LIMRA: 2024 life insurance premium sets $15.9B sales record

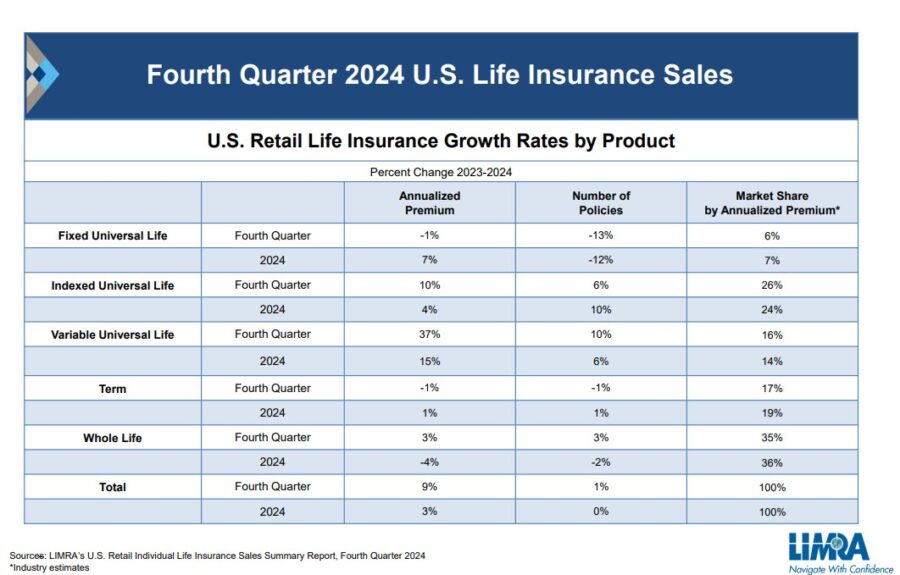

Annualized life insurance premium increased 3% in 2024 to $15.9 billion, according to LIMRA’s retail life insurance sales survey results, setting a record for the fourth consecutive year. In 2024, policy count was level with 2023 results.

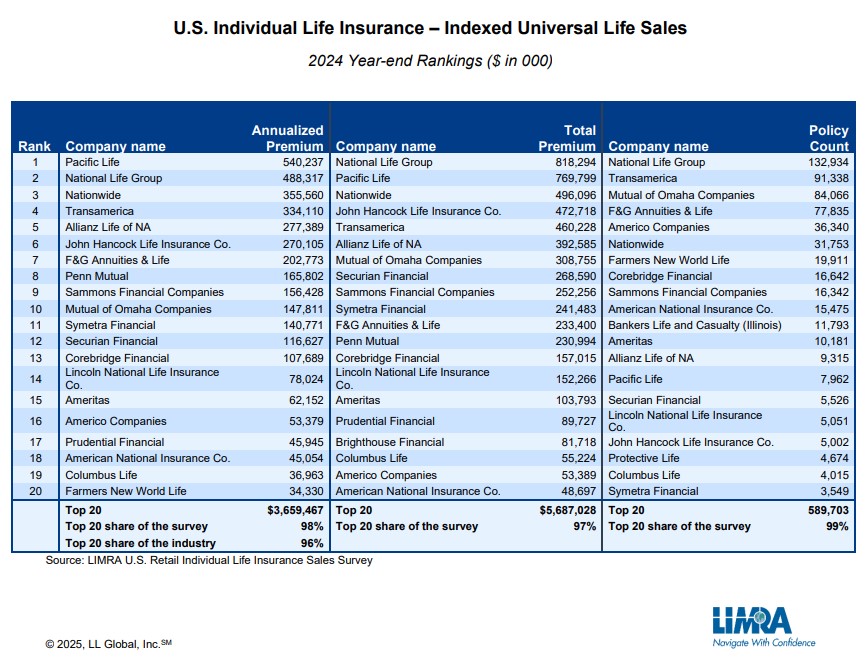

LIMRA also reported record-high indexed universal life sales of $3.8 billion in new annualized premium and variable universal life new annualized premium rising 15% to $2.2 billion.

“Independent distribution continues to drive the record sales in the U.S. market. This channel represented 6 in 10 dollars sold in 2024 — up from half of new premium sold just five years ago and represented over 90% of the record indexed universal life (IUL) sales in 2024,” said John Carroll, senior vice president and head of Life & Annuities, LIMRA and LOMA. “As middle-income and mass affluent consumers look for new investment tools to help them save for retirement, the IUL market has shifted. We see more smaller and simplified policies sold to these consumers, who seek investment protection in a volatile equity market environment.”

In the fourth quarter, total new premium rose 9% year-over-year to $4.5 billion. The number of policies sold increased by 1%, compared with fourth-quarter 2023 results.

