement planning

- Integrity adds further scale with blockbuster acquisition of AIMCOR

- MetLife Declares First Quarter 2026 Common Stock Dividend

- Using annuities as a legacy tool: The ROP feature

More Annuity NewsHealth/Employee Benefits News

- Long-term care insurance can be blessing

- Thousands in Conn. face higher health insurance costs

- Ben Franklin's birthday; Meet Mandy Mango; Weekly gun violence brief | Morning Roundup

- Virginia Republicans split over extending health care subsidies

- CareSource spotlights youth mental health

More Health/Employee Benefits NewsLife Insurance News