New data reveal reckless driving has increased post-pandemic

The odd phenomenon of increased traffic accidents and fatalities during the pandemic has been widely reported. But new data show that traffic violation citations in the U.S. decreased 13%, even while the number of fatal vehicle accidents rose. Additionally, drivers are now more reckless, the study shows.

This negative correlation, along with several other concerning trends in driving behaviors, were part of the findings from a TransUnion report “Life on the Road: How Better Data Help Carriers Respond to an Altered Driving and Law Enforcement Landscape.” The findings were presented at TransUnion’s annual Insurance Summit this week.

Since 2019, there has been a 21% increase in the number of fatal crashes involving unrestrained occupants, an 18% increase in alcohol-impaired fatal crashes, and a 17% increase in fatal crashes involving speeding. The insurance-focused consumer survey found Millennials were the most likely group to participate in most of the riskier driving practices.

Traffic enforcement ‘plays a role’ in safety

“Among many important takeaways from this research is the plain fact that traffic enforcement plays a role in maintaining safety on the road,” said Mark McElroy, executive vice president and heat of TransUnion’s insurance business. “That said, insurers can play a vital role in reversing this trend by educating their customers and promoting safe driving practices.”

It’s believed that fewer cars on the road during the pandemic, especially during lockdown periods, encouraged more unsafe driving habits. The Department of Transportation’s National Highway Traffic Safety Administration (NHTSA) reported that traffic fatalities during the first half of 2021 increased 18.4% compared to the same period the previous year, while the 20,160 fatalities during the first half of 2021 was the highest since 2006. The numbers and frequency of accidents have not substantially decreased post-pandemic.

“This was completely unprecedented,” said Ken Kolosh, a researcher at the nonprofit National Safety Council. “We didn’t know what was happening.”

Stressed-out Americans seemed to be releasing anxieties on the wide-open roads and expectations were that accidents and fatalities would decline once traffic returned to normal levels

But that hasn’t happened.

Reckless driving increased post-pandemic

The latest numbers suggest that after decades of safety gains, the pandemic has made U.S. drivers more reckless – more likely to speed, drink, or use drugs, and leave their seat belts unbuckled.

The TransUnion survey found younger drivers, in particular, hold attitudes that represent the potential for increased risk. For example, 30% of Millennials said it was OK to drive more than 20 miles per hour over the speed limit on a major highway, and 35% of Gen Z drivers said it’s not necessary to wear a seat belt for car trips. (Among Baby Boomers, meanwhile, just 5% answered yes to those questions).

“Younger drivers are often more prone to risky behaviors, but it is especially concerning to see Millennials – who are predominantly in their 30s and 40s – express such a lax attitude toward safety,” said McElroy. “It’s important they understand that this behavior is contributing to 50,000 preventable deaths every year.”

Number of traffic stops declined

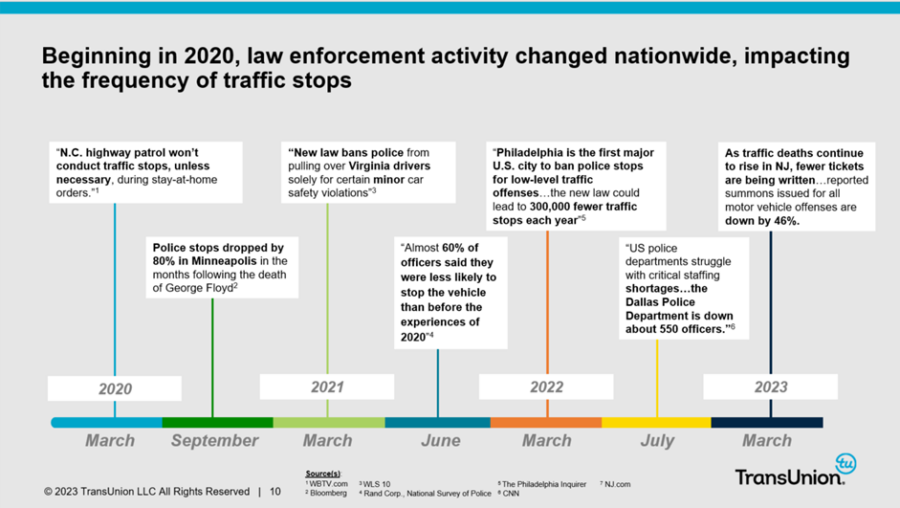

But the reasons why law enforcement activity changed and the frequency of traffic stops declined isn’t as clear. As violation rates have gone down, death rates have gone up, TransUnion found.

