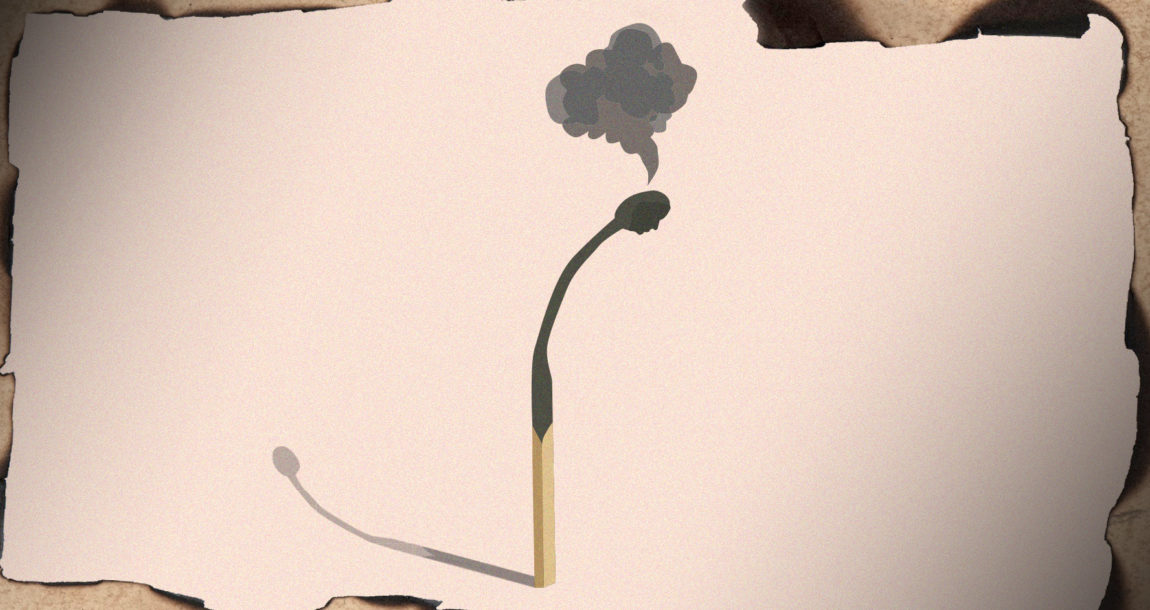

Study: Mental health issues, including burnout, affecting the workplace

The burgeoning and critical need for mental health resources in the U.S. extends well beyond families and schools to the workplace, with more than half of employers saying that mental health issues have affected their businesses in the past year, according to the latest WorkForces Report from Aflac Inc.

The 12th annual study from Aflac, a leading provider of supplemental health insurance and products, found that more than half (59%) of American workers are experiencing at least moderate levels of burnout, a notable increase over the 2021 figure of 52%.

“If there is one thing employers and insurance leaders should take from our survey, it’s that the mental health epidemic will outlast the COVID-19 pandemic,” said Matthew Owenby, Aflac chief human resources officer. “Our survey found that burnout has actually gotten worse over the past year, even as life has, in many ways, gotten back to ‘normal.’”

Moreover, nearly 80% of employees agreed that mental health coverage is critical, yet only 61% have access to mental health as part of their benefits package.

'More needs to be done'

“Clearly, more needs to be done,” Owenby said. “Offering health care benefits that cover mental health conditions would go a long way toward addressing the burnout epidemic.”

Moreover, the survey revealed some alarming findings of how badly many American workers are struggling financially and are vulnerable to unexpected medical costs. More than half of respondents (58%) said they could not pay $1,000 in out-of-pocket costs. The most affected groups were Gen Z (78%), African Americans (72%) and Hispanics (65%).

"Soaring health care costs, lack of understanding of benefits on health insurance policies and the economic downturn have contributed to employees' anxiety about their insurance coverage," said Owenby. "Hispanics and younger workers have been hard-hit by inflation with nearly half indicating that rising costs have driven them to choose between paying medical or other bills."

Other issues revealed in the survey hinted at how worker attitudes have been impacted by pandemic-enforced remote and hybrid employee attendance.

“One finding that stood out to us is that, compared to fully onsite and fully remote workers, employees with a hybrid working arrangement are much more likely to feel their organizations care about their mental health and overall wellbeing,” Owenby said. “Seventy percent of hybrid workers believe that their organizations care about them at least a moderate amount, compared to 56% of remote workers and 48% of onsite workers.”

The employer survey took place online between Aug. 31, 2022, and Sept. 20, 2022, and captured responses from 1,200 employers. The online employee survey captured responses from 2,001 employees between Aug. 31, 2022, and Sept. 20, 2022.

"...Employees with a hybrid working arrangement are much more likely to feel their organizations care about their mental health and overall wellbeing.” Matthew Owenby, Aflac chief human resources officer

“It is a pretty large sample,” Owenby said. “As in previous years, we surveyed U.S. adults who are employed full- and part-time, and quotas were applied to ensure the sample was representative of the U.S. workforce. What’s more, this survey affirmed findings from other research Aflac conducts.”

The survey also confirmed some stats others have found that despite technological proficiency among millennials, many prefer to work with in-person benefits advisors.

“Perhaps because this group is the most likely to be going through major life changes – such as marriage or the birth of a child – that could impact their benefits decisions,” Owenby said.

In-person advisor meetings preferred

“Nearly two-thirds of millennials prefer meeting in-person with an advisor, rather than over the phone or videoconference. We also found that employees with a hybrid work arrangement were most likely to have worked with a benefits advisor this past year – 67%, compared to 41% of employees who work onsite and 46% of employees who work remotely.”

At the same time, though, the report found employers must recognize that employees increasingly expect to have a seamless digital experience when interacting with their benefits provider, such as when filing claims.

“When asked what they’re looking for when choosing a benefits provider, employers rank cost first and innovation last – even though 80% say it is important for their benefits provider to be a leader in digital technology,” Owenby said. “At the same time, the majority of employees say it is very or extremely important for them to be able to manage their benefits online, and about 1 in 5 millennials and Gen Z prefer filing claims using a mobile app.”

This trend will only accelerate as more digital natives join the workforce, he said.

“So employers and insurance providers must adopt a digital-first mentality when it comes to benefits administration and management if they want to stay relevant,” Owenby said.

Doug Bailey is a journalist and freelance writer who lives outside of Boston. He can be reached at doug.bailey@innfeedback.com.

© Entire contents copyright 2022 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

OMB moves DOL ESG rule, as backlash builds

7 year-end tax tips to help you and your clients close the year successfully

Advisor News

- TIAA, MIT Age Lab ask if investors are happy with financial advice

- Youth sports cause parents financial strain

- Americans fear running out of money more than death

- Caregiving affects ‘sandwich generation’s’ retirement plans

- Why financial consciousness is the key to long-term clarity

More Advisor NewsAnnuity News

Health/Employee Benefits News

- Bill aimed at holding health insurance companies accountable stalls at Capitol

- Health Insurance Subsidies Set to Expire, Threatening Coverage for Millions

- Expiring health insurance tax credits loom large in Pennsylvania

- Confusion muddies the debate over possible Medicaid cuts

- Trump protesters in Longview aim to protect Medicaid, democracy, due process

More Health/Employee Benefits NewsLife Insurance News

- ‘Really huge’ opportunity for life insurance sales if riddle can be solved

- Americans fear running out of money more than death

- NAIFA eyes tax reform, retirement issues in 2025

- Legislation would change tax treatment of life insurers’ debt investments

- Closing the life insurance coverage gap by investing in education

More Life Insurance News