Annuity sales continue steady climb in first quarter, Wink reports

Total first-quarter sales for all deferred annuities were $59.7 billion, a decrease of 1.9% when compared to the previous quarter and an increase of 2.2% when compared to the same period last year, according to Wink’s Sales & Market Report.

All deferred annuities include the variable annuity, structured annuity, indexed annuity, traditional fixed annuity, and MYGA product lines.

Noteworthy highlights for all deferred annuity sales in the first quarter include Jackson National Life ranking as the No. 1 carrier overall for deferred annuity sales, with a market share of 7.8%. New York Life moved into second place, while AIG, Equitable Financial, and Allianz Life rounded out the top five carriers in the market, respectively.

Jackson National’s Perspective II Flexible Premium Variable & Fixed Deferred Annuity, a variable annuity, was the No. 1 selling deferred annuity, for all channels combined in overall sales for the thirteenth consecutive quarter.

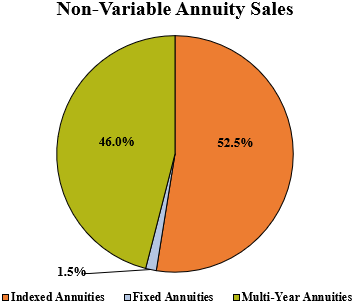

Total first quarter non-variable deferred annuity sales were $31.7 billion, an increase of 10.7% when compared to the previous quarter and 12% when compared to the same period last year. Non-variable deferred annuities include the indexed annuity, traditional fixed annuity, and MYGA product lines.

Noteworthy highlights for non-variable deferred annuity sales in the first quarter include AIG ranking as the No. 1 carrier overall for non-variable deferred annuity sales, with a market share of 9.5%. New York Life moved into second place, while Massachusetts Mutual Life Companies, Athene USA, and Global Atlantic Financial Group completed the top five carriers in the market, respectively. Western-Southern life’s SmartSelect 3-Year, a MYGA, was the No. 1 selling non-variable deferred annuity, for all channels combined.

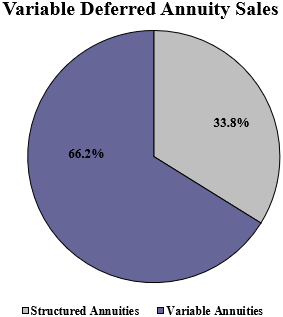

Total first-quarter variable deferred annuity sales were $27.9 billion, down 13.3% when compared to the previous quarter and down more than 6.9% when compared to the same period last year. Variable deferred annuities include the structured annuity and variable annuity product lines.

Noteworthy highlights for variable deferred annuity sales in the first quarter include Jackson National Life ranking as the No. 1 carrier overall for variable deferred annuity sales, with a market share of 15.3% Equitable Financial held onto the second-place position, as Lincoln National Life, Brighthouse Financial, and Nationwide concluded the top five carriers in the market, respectively.

Jackson National’s Perspective II Flexible Premium Variable & Fixed Deferred Annuity, a variable annuity, was the No. 1 selling variable deferred annuity, for all channels combined in overall sales for the thirteenth consecutive quarter.

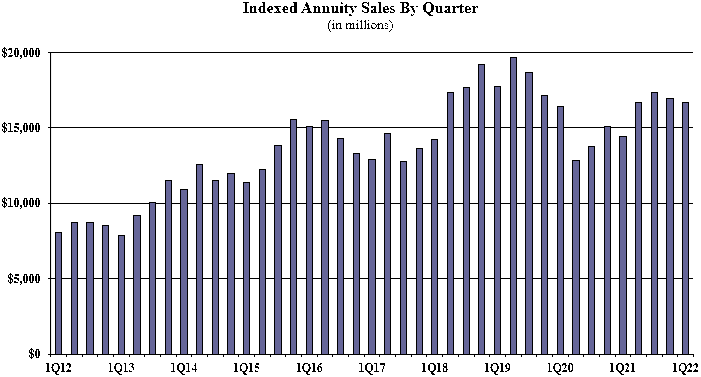

Indexed annuity sales for the first quarter were $16.6 billion; down 1.6% when compared to the previous quarter, and up 14.5% when compared with the same period last year. Indexed annuities have a floor of no less than zero percent and limited excess interest that is determined by the performance of an external index, such as Standard and Poor’s 500.