“The initial reduction in traffic enforcement occurred at the start of the pandemic as police departments temporarily instructed officers to cease traffic stops for minor violations to prevent the spread of covid-19, and as a result of staffing shortages,” said McElroy. The ‘temporary’ changes eventually ushered in new policies and legislation with several jurisdictions banning traffic stops for certain minor offenses.”

“Even if enforcement returns to typical historical patterns, some damage has already been done because many P&C carriers use a violation look back period when assessing surcharges,” the TransUnion report said.

Industry may be missing out on surcharge revenue

The report said an internal analysis of existing driving histories showed the industry could be missing out on $200 million in compounding surcharge revenue.

“These findings demonstrate the predictive nature of prior violations for projecting future auto insurance losses and highlight the need for insurers to access court records and violations data so they can effectively evaluate and price risk,” the report said.

In 2019, 42% of accidents involved drivers who had traffic violations within the prior three years. In 2022, that number jumped to 51%.

Despite the lower number of total violations issued, the predictive power of using prior violation history to project future auto insurance losses has increased during the period studied.

In addition, the rise in severe accidents resulting in fatalities has caused the amount insurers have paid for medical bills, legal fees, repairs, and replacements to skyrocket. The result underscores the importance for insurers to access court records but also for police departments to increase enforcement to document and curb dangerous driving behaviors, the report said.

“Ultimately, without traffic violation data, insurers aren’t able to accurately assess and underwrite a driver’s risk,” said McElroy. “With the compounding cost from accidents, carriers are now increasing rates for everyone, meaning we are all paying for this problem.”

With the advent of more telematics programs, McElroy said, insurers could offer millennials and other groups discounts based on completion of safe-driving educational courses.

“They could also include messaging advocating for safe driving practices in their national media campaigns. Finally, insurers should consider focusing their lobbying efforts to encourage state and local police departments to increase their traffic enforcement.”

Doug Bailey is a journalist and freelance writer who lives outside of Boston. He can be reached at [email protected].

© Entire contents copyright 2023 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

Doug Bailey is a journalist and freelance writer who lives outside of Boston. He can be reached at [email protected].

Inheritors likely to keep family advisor if relationship established early

The Big I apologizes again for ‘unacceptable’ Jesse Watters appearance

Advisor News

- Global economic growth will moderate as the labor force shrinks

- Estate planning during the great wealth transfer

- Main Street families need trusted financial guidance to navigate the new Trump Accounts

- Are the holidays a good time to have a long-term care conversation?

- Gen X unsure whether they can catch up with retirement saving

More Advisor NewsAnnuity News

- Pension buy-in sales up, PRT sales down in mixed Q3, LIMRA reports

- Life insurance and annuities: Reassuring ‘tired’ clients in 2026

- Insurance Compact warns NAIC some annuity designs ‘quite complicated’

- MONTGOMERY COUNTY MAN SENTENCED TO FEDERAL PRISON FOR DEFRAUDING ELDERLY VICTIMS OF HUNDREDS OF THOUSANDS OF DOLLARS

- New York Life continues to close in on Athene; annuity sales up 50%

More Annuity NewsHealth/Employee Benefits News

Life Insurance News

- AM Best Affirms Credit Ratings of Manulife Financial Corporation and Its Subsidiaries

- AM Best Upgrades Credit Ratings of Starr International Insurance (Thailand) Public Company Limited

- PROMOTING INNOVATION WHILE GUARDING AGAINST FINANCIAL STABILITY RISKS SPEECH BY RANDY KROSZNER

- Life insurance and annuities: Reassuring ‘tired’ clients in 2026

- Reliance Standard Life Insurance Company Trademark Application for “RELIANCEMATRIX” Filed: Reliance Standard Life Insurance Company

More Life Insurance News