US deficits are unlikely to detract from fixed income’s appeal

U.S. deficits loom, and while that is a long-term consideration, we do not expect it to discourage insurers from adding to their fixed income exposure in the near-term.

We see the deficit as a longer-term issue

Election years tend to give rise to fiscal policy and deficit discussions, and we will see that happen again in 2024.

However, we believe that incorporating a long-term view on the deficit into tactical or strategic asset allocation decisions would be premature at this stage. In the near term, we believe fixed income is attractive given historically elevated yields and the potential upcoming easing cycle.

We do not expect to see deficit-related market dislocations over the near term

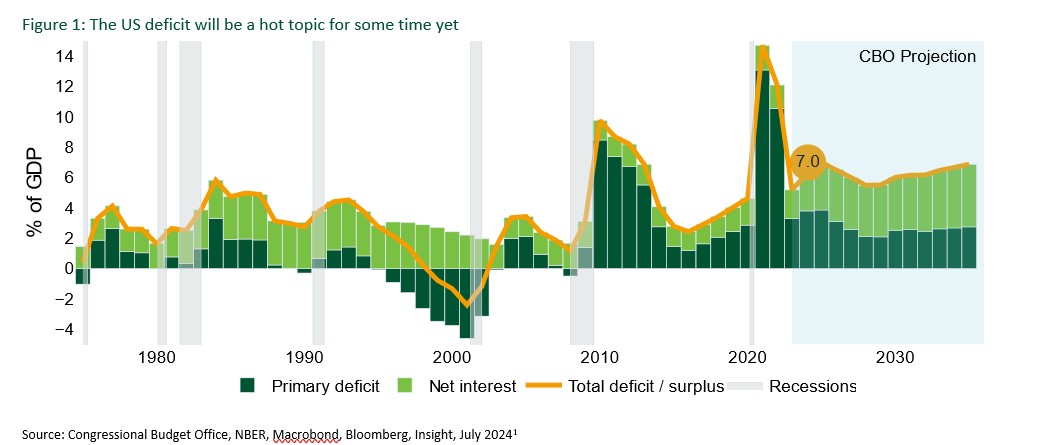

The U.S. budget deficit is currently 5.6% of gross domestic product, and the Congressional Budget Office projects it will hit 7% by 2025. The November election is unlikely to temper this rise, given neither party is standing on a platform of austerity.

The trajectory of the nation’s debt may nonetheless be a hot topic for some time. Another potential debt ceiling stand-off looms in 2025 and, if elected, former President Donald Trump has expressed a desire to make permanent the tax cuts from the 2017 Tax Cuts and Jobs Act bill that are set to expire next year.

Nonetheless, in the words of Charles de Gaulle, the U.S. dollar retains the “exorbitant privilege” of being the world’s reserve currency. Political trends abroad, which also point to more fiscal spending, make a changing of the guard less of a threat in our view.

For fixed income markets, there are two potential near-term considerations.

The first is the potential for another U.S. credit rating downgrade. We would not rule that out, but we believe any fallout would be limited. Since S&P’s U.S. downgrade in 2011, many regulatory regimes and financial contracts refer to “U.S. Treasuries” as opposed to “AAA government debt,” which reduced the risk of forced selling. It was why there was little notable market impact when Fitch downgraded the U.S. last year. If needed, we expect insurance investors would modify their investment guidelines and regulators would modify capital treatment rules to avoid any dislocations.

The second potential consideration is that heavy Treasury supply (to finance the government fiscal commitments) could cause disruption in bond markets. These concerns have been building since last year’s debt ceiling stand-off, when the Treasury began relying on a higher share of T-bill issuance than recommended by the Treasury Borrowing Advisory Committee.

While it is possible that an eventual increase in longer-dated Treasury bond supply could impact yields, we would expect any sell-off would be limited. Long-dated Treasury yields in the 5% to 6% range would, we suspect, be irresistible to many global investors. Failing that, we expect the Fed would stand ready with “operation twist”-style initiatives if things were to get disruptive.

In our conversations with insurance investors, we have found that many are not concerned about the U.S. deficit over their investment horizons, albeit they are keeping an eye on longer-term risks. Instead, investors are basing their decisions on economic conditions, monetary policy and valuations.

We believe deficit considerations are unlikely to impact the near-term appeal of fixed income

We expect insurers to continue to weigh the benefits of adding fixed income exposure at the current stage of the cycle, irrespective of longer-term deficit concerns.

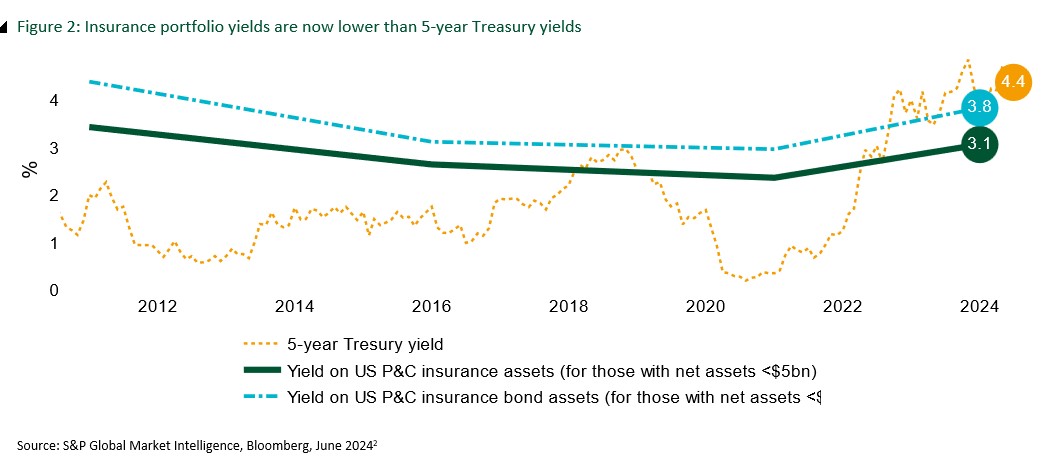

Given the rise in all-in fixed income yields over the last two years, five-year Treasury yields are now above average yields on the average property/casualty insurers’ invested assets.

