Survey finds some support for DOL fiduciary rule

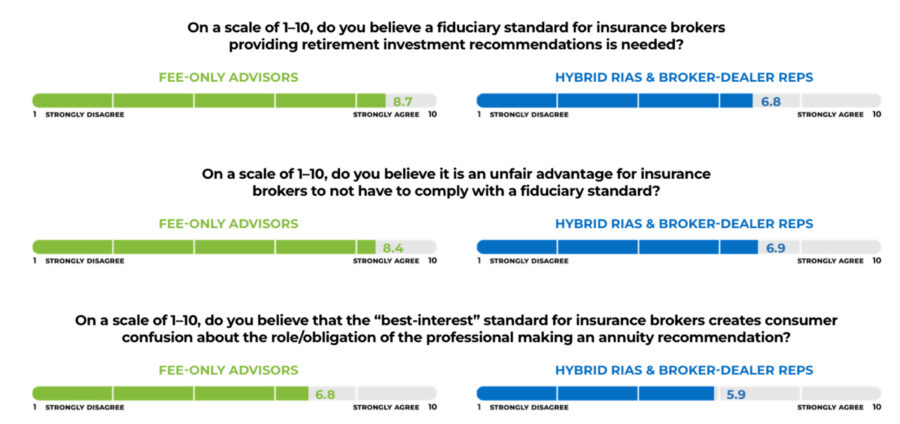

A new survey of financial professionals shows surprising and almost uniform support for the Department of Labor’s Retirement Security Rule that would require insurance brokers who provide retirement planning services be held to a fiduciary standard.

The survey of more than 230 advisors by DPL Financial Partners, fee-only advisors were more likely to strongly agree with the need for a fiduciary standard, but even hybrid RIAs and broker-dealer representatives were more likely than not to agree that a standard is needed.

“It’s remarkable to find such a strong consensus among all types of advisors that a fiduciary standard is needed when it comes to insurance products,” said DPL Founder and CEO David Lau. “The fact that hybrid RIAs and even broker-dealer reps, who receive compensation in the form of commissions, would welcome such a standard speaks volumes about the need for the Labor Department’s commonsense proposal.”

The DOL’s proposal, which was to go into effect in September, has been stayed by a pair of rulings in federal courts in Texas. The DOL has appealed. Considering strong opposition to the rule from the insurance industry, the advisors surveyed were uncertain it will survive, despite their strong agreement with it.

DPL recently hosted an online seminar titled “How Commissioned Annuities Fail Retirees,” in which participants generally agreed change was needed.

Panelist: Commissions at issue

“Annuities are always controversial and probably one of the most divisive financial products that are in the market, largely due to the commissions,” Lau said. “People who don't like commissions and don't accept commissions tend to think of annuities as a four-letter word. And people who like commissions tend to like annuities quite a lot because they pay very handsome commissions generally.”

Other panelists threw shade on the insurance industry’s major opposition to the DOL fiduciary rule that it would limit financial advice for everyday Americans.

“I've heard that argument before,” said Chuck Failla, founder, and CEO of Sovereign Financial Group. “But the argument is saying if you force a commission-based insurance salesperson to be a fiduciary, they can’t do their job. In my opinion, that's garbage.”

Failla said fears that the small investor will not get proper financial advice are unwarranted.

“What's going to happen is that agent is not going to be able to sell a $100,000 annuity with a 10% commission, walk away with $10,000 in commission, and never talk to that person again,” he said “That will stop. But that's not a bad thing in my opinion.”

A greater understanding for customers

Failla said the commissions would become planning fees and the customer would have a greater understanding of what, exactly, they are paying for.

“If you want to charge a fee for planning, charge a fee for planning,” he said. “And there are a lot of solutions now that are cropping up that are designed for that low net-worth person in which you can give a client advice that doesn't have to come via a $10,000 hit in commission.”

The panelists decried what they called PNOs (Planners in Name Only) and said the new fiduciary rule will bring more accountability and professionalism to the practice of financial advising.

“There is an absolute real culture and entire system dedicated to training those younger advisors,” Failla said. “They come in, they really don't know planning, but they go out with a pretense or being planners.”

Failla said typically these PNOs will ultimately recommend some variety of index universal life insurance policies for their clients.

“Why” he asked. “Is it the best for the client? Or is that the best way to bury an opaque, very high commission?”

Incentives cited

The panelists also noted an elevated level of incentives in the business for selling proprietary products that may or may not help customers. They cited reports of professionals winning lavish international travel, iPhones, and other goodies for hitting certain sales thresholds.

“This isn’t just about fees versus commissions or fiduciaries versus non-fiduciaries,” said Micah Hauptman, director of investor protection at The American College of Financial Services. “It's the differential compensation and all the other incentives that encourage and reward bad advice. If a financial professional could earn $5,000 for recommending and selling one annuity, but $10,000 for recommending and selling another, it's pretty clear that their incentive is to recommend the one that pays them $10,000, even if that annuity is worse for the investor. It’s human nature and not about bad people. It’s people responding to incentives.”

He said the financial products would better compete based on cost and quality, not how much they compensate the salesperson or the producer.

Despite some problematic issues, the panelists could not get beyond the fact that annuities are increasingly popular with consumers, and this may be a good time for many people to purchase an annuity.

“Consumers want the benefits of annuities there are more and more people are retiring now, something like 13,000 people turning 65 every day now without pensions and needing to self-fund retirements,” said Lau. “Annuities are really attractive to retirees providing guaranteed lifetime income.”

© Entire contents copyright 2024 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

Doug Bailey is a journalist and freelance writer who lives outside of Boston. He can be reached at [email protected].

MassMutual delivers record $2.5 billion dividend to policyholders

US catastrophe claims hit 7-year high, report finds

Advisor News

- Most Americans optimistic about a financial ‘resolution rebound’ in 2026

- Mitigating recession-based client anxiety

- Terri Kallsen begins board chair role at CFP Board

- Advisors underestimate demand for steady, guaranteed income, survey shows

- D.C. Digest: 'One Big Beautiful Bill' rebranded 'Working Families Tax Cut'

More Advisor NewsAnnuity News

- MetLife Declares First Quarter 2026 Common Stock Dividend

- Using annuities as a legacy tool: The ROP feature

- Jackson Financial Inc. and TPG Inc. Announce Long-Term Strategic Partnership

- An Application for the Trademark “EMPOWER PERSONAL WEALTH” Has Been Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

- Talcott Financial Group Launches Three New Fixed Annuity Products to Meet Growing Retail Demand for Secure Retirement Income

More Annuity NewsHealth/Employee Benefits News

- Congress takes up health care again – and impatient voters shouldn’t hold their breath for a cure

- Guardant Health’s Shield Blood Test for Colorectal Cancer Screening Now Available for U.S. Military Members and Families

- Coalition in House backs health subsidy

- Stories to Watch in 2026: Health Insurance Woes

- CT set aside $120 million to help cover residents’ health insurance costs. How to get help

More Health/Employee Benefits NewsLife Insurance News