A.I. for life agents enables faster and more accurate field underwriting

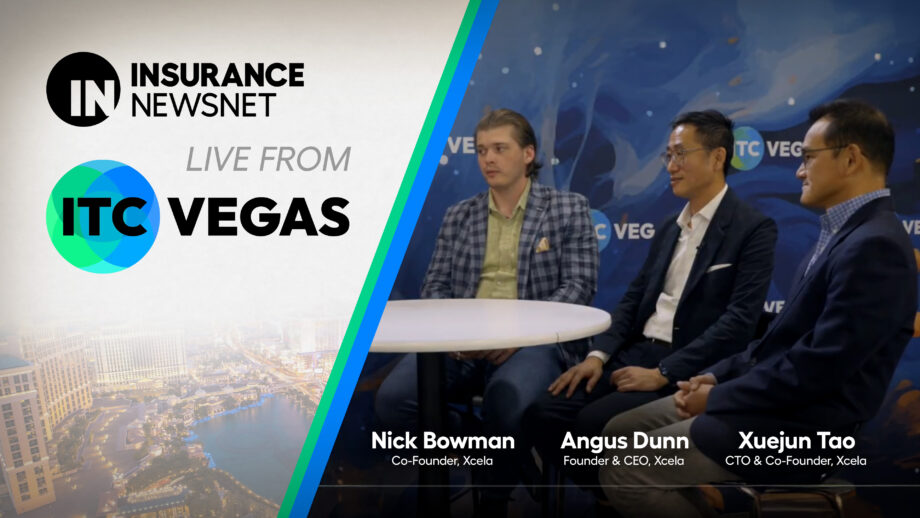

Live from the ITC 2024 Vegas conference, InsuranceNewsNet Publisher Paul Feldman interviews leaders from Xcela, an AI-driven platform designed to simplify and accelerate the insurance sales and underwriting processes. Co-founders Angus Dunn and Nick Bowman explain that Xcela’s platform uses advanced AI to automate repetitive tasks, enabling agents and brokerages to focus on client relationships rather than administrative burdens. The platform’s standout feature is its ability to process complex medical and lifestyle data in real-time, offering fast, reliable underwriting decisions directly from agents’ devices.

Bowman highlights how the platform helps agents input information, such as medications or health history, and instantly provides underwriting suggestions by matching client data with carrier guidelines. This saves agents significant time and helps them avoid the lengthy back-and-forth often required to collect missing information. Xcela’s integration of third-party data sources, such as prescription histories, further supports accurate decision-making.

Xcela’s leaders discuss the platform’s tailored benefits for different user types: independent agents gain quick quote capabilities, while brokerages and IMOs benefit from increased operational efficiency, pushing high volumes of applications with fewer errors. The platform reduces underwriting timelines from months to under a week, facilitating faster policy issuance and client satisfaction.

Xcela is also exploring ways to apply AI in document processing, like summarizing APS reports, to streamline workflows. Dunn emphasizes Xcela’s commitment to data privacy and security, ensuring HIPAA compliance and building transparency into AI decisions. The technology prioritizes accuracy to avoid AI "hallucinations," with every AI-driven recommendation grounded in client-specific data to support trust and usability across the industry. Xcela’s forward-looking approach aims to redefine industry standards, making underwriting faster, simpler, and more reliable for agents and clients alike.

Video Transcript:

Paul Feldman:

Hello everyone, it's Paul Feldman, InsuranceNewsNet, and I'm excited to be here at the ITC 2024 conference with one of the biggest innovators that I've met at this conference: Xcela. I've seen their product. It's a really interesting concept. I think it might be industry standard going forward. Tell us a little bit about what you do.

Angus Dunn:

you for inviting us here, Paul. I really appreciate it. I'm so excited to have this fireside chat with you. A little bit about Xcela. We focus on an AI platform helping insurance agents and brokerages to sell faster and better. And the way that we do it is the AI platform is going to handle the sales thousand operations, the manual tasks for you so that agents can focus on the client relationship much better.

Paul Feldman:

How does that work?

Angus Dunn:

Alright, you want to get into that a little bit?

Nick Bowman:

Paul, thanks for having us here today. I'm one of the co-founders of Xcela. I've been in life insurance for 14 years and I started out as an agent at MassMutual, from calling two people a day all the way through to working in the advanced markets team at Lion Street. And our tool really helps accelerate the underwriting process and pain points that agents are having. I started in the business 14 years ago and it's still done mostly the same way. Even with a lot of the digital innovation, there's a lot of manual inputs and manual entries. What we're doing is making that pain point not a pain point, automating all of those features to really give a seamless process to not just the underwriting piece but various administrative tasks.

Paul Feldman:

And one of the cool things that I've seen with your platform is the fact that an agent can go in, they can type out all of the drugs that somebody's on, they can put in all of the habits they have or problems they have. And you guys are shopping the underwriting guides all through AI, through natural conversation, which is even better. That makes it easier for an agent when they're in the field… or a BGA or a carrier or whoever is looking at an application. So tell us a little bit more about how that works.

