Sales of life combination products rebound in 2021, LIMRA reports

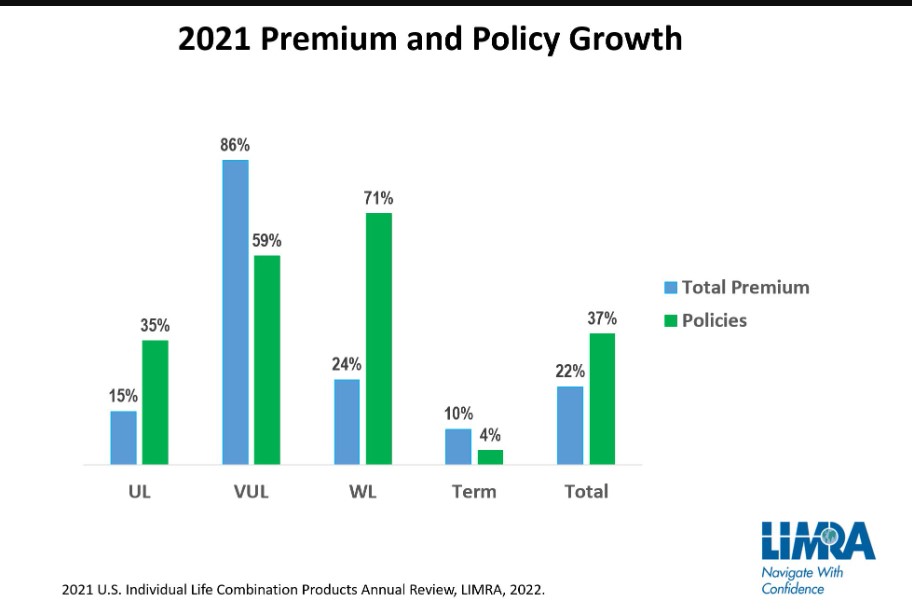

WINDSOR, Conn., Aug. 9, 2022 — Total new premium for individual life combination products increased 22% to $4.3 billion, compared with prior year results, and down slightly from the $4.8 billion in premium generated in 2019, according to LIMRA’s 2021 U.S. Individual Life Combination Products Annual Review. Combination products represented 20% of total life insurance premium in 2021.

LIMRA research shows there were nearly 559,000 policies sold in 2021, up 37% compared with 2020 results.

“The pandemic led to the steepest one-year decline (2020) of life combination product sales recorded since LIMRA began tracking this data in 2010,” Karen Terry, assistant vice president, Insurance Research, LIMRA. “Sales rebounded significantly in 2021 due to the introduction of the Washington Cares Act, which propelled sales in long-term care (LTC) extension and acceleration sales.”

The act, signed into law in 2019, established a state-sponsored long-term care benefit program funded by a 0.58 percent payroll tax, which was set to begin on Jan. 1, 2022. Workers in the state could apply for an exemption from the payroll tax if they owned private LTC coverage on or before Nov. 1, 2021.

Life combination products provide life insurance coverage with long-term care or chronic illness coverage, an attractive value proposition to consumers, according to LIMRA consumer research.

In contrast to 2020, where sales were down slightly, recurring premium sales have shown an overwhelming amount of growth (39% increase in policies). While single-premium policies continue to decline, down 4%, the drop is not as drastic as it was in 2020. Recurring premium products increased their share of the combination product policy market by one percentage point over 2021, now representing 97% of all new life combination policies issued.

According to LIMRA research, 1 in 4 consumers are extremely or very likely to consider a life combination product when shopping for life insurance. The top reasons they give for considering life combination products are:

- The ability to choose whether they receive care at home or in a facility

- Coverage for temporary illnesses/conditions

- The ability to use benefits to pay for home modifications or equipment that helps them stay at home

- Adult day care coverage

On a product level, whole life combination product sales gained 6 percentage points of policy market share in 2021 after decreasing 2 percentage points in 2020.

Indexed universal life (IUL) and term life both dropped 5 points of policy market share respectively, shifting mostly towards whole life products. IUL continues to hold the largest share of any product within the premium market share, growing 2 percentage points.

Chronic illness (CI) acceleration riders, which allow you to tap into your life insurance policy's death benefit while you're still living if you're diagnosed with a qualifying health issue, continued to dominate the acceleration rider market in 2021. CI acceleration riders gained 3 percentage points of premium market share to extend their lead over long-term care extension-of-benefit products.

Life policies with long-term care acceleration riders captured an additional 7 percentage points of policy market share, while also gaining some ground in premium market share as well. These products stood out in a year of significant policy growth, increasing 75% from 2020.

“Our 2022 Insurance Barometer study shows 4 in 10 consumers are very concerned about how they will pay for long-term care services,” notes Terry. “Combination products are an affordable, attractive solution for people who want to have options regarding the care they receive, particularly if they wish to remain in their homes.”

Integrity Marketing Group acquires Richman Insurance Agency

AIG delays IPO for Life and Retirement division

Advisor News

- Tax filing season is a good time to open a Trump Account

- Why aligning wealth and protection strategies will define 2026 planning

- Finseca and IAQFP announce merger

- More than half of recent retirees regret how they saved

- Tech group seeks additional context addressing AI risks in CSF 2.0 draft profile connecting frameworks

More Advisor NewsAnnuity News

- Allianz Life Launches Fixed Index Annuity Content on Interactive Tool

- Great-West Life & Annuity Insurance Company Trademark Application for “SMART WEIGHTING” Filed: Great-West Life & Annuity Insurance Company

- Somerset Re Appoints New Chief Financial Officer and Chief Legal Officer as Firm Builds on Record-Setting Year

- Indexing the industry for IULs and annuities

- United Heritage Life Insurance Company goes live on Equisoft’s cloud-based policy administration system

More Annuity NewsHealth/Employee Benefits News

- Data from University of Michigan Provide New Insights into Managed Care (Attitudes About Administrative Burdens for Beneficiaries and Dental Care Providers in Medicaid): Managed Care

- Study Data from St. Christopher’s Hospital for Children Provide New Insights into Managed Care (Emergency Dental Care in the ACA Era: Rural-Urban Disparities and Their Association With State Medicaid Policy): Managed Care

- Researchers from University of California Discuss Findings in COVID-19 (Assessing the Use of Medical Insurance Claims and Electronic Health Records to Measure COVID-19 Vaccination During Pregnancy): Coronavirus – COVID-19

- 85,000 Pennie customers dropped health plans as tax credits shrank and costs spiked

- Lawsuit: About 1,000 Arizona kids have lost autism therapy

More Health/Employee Benefits NewsProperty and Casualty News

- Trademark Application for “ASSURANCEAMERICA” Filed by AssuranceAmerica Corporation: AssuranceAmerica Corporation

- Loews Corp. (NYSE: L) Climbs to New 52-Week High

- 5 risk mitigation strategies for HNW clients

- The fight over ICE could affect FEMA, flood insurance. See what it might mean for Louisiana.

- The fight over ICE could affect FEMA, flood insurance. See what it might mean for Louisiana.

More Property and Casualty News