Noteworthy highlights for indexed annuities in the first quarter include Athene USA ranking as the No. 1 seller of indexed annuities, with a market share of 8.7%. Allianz Life maintained the second-ranked position while AIG, Sammons Financial Companies, and Fidelity & Guaranty Life rounded out the top five carriers in the market, respectively.

Allianz Life’s Allianz Benefit Control Annuity was the No. 1 selling indexed annuity, for all channels combined for the sixth consecutive quarter.

“Indexed annuity sales are blowing past where they were this time last year," said Sheryl Moore, CEO of both Wink, Inc. and Moore Market Intelligence. "If this quarter is an indicator of things to come, this could be a record year for indexed annuity sales.”

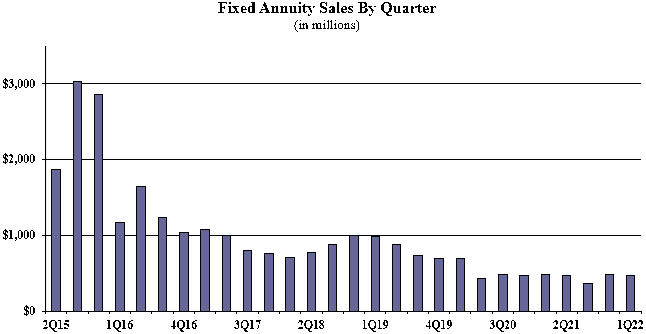

Traditional fixed annuity sales in the first quarter were $463.5 million and sales were down 4.8% when compared to the previous quarter, and up more than 2.8 % when compared with the same period last year. Traditional fixed annuities have a fixed rate that is guaranteed for one year only.

Noteworthy highlights for traditional fixed annuities in the first quarter include Modern Woodmen of America ranking as the No. 1 carrier in fixed annuities, with a market share of 21.15%. Global Atlantic Financial Group ranked second, while Jackson National Life, American National, and EquiTrust rounded out the top five carriers in the market, respectively.

Forethought Life’s ForeCare Fixed Annuity was the No. 1 selling fixed annuity, for all channels combined for the seventh consecutive quarter.

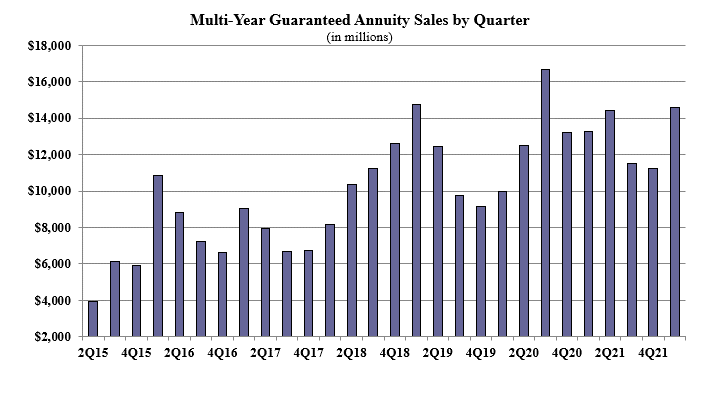

Multi-year guaranteed annuity (MYGA) sales in the first quarter were $14.5 billion and sales were up 30.1% when compared to the previous quarter, and up more than 9.86% when compared to the same period last year. MYGAs have a fixed rate that is guaranteed for more than one year.

Noteworthy highlights for MYGAs in the first quarter include New York Life ranking as the No. 1 carrier, with a market share of 19.0%. Massachusetts Mutual Life Companies moved to the second-ranked position, while AIG, Western-Southern Life Assurance Company, and Global Atlantic Financial Group rounded out the top five carriers in the market, respectively.

Western-Southern Life’s SmartSelect 3-Year was the No. 1 selling multi-year guaranteed annuity for all channels combined for the quarter.

“Multi-Year Guaranteed Annuity sales exploded again this quarter,” Moore said. “If interest rates continue their upward movement, we can count on more of this in future quarters.”