Nick Bowman:

Yeah, it's really cool. So most insurance is still sold at the kitchen table and our tool, our platform is not only for computer usage, but it's also an underwriter and case manager in your pocket. So while you're sitting with a client, in five minutes you can have them sign a HIPAA, get all their medical data and run it through the carrier guidelines to find out where that client lines up and who the next step will be. So it really accelerates the process.

Angus Dunn:

For a certain carrier, someone might be uninsurable, but then there's always something that you can do from our AI. We'll recommend actions that you can take, things that you can do, information that you can collect to make it an insurable class so that way at least you can work with a client to work towards that.

Paul Feldman:

And I think that's really valuable for an agent advisor. Underwriting for life insurance is the hardest thing.

Angus Dunn:

One of the things that we did really well, I think in our software, on our platform, is that we want the agents to focus on the relationship with the clients and all the heavy work behind the scenes, we take out that on a platform. With underwriting, we minimize the turnaround, minimize the round trip. You have to negotiate with the insurance carrier because you've got the right information up front by talking to your client so that you can work on a much speedier offers for them rather than what in some cases takes six to nine months. We can actually bring it down to literally under a week.

Paul Feldman:

So tell me a little bit more about this. What should an agent advisor, BGA, IMO, why should they be looking at this?

Angus Dunn:

Depending on whether you’re dealing with. For independent agents, it’s easy. The reason is because they can collect information from a client; they use our software and get some indicative offer. And then for brokerages or the IMOs, the story is a little bit different because they usually work at a much higher volume of applications. They might have more agents that they're working with. They're looking at operational efficiency because they have to push through a lot of applications through our system so that they can actually achieve the high throughput using our AI platform.

Paul Feldman:

So tell me a little bit more about how you guys are helping BGAs, IMOs agents, advisors with your technology platform.

Angus Dunn:

Very good question, Paul. The way that we deal with it is we actually have two different approaches. Agents, independent agents, they actually use our software to get a quick quote, get a quick offers from our system. They’ve got a client, they’ve got some basic information, they can easily get their offers from our system, from the field underwriting guide, from the various insurance carriers. That way it actually helps them to understand what are the best carriers, best offers they're going to go for so that it minimize the turnaround time. It's a lot easier for the clients and for them to close the deal. For BGAs and also for IMOs, it's going to be different. The reason is because for BGAs and IMOs, what they do is they have a much bigger operations, they have a lot of agents in place. What they do is they really want to see how they can push through a lot more cases faster. And the way that we offer value for them is the operational efficiency. We collect information, we drive the data point that's important to drive the underwriting decisions all in one place to make it fast. Cutting down from months to literally under a week so that they can push through all the system.

Nick Bowman:

Most of the time, those applications are missing information. So you're going back and forth with the carrier and then you’ve got to go back and forth with the client. What we're doing is telling you all those little pieces that are missing while you're sitting with the client. So you don't have to do the back and forth anymore. It's all there.

Paul Feldman:

Which I think is really helpful. If I'm an agent and I'm sitting in front of a client and they tell me I'm on this blood pressure medication, what are the next questions to follow up that's going to help the underwriter?

Angus Dunn:

Absolutely, that's right.

Nick Bowman:

Some of the partnerships that we have with exam companies and reinsurers, we're able to gather third party data sources that bring in. Alright, great big pain point is clients don't always tell you the medication that they're on or their doctors not because they're lying just because they don't remember. I mean, do you remember all the doctors you've seen in the last two years? So we're able to do in less than five minutes is pull a list of every doctor they've seen in the last five years and tell the agents which ones are actually beneficial for ordering their records. We're getting all the prescription history data.

Paul Feldman:

Okay. That's a huge deal. So you guys are shortening underwriting time, you're making it easier for agents to do business and ask the clients the right questions.

Nick Bowman:

Correct.

Paul Feldman:

And I think that's really fantastic.

Nick Bowman:

Yeah, we can take an agent that knows nothing about underwriting, whether it's a P&C agent who wants to get into life and make them look like an expert. We can also take the life insurance agents who are solely focused on life and really provide value in the underwriting process and augment them to be better. We have two guys here that have nine patents in AI and machine learning that came out of Google, came out of Salesforce. Really smart guys. And we believe that AI doesn't replace people, it makes them look better. I think that that's a big differentiator for us. Another big differentiator is that any data you put in the software, it's always your data. We don't keep it, we don’t even train on it. If you decide you don’t want to work with us anymore, we'll give you your data back, no questions asked.

Paul Feldman:

That's fantastic.