Indexed universal life

Indexed universal life (IUL) set a quarterly and annual sales record. IUL new premium rose 10% to $1.15 billion in the fourth quarter. New or enhanced product designs and expanded distribution propelled the sales this quarter with half of IUL carriers reporting gains. Policy count grew 6% in the fourth quarter.

In 2024, IUL new premium totaled a record-high $3.8 billion in 2024, up 4% from prior year. Policy count grew 10% year over year.

IUL new premium represented 24% of the total U.S. life insurance market in 2024.

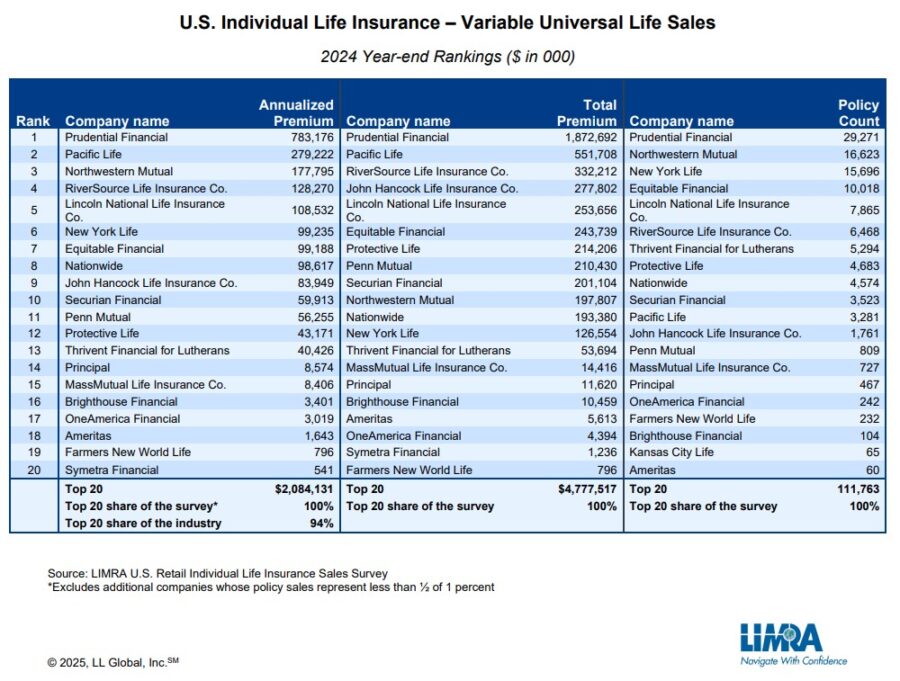

Variable universal life

Variable universal life (VUL) new premium rose 37% to $741 million in the fourth quarter. The number of policies sold increased 10% in the quarter. For the year, VUL new premium was $2.2 billion, up 15% year over year and policy count improved 6%.

In 2024, VUL held 14% of the total U.S. individual life insurance market.

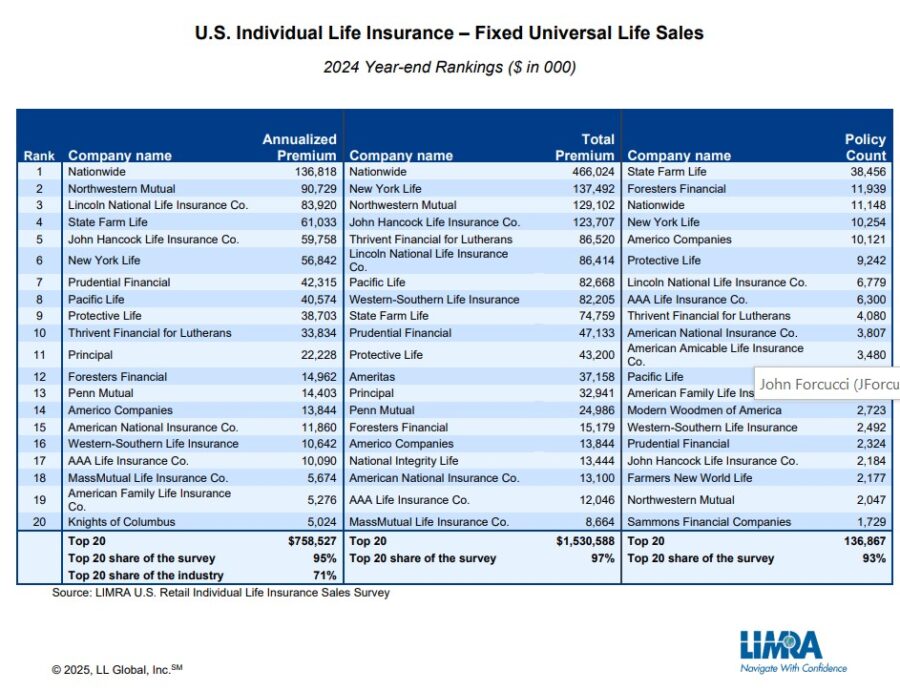

Fixed Universal Life

Fixed universal life (fixed UL) new premium dropped 1% in the fourth quarter to $275 million. Policy count fell 13% from fourth-quarter 2023 results. For the year, fixed UL new premium was $1.1 billion, 7% higher than prior year’s results. Policy count fell 12%.

