The ‘Napkin Concept’ Showing LTCi’s Impact On Tax Planning

Many financial professionals don't include long-term care insurance when tax planning with their clients. However, for clients in certain tax brackets, increased income to pay for extended care expenses could negatively impact their tax bill.

Would an additional $100,000 annual withdrawal from investments impact a client’s tax planning? Most financial professionals would answer “Yes!” How clients fill their retirement income gap will effectively either lower or increase their tax rates.

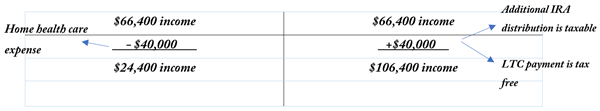

Some financial professionals say clients will simply “reduce their lifestyle in retirement to make up for the increased care dollars,” but this isn’t the reality for most couples. The “napkin concept” below is a very simple way to show exactly how LTC expenses could impact income:

“Mr. and Mrs. Jackson – you currently are taking $80,000 annually out of your IRA, giving you a $66,400 income after tax. If you were to have an extended care event and needed someone to come into your home to help shower, toilet or dress you - estimated at $40,000 a year – would you rather have an income of $24,400 or $106,400 using some additional planning?”

It’s hard to imagine a client who would choose the lower number.

If a client decides to pull more money out of an individual retirement account to pay this bill (instead of insuring the risk), they would need to withdrawal $128,000 from their IRA, which would push that individual (for taxes filed for 2020) from the 12% tax bracket to the 22% tax bracket.

If the client decides to insure all or part of this risk, the original pool of money put aside for funding an extended care need can be repositioned into a hybrid LTCi product. Now, the money can be used tax-free for a qualified LTC expense and, if never used, their heirs inherit a tax-free death benefit.

Don’t forget, qualified LTCi premiums and expenses are deductible personal medical expenses for individuals who itemize.

Business owners (depending on the type of entity) also have tax deductibility. For example, a self-employed person may deduct 100% of the premium paid for the individual, as well as the individual’s spouse and dependents, up to the maximum eligible allowed based upon the government’s 2020 age-based table without regard to the 10% adjusted gross income rule.

Think about clients who have money in IRAs, annuities or other brokerage accounts that they are using for emergency funds. Instead of leaving the money in a taxable account, consider repositioning those tax-inefficient dollars into a tax-free solution that offers additional leverage.

There are many annual opportunities, life events and review opportunities that would be a natural time to discuss extended care planning. Don’t let that opportunity pass you by!

Eileen Shovlin is regional director, sales, at Crump Life Insurance Services. She may be contacted at [email protected].

© Entire contents copyright 2021 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

Oregon Broker, Raymond James, Fined For ‘Churning’ Claims

COVID-19 ‘Mucked Up’ Insurance Marketplace, Analyst Says

Advisor News

- Principal builds momentum for 2026 after a strong Q4

- Planning for a retirement that could last to age 100

- Tax filing season is a good time to open a Trump Account

- Why aligning wealth and protection strategies will define 2026 planning

- Finseca and IAQFP announce merger

More Advisor NewsAnnuity News

- Half of retirees fear running out of money, MetLife finds

- Planning for a retirement that could last to age 100

- Annuity check fraud: What advisors should tell clients

- Allianz Life Launches Fixed Index Annuity Content on Interactive Tool

- Great-West Life & Annuity Insurance Company Trademark Application for “SMART WEIGHTING” Filed: Great-West Life & Annuity Insurance Company

More Annuity NewsHealth/Employee Benefits News

- Stop VA Claim Sharks: Why MOAA Backs the GUARD VA Benefits Act

- Soaring health insurance costs, revenue shortfalls put pressure on Auburn's budget

- Medicare Moments: Are clinical trial prescriptions covered by Medicare?

- Blue Cross Blue Shield settlement to start payouts from $2.67 billion class-action suit

- Why the Cost of Health Care in the US is Soaring

More Health/Employee Benefits NewsLife Insurance News