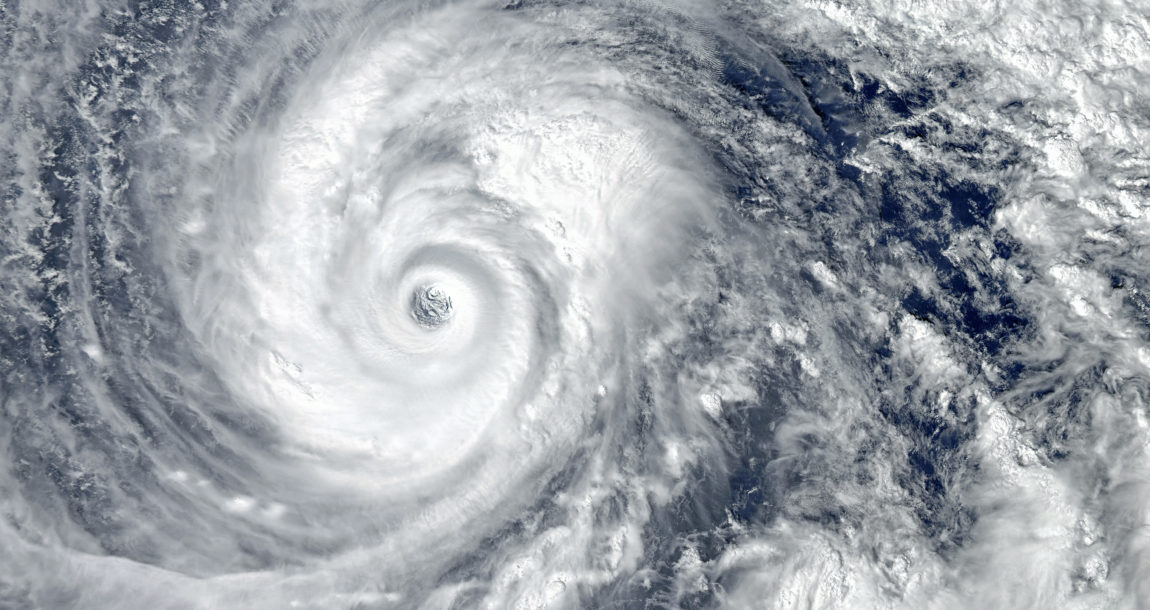

Hurricane Ian delivers powerful reminder of retirement location considerations

The catastrophe of Hurricane Ian battering Florida with 150-mile-per-hour winds provided a harsh reminder that Americans must prepare themselves for the negative impact that climate change driven disasters will have on their finances, health and lifestyle.

Those living in flood and fire zones must prepare themselves for rising costs of insurance of all forms—if they are able to find coverage. The loss of property or employment from the impact of a catastrophic event can disrupt a person’s income and their savings for the future. For seniors, this can be particularly problematic because they have less time – and income – to recover.

There are serious financial consequences for seniors suddenly forced to deal with destruction of homes and property – as well as the aftereffects on their physical, mental and emotional health.

Seniors often are more isolated and can find it difficult to prepare for or avoid being impacted by these conditions. As seniors age, they be more susceptible to conditions that can impact their respiratory systems, body temperature or ability to sustain trauma. It’s critical that loved ones know where they are and how they are doing during these events, and for seniors to know where to go and how to get to shelter in times of emergency.

Home ownership not only provides shelter but is an important part of building equity. Housing prices have been on the rise recently. Ironically, some of the highest growth has been in many of the most vulnerable areas to climate change. The question over the next few years will be: Is this a game of musical chairs and, at some point, who is going to get burned? It has become clear where problems like these are accelerating. These realities must be considered when choosing a retirement location.

Despite climate challenges, areas such as Florida, Arizona, Texas and California continue to be among the most desired retirement destinations. How long will that continue to make sense? There are numerous regions in the U.S. and in other parts of the world with less volatile living environments, as well as a lower cost of living.

Retirement location checklist

Here is a checklist of what to consider when planning a move to a new location, either domestic or international:

- Cost of living: Will the move increase, decrease or keep your current cost of living on par?

- Climate: Are you prepared for a change in climate and what do the prospects of climate change foretell for the coming years?

- Daily life: Will things such as grocery shopping, dining and entertainment, transportation, doctor’s, etc. become easier or more difficult to access?

- Healthcare: Will access to quality healthcare be readily available or more difficult to reach?

Safety and stability: What is the crime rate? What are the typical hazards associated with natural occurrences? - Distance from family: How far away is the location from important family members?

- Language (intl.): Are you going to a place where English is common, or will there be language barriers?

- Banking and currency (intl.): Is the financial infrastructure navigable and favorable? Is the currency exchange in your favor?

- Residency/visa process (intl.): What are the requirements to live for extended periods as a resident alien, and what about working or investing in the local economy?

Whether in the U.S. or internationally, climate change must be among the top considerations for seniors deciding where to reside in retirement. There are significant financial and safety consequences for people living in heat wave, drought and fire zones, or areas that will be impacted by rising sea levels and more intense hurricanes. The world has reached a “code red” moment as the climate has undeniably changed and will continue to change at an accelerating pace—and seniors will be among the most vulnerable and impacted people to the financial, health and lifestyle consequences to come.

Chris Orestis, CSA President of Retirement Genius, is a nationally recognized financial, health/LTC, and retirement issues expert. He has over 25 years’ experience in the insurance and long-term care industries and is credited with pioneering the Long-Term Care Life Settlement over a decade ago. Known as a political insider and senior issues advocate, Orestis is a former Washington, D.C. lobbyist who has worked in both the White House and for the Senate Majority Leader on Capitol Hill. In 2007 he founded Life Care Funding, in 2017 he founded the LifeCare Xchange, and in 2020 he founded Retirement Genius. He is author of the books Help on the Way and A Survival Guide to Aging-- with a third book Retire Like a Genius to be published in 2022. He has appeared in The New York Times, The Wall Street Journal, CNBC, and many other leading media outlets.

© Entire contents copyright 2022 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

Addressing the 2 most common objections to buying life insurance

Insurers must reimagine work, ACLI speaker says

Advisor News

- Retirement optimism climbs, but emotion-driven investing threatens growth

- US economy to ride tax cut tailwind but faces risks

- Investor use of online brokerage accounts, new investment techniques rises

- How 831(b) plans can protect your practice from unexpected, uninsured costs

- Does a $1M make you rich? Many millionaires today don’t think so

More Advisor NewsAnnuity News

- Great-West Life & Annuity Insurance Company Trademark Application for “EMPOWER BENEFIT CONSULTING SERVICES” Filed: Great-West Life & Annuity Insurance Company

- 2025 Top 5 Annuity Stories: Lawsuits, layoffs and Brighthouse sale rumors

- An Application for the Trademark “DYNAMIC RETIREMENT MANAGER” Has Been Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

- Product understanding will drive the future of insurance

- Prudential launches FlexGuard 2.0 RILA

More Annuity NewsHealth/Employee Benefits News

Life Insurance News

- Baby On Board

- 2025 Top 5 Life Insurance Stories: IUL takes center stage as lawsuits pile up

- Private placement securities continue to be attractive to insurers

- Inszone Insurance Services Expands Benefits Department in Michigan with Acquisition of Voyage Benefits, LLC

- Affordability pressures are reshaping pricing, products and strategy for 2026

More Life Insurance News