Angus Dunn:

So one thing I wanted to add, more on the functionality side, is that some of the agents that we've been talking to say they have to use so many different pieces of software. Often, they have to call the help provider up to get the prescriptions, maybe another portal to get that information. What we are doing here is a one single platform so that they can get everything within our platform without having to do any multi manual tasks. That’s critical in terms of operational efficiency. And then, in addition to that, I want to also want to say one thing is about the data. We actually have compliances like the HIPAA compliance in place. So that’s one less thing the agent has to deal with when they work with the clients. We have the HIPAA compliant form in our software that you can actually directly send out to your client and they can actually take out the e-signature over there and we can get the additional information afterwards.

Paul Feldman:

So where do you see your technology going in the next year?

Angus Dunn:

That's a very good question. We start with an AI platform. Our initial goal right now today is to use language models, our RAG technology… all the good stuff to help an agent to sell fast and better. So with some integration as well, our goal is to get this to the next level for the brokerages. So we work with brokerages to do operational efficiency. Now the next step, what we are going to do is to understand some of the more complex documents that they are providing. We'll be able to process those too as well to help them with the decisions maybe

Xuejun Tao:

I worked at a Google engineering director. I worked in the development for a few AI and the search recommendation products, including documented AI. So I think that it’s very relevant to what we are doing. So I see a lot of common challenges that actually are very common for many industries, especially for financial, especially for insurance. So there are many challenges. How do you get the data out from those structured storage, for example, like a PDF document or image in the PDF. So that's why we see a need to really build a platform to help developers actually to build the solutions, to meet the special needs for the industry, especially for financial. And now AI in particular. Generally, AI is completely different from what we saw a few years ago.

Now it gives us a new opportunity to actually solve the problem. So the challenge is how do we adopt general technology in the right way? The foundation large language model often can have problems with hallucinations. That's why we want to apply our new technologies on top of that. So the technology is called retrieval augmented generation. So we want to give more specific context for this specific domain, the search or the guideline, get the specific context for the specific insurance carrier and use that as the specific context and you can get the right information and then you can actually call the model and get the right information out and to really solve the problems.

Paul Feldman:

So we've covered a lot here and you guys have an awesome platform. Is there a question that I didn't ask that I should have, which is one of my favorite interview questions of all time?

Angus Dunn:

Well, you are right on that part because that's one thing that we hear from our client that you didn't ask. So anytime we are talking about AI large language models, there's always something that we’re asked: “what about hallucinations?” How do you guys deal with it? How can we even trust your AI solutions? And that's where we actually focus on one of the number one values in our company at Xcela is trust. If you just use your LM like that, you will get hallucination. I’ve heard a lot of bad stories. That can actually jeopardize someone’s entire application. We actually have special technologies that actually ground the data so that it will only use what we provide, in order to minimize the hallucination in our systems. So that's why we actually have the trust factor in place. In fact, it just doesn't stop there. We also have compliances in place as well, security compliances in place, HIPAA compliance, which we mentioned earlier. Those are very critical for us in order to get the trust from our customers.

Nick Bowman:

We’re also really big on transparency. One of the biggest issues that people have with AI in addition to hallucinations is how did the AI get that decision? Our tool tells you exactly how it came to that decision, gives you that data to print out so you can take it to a professional underwriter at a carrier and have an actually educated conversation and negotiation with them as opposed to just trusting

Paul Feldman:

Super powerful. That helps an agent deal with an underwriter. Your solution is very well-rounded.

Angus Dunn:

That's right

Paul Feldman:

Thank you for your time. You guys are really on the right path. Let's make underwriting fast!

Xuejun Tao:

Thank you, Paul, for having us here. Thanks very much.

How A.I. is making life carriers faster, better, and more profitable

Redhawk Wealth Advisors: Leading the Way in Balancing Market Growth and Risk Mitigation

Advisor News

- How OBBBA is a once-in-a-career window

- RICKETTS RECAPS 2025, A YEAR OF DELIVERING WINS FOR NEBRASKANS

- 5 things I wish I knew before leaving my broker-dealer

- Global economic growth will moderate as the labor force shrinks

- Estate planning during the great wealth transfer

More Advisor NewsAnnuity News

- An Application for the Trademark “DYNAMIC RETIREMENT MANAGER” Has Been Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

- Product understanding will drive the future of insurance

- Prudential launches FlexGuard 2.0 RILA

- Lincoln Financial Introduces First Capital Group ETF Strategy for Fixed Indexed Annuities

- Iowa defends Athene pension risk transfer deal in Lockheed Martin lawsuit

More Annuity NewsHealth/Employee Benefits News

Life Insurance News

- An Application for the Trademark “HUMPBACK” Has Been Filed by Hanwha Life Insurance Co., Ltd.: Hanwha Life Insurance Co. Ltd.

- ROUNDS LEADS LEGISLATION TO INCREASE TRANSPARENCY AND ACCOUNTABILITY FOR FINANCIAL REGULATORS

- The 2025-2026 risk agenda for insurers

- Jackson Names Alison Reed Head of Distribution

- Consumer group calls on life insurers to improve flexible premium policy practices

More Life Insurance News