A.I. for life agents enables faster and more accurate field underwriting

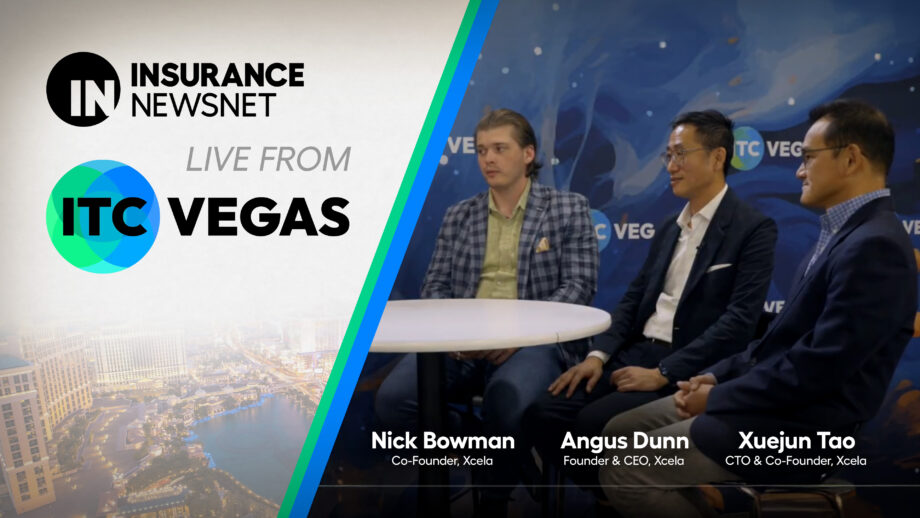

Live from the ITC 2024 Vegas conference, InsuranceNewsNet Publisher Paul Feldman interviews leaders from Xcela, an AI-driven platform designed to simplify and accelerate the insurance sales and underwriting processes.