In our view, adding exposure to spread assets (such as corporate or structured credit) could offer the potential for compelling all-in yields, even considering that credit spreads are historically tight.

We believe investors may wish to rebalance from their equity and alternatives allocations (to increase the certainty of their return streams) and their cash and short-term holdings (to reduce reinvestment risks).

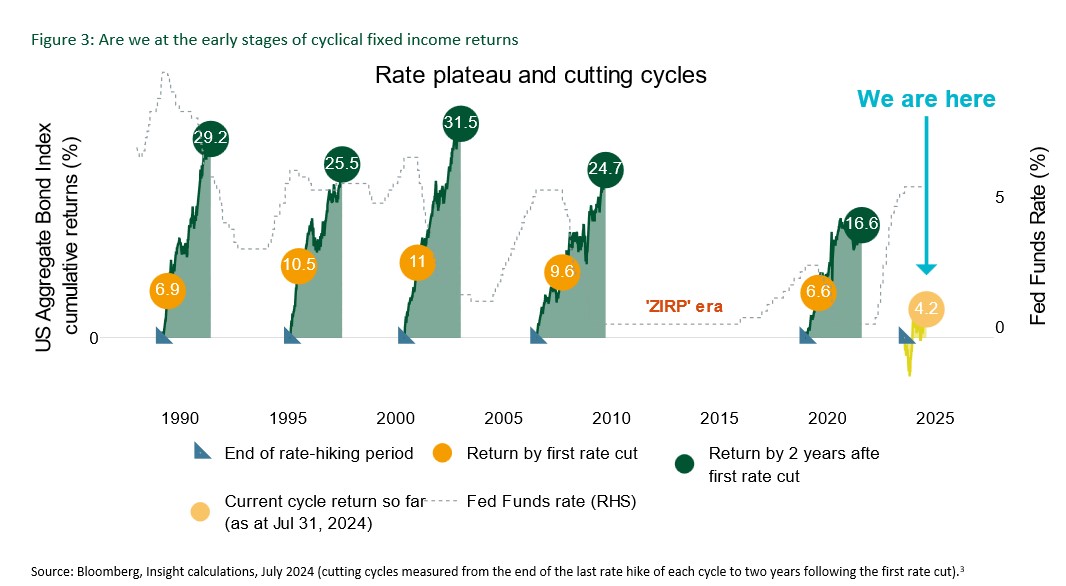

Fixed income may also offer the potential for near-term capital gains. The “Agg” (the Bloomberg Aggregate Bond Index) has cumulatively delivered 16% to 32% total returns during the last five rate cutting cycles. So far this cycle, fixed income has returned 4%, implying potential upside remains.

Deficits are worth watching, but we do not expect them to impact insurance investors

Deficits have become a hot topic again in the wake of the CBO’s projections and amid political posturing ahead of the presidential election. While the forecasts clearly show current fiscal policy trends are unsustainable over the long term, we do not see a catalyst for a near-term dislocation in U.S. Treasuries. Moreover, we believe investors should consider adding to fixed income given attractive yield levels and expectations for monetary policy easing. With current expectations for the first cut in September, the time to act may be now.

© Entire contents copyright 2024 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

LIMRA launches resources for Life Insurance Awareness Month

Dellwood executives urge court to reject AIG’s ‘Hotel California theory’ in breakup suit

Advisor News

- Americans increasingly worried about new tariffs, worsening inflation

- As tariffs roil market, separate ‘signal from the noise’

- Investors worried about outliving assets

- Essential insights a financial advisor needs to grow their practice

- Goldman Sachs survey identifies top threats to insurer investments

More Advisor NewsAnnuity News

- AM Best Comments on the Credit Ratings of Talcott Financial Group Ltd.’s Subsidiaries Following Announced Reinsurance Transaction With Japan Post Insurance Co., Ltd.

- Globe Life Inc. (NYSE: GL) is a Stock Spotlight on 4/1

- Sammons Financial Group “Goes Digital” in Annuity Transfers

- Somerset Reinsurance Announces the Appointment of Danish Iqbal as CEO

- Majesco Announces Participation in LIMRA 2025: Showcasing Cutting-Edge Innovations in Insurance Technology

More Annuity NewsHealth/Employee Benefits News

- ‘They won’t help me’: Sickest patients face insurance denials despite policy fixes

- Thousands of Missouri construction workers with Anthem health insurance left scrambling

- Don't let death penalty turn Luigi Mangione into a martyr

- More than 5M could lose Medicaid coverage if feds impose work requirements

- Don't make Mangione a martyr

More Health/Employee Benefits NewsLife Insurance News

- 2024 ModeSlavery Report (bpcc modeslavery report 2024 en final)

- Exemption Application under Investment Company Act (Form 40-APP/A)

- Annual Report 2024

- Revised Proxy Soliciting Materials (Form DEFR14A)

- Proxy Statement (Form DEF 14A)

More Life Insurance News