Fixed UL new premium held 7% of the U.S. life insurance market in 2024.

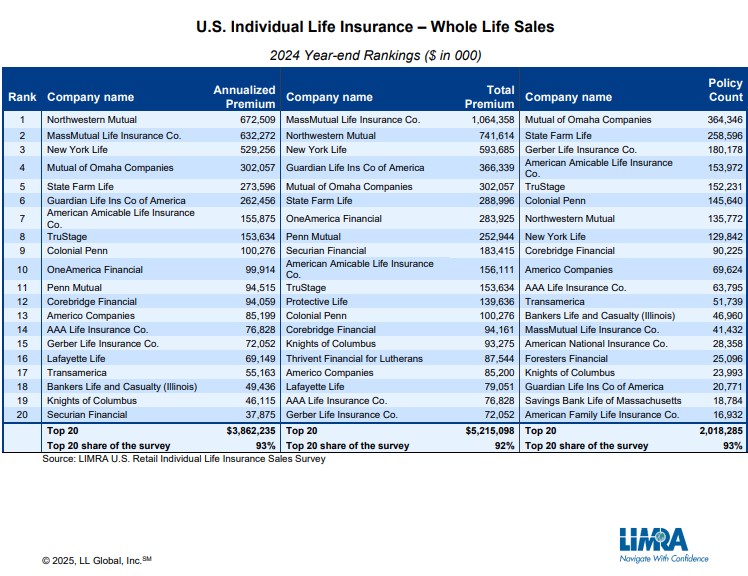

Whole Life

Following three consecutive quarters of declines, whole life (WL) sales rebounded in the fourth quarter. WL new annualized premium totaled $1.6 billion in the fourth quarter, 3% above prior year’s results. The number of WL policies sold increased 3% in the quarter.

“Final expense and other smaller-face whole life policies drove the overall growth in the fourth quarter,” said Karen Terry, assistant vice president and head of LIMRA Insurance Product Research. “Historically, interest rate cuts and increased market volatility bolster whole life sales and we expect this trend to continue in 2025.”

In 2024, WL new premium fell 4% to $5.8 billion, compared with 2023 results. Policy count fell 2% year over year.

WL new premium represented 36% of the total life insurance market in 2024, which is the product line’s lowest market share since 2014.

Term Life Insurance

Term life new premium totaled $749 million, down 1% than prior year’s results. Policy count also fell 1% in the quarter. In 2024, new premium topped $3 billion, up 1% compared with 2023 results. The number of policies sold increased slightly, up 1%.

Term life new premium represented 19% of total sales in 2024.

Growth by life insurance product

For more details on the sales results, go to Life Insurance Sales Growth Rates (2024 Fourth Quarter) in LIMRA’s Fact Tank.

LIMRA’s Retail Individual Life Insurance Sales Survey represents 80% of the U.S. life insurance market. With more than 100 years of expertise, LIMRA conducts over 80 benchmark studies — producing nearly 500 reports annually — for our members and the industry as a whole. These studies provide trusted insights and a comprehensive understanding of market dynamics, trends, and behaviors.

How to address ‘it’s too expensive’ without discounting your value

Market volatility driven by fear, emotion

Advisor News

- Why aligning wealth and protection strategies will define 2026 planning

- Finseca and IAQFP announce merger

- More than half of recent retirees regret how they saved

- Tech group seeks additional context addressing AI risks in CSF 2.0 draft profile connecting frameworks

- How to discuss higher deductibles without losing client trust

More Advisor NewsAnnuity News

- Allianz Life Launches Fixed Index Annuity Content on Interactive Tool

- Great-West Life & Annuity Insurance Company Trademark Application for “SMART WEIGHTING” Filed: Great-West Life & Annuity Insurance Company

- Somerset Re Appoints New Chief Financial Officer and Chief Legal Officer as Firm Builds on Record-Setting Year

- Indexing the industry for IULs and annuities

- United Heritage Life Insurance Company goes live on Equisoft’s cloud-based policy administration system

More Annuity NewsHealth/Employee Benefits News

- After loss of tax credits, WA sees a drop in insurance coverage

- My Spin: The healthcare election

- COLUMN: Working to lower the cost of care for Kentucky families

- Is cost of health care top election issue?

- Indiana to bid $68 billion in Medicaid contracts this summer

More Health/Employee Benefits NewsLife Insurance News