Structured annuity sales in the first quarter were $9.4 billion, down more than 6.3% as compared to the previous quarter, and down 4.6% as compared to the previous year. Structured annuities have a limited negative floor and limited excess interest that is determined by the performance of an external index or subaccounts.

Noteworthy highlights for structured annuities in the first quarter include Equitable Financial ranking as the No. 1 carrier in structured annuity sales, with a market share of 21%. Allianz Life ranked second, while Prudential, Brighthouse Financial, and Lincoln National Life completed the top five carriers in the market, respectively.

Pruco Life’s Prudential FlexGuard Indexed VA was the No. 1 selling structured annuity for all channels combined, for the third consecutive quarter.

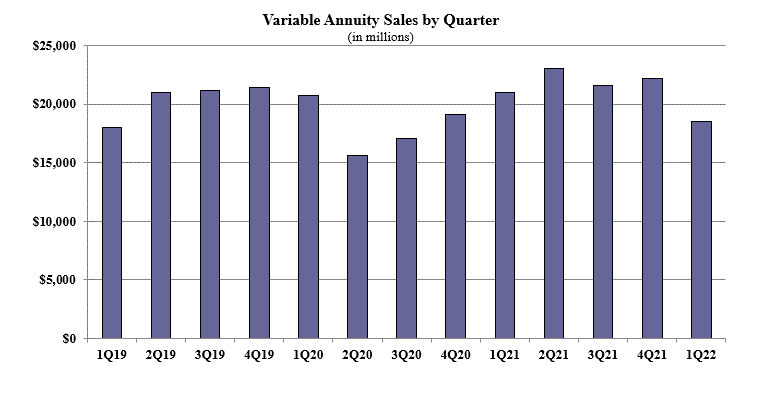

Variable annuity sales in the first quarter were $18.5 billion, down more than 16.4% as compared to the previous quarter and down 11.9% as compared to the same period last year. Variable annuities have no floor, and the potential for gains/losses are determined by the performance of the subaccounts that may be invested in an external index, stocks, bonds, commodities, or other investments.

Noteworthy highlights for variable annuities in the first quarter include Jackson National Life ranking as the No. 1 carrier in variable annuities, with a market share of 21.7%. Equitable Financial ranked second, while Lincoln National Life, Nationwide, and New York Life finished out the top five carriers in the market, respectively.

Jackson National’s Perspective II Flexible Premium Variable & Fixed Deferred Annuity was the No. 1 selling variable annuity for the thirteenth consecutive quarter, for all channels combined.

Sixty-two indexed annuity providers, 44 fixed annuity providers, 68 multi-year guaranteed annuity (MYGA) providers, 16 structured annuity providers, and 43 variable annuity providers participated in the 99th edition of Wink’s Sales & Market Report for 1st Quarter, 2022.

Wink reports on indexed annuity, fixed annuity, multi-year guaranteed annuity, structured annuity, variable annuity, and multiple life insurance lines’ product sales. Sales reporting on additional product lines will follow in the future, Moore said.

Palm Springs insurance agent allegedly stole from late art dealer

How brokers can ease the pain of clients’ high health-care costs

Advisor News

- Metlife study finds less than half of US workforce holistically healthy

- Invigorating client relationships with AI coaching

- SEC: Get-rich-quick influencer Tai Lopez was running a Ponzi scam

- Companies take greater interest in employee financial wellness

- Tax refund won’t do what fed says it will

More Advisor NewsAnnuity News

- The structural rise of structured products

- How next-gen pricing tech can help insurers offer better annuity products

- Continental General Acquires Block of Life Insurance, Annuity and Health Policies from State Guaranty Associations

- Lincoln reports strong life/annuity sales, executes with ‘discipline and focus’

- LIMRA launches the Lifetime Income Initiative

More Annuity NewsHealth/Employee Benefits News

- Insurer ends coverage of Medicare Advantage Plan

- NM House approves fund to pay for expired federal health care tax credits

- Lawmakers advance Reynolds’ proposal for submitting state-based health insurance waiver

- Students at HPHS celebrate 'No One Eats Alone Day'

- Bloomfield-based health care giant Cigna plans to lay off 2,000 employees worldwide

More Health/Employee Benefits NewsLife Insurance News