Future proofing insurance companies for the next shock

Insurance investors suffered a perfect storm as they emerged from the pandemic, and had to contend with persistent inflation, investment losses and a hardening reinsurance market.

Now that we are further along in the cycle, it may be the ideal time for insurers to revisit their enterprise risk management programs and investment strategy, to ensure they are prepared for the next shock.

Reflecting on a perfect storm

Last year, inflation disrupted insurance companies on two fronts. First, rising rates caused bonds and equities to fall together for the first calendar year in almost five decades. Second, inflation eroded premiums in real terms and increased claims severity trends.

Inflation was not the only issue. Fitch estimated that 2022 was the third costliest year ever for weather-related events for insurers and reinsurers. Insurance companies had less capital available to write new business, further pushing up reinsurance costs.

The property/casualty industry has used, on average, 10% of direct premiums to buy reinsurance coverage over the last four years, S&P reported, so smaller insurers have likely exceeded that level.

Insurance companies needed to write more premiums, retaining more risk as reinsurance costs rose

Future-proofing for further storms

Insurance companies can now look more closely at the data from 2022 to test the effectiveness of their enterprise risk management programs and update their Risk Appetite Statement.

This may be particularly helpful because uncertainty and market volatility are not going away. The news cycle persists with rate and equity market volatility, as well as rising geopolitical risks leading to higher disaster probabilities and downside risk. Weather-related uncertainty will also continue. A re-evaluation of core ERM processes should be on every insurer’s agenda.

We offer three potential starting points for insurers.

The first is to work in collaboration with their investment managers and consider aligning their underwriting pricing assumptions with their capital market assumptions. This can help establish strategic investment guidelines to reduce volatility in net income and ultimately lower volatility in statutory surplus.

The second is retroactively test the effectiveness of their current ERM policies, revisit risk tolerance limits for all major risks and reinforce the need to implement a holistic approach to modeling surplus risk.

Finally, it may be worth considering how liquidity events (such as the banking sector stress from earlier this year) can expose liquidity risk and as a result, the need for diversification and awareness of where liquidity is held.

Should insurance companies consider investment and underwriting policy together?

Modeling underwriting results and investment results together is common practice in capital modeling for insurance companies.

We have worked with insurance companies that have strategically aligned total return assumptions with underwriting pricing assumptions to establish target volatility limits for investment income and underwriting income, as part of their annual capital modeling and portfolio optimization exercise.

We also believe the dominance of investment income on property/casualty insurers’ income statements presents an opportunity for insurers to leverage capital modeling to better understand downside risk to surplus relating to underwriting risk, reserve risk, liquidity risk and investment risk.

Investment income has dominated P/C historical net income results

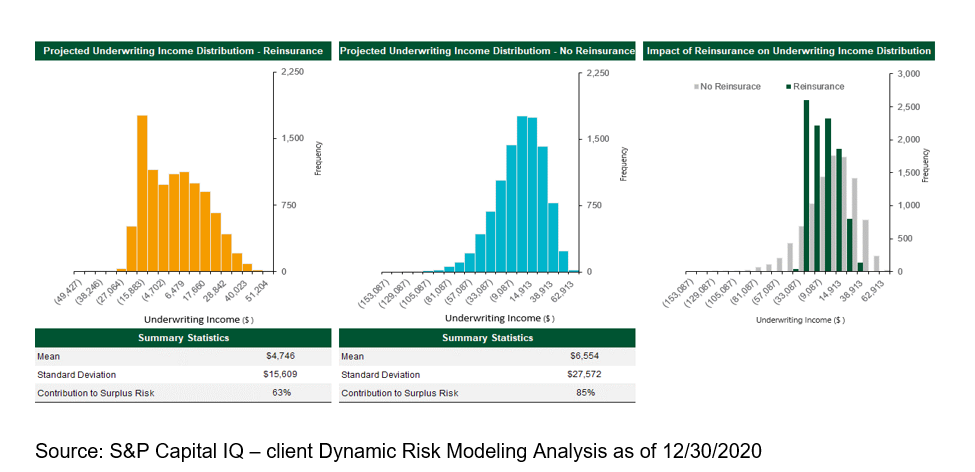

Below is a visual representation of the impact of reinsurance coverage on income distribution.

Impact of lower reinsurance coverage on downside risk to surplus

We believe the extreme range in outcomes provides further support for implementing a more holistic approach to insurance underwriting risk and investment policy objectives. An integrated approach can increase the certainty of the desired outcome being achieved.

Taking a holistic approach does require sophisticated dynamic financial analysis (which includes capital modeling, stress testing, strategic asset allocation and forecasting downside risk to statutory surplus or net position). Insurance companies may wish to partner with managers that specialize in insurance asset management and have the requisite skills and experience to obtain a second opinion on their capital modeling and portfolio optimization.

Kerry O’Brien is head of insurance portfolio management, Insight Investment. Contact her at [email protected].

© Entire contents copyright 2023 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

Kerry O’Brien is head of insurance portfolio management, Insight Investment. Contact her at [email protected].

‘Excess mortality’ continuing surge causes concerns

MassMutual embraces behavioral insurance with new program

Advisor News

- 2026 may bring higher volatility, slower GDP growth, experts say

- Why affluent clients underuse advisor services and how to close the gap

- America’s ‘confidence recession’ in retirement

- Most Americans surveyed cut or stopped retirement savings due to the current economy

- Why you should discuss insurance with HNW clients

More Advisor NewsAnnuity News

- Guaranty Income Life Marks 100th Anniversary

- Delaware Life Insurance Company Launches Industry’s First Fixed Indexed Annuity with Bitcoin Exposure

- Suitability standards for life and annuities: Not as uniform as they appear

- What will 2026 bring to the life/annuity markets?

- Life and annuity sales to continue ‘pretty remarkable growth’ in 2026

More Annuity NewsHealth/Employee Benefits News

- Hawaii lawmakers start looking into HMSA-HPH alliance plan

- EDITORIAL: More scrutiny for HMSA-HPH health care tie-up

- US vaccine guideline changes challenge clinical practice, insurance coverage

- DIFS AND MDHHS REMIND MICHIGANDERS: HEALTH INSURANCE FOR NO COST CHILDHOOD VACCINES WILL CONTINUE FOLLOWING CDC SCHEDULE CHANGES

- Illinois Medicaid program faces looming funding crisis due to federal changes

More Health/Employee Benefits NewsLife Insurance News