3Q Annuity Sales Up Double Digits Over Last Year, Wink Reports

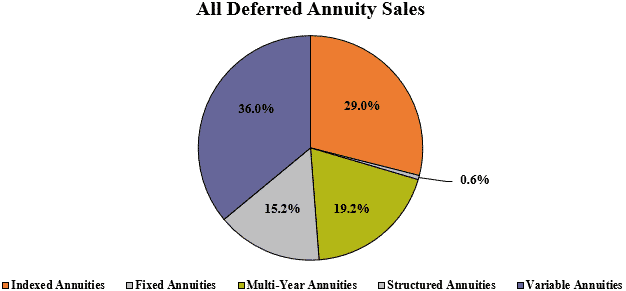

Third-quarter sales for all deferred annuities totaled $59.8 billion, a decrease of 7.1% compared to the second quarter and an increase of 10.4% when compared to the same period last year, according to Wink’s Sales & Market Report.

Total deferred annuities include the variable annuity, structured annuity, indexed annuity, traditional fixed annuity, and MYGA product lines.

Noteworthy highlights for all deferred annuity sales in the third quarter include Jackson National Life ranking as the No. 1 carrier overall for deferred annuity sales, with a market share of 8%. Allianz Life moved into second place, while Equitable Financial, AIG, and Massachusetts Mutual Life Companies rounded out the top five carriers in the market, respectively.

Jackson National’s Perspective II Flexible Premium Variable & Fixed Deferred Annuity, a variable annuity, was the No. 1 selling deferred annuity, for all channels combined in overall sales for the eleventh consecutive quarter.

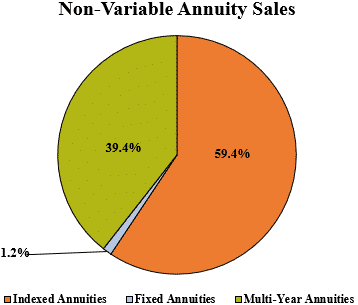

Total third-quarter, non-variable deferred annuity sales were $29.2 billion, down more than 7.4% when compared to the previous quarter and down 5.5% when compared to the same period last year. Non-variable deferred annuities include the indexed annuity, traditional fixed annuity, and MYGA product lines.

Noteworthy highlights for non-variable deferred annuity sales in the third quarter include Massachusetts Mutual Life Companies ranking as the No. 1 carrier overall for non-variable deferred annuity sales, with a market share of 10%. Allianz Life moved into second place, while Athene USA, AIG, and Global Atlantic Financial Group completed the top five carriers in the market, respectively.

Allianz Life’s Allianz Benefit Control Annuity, an indexed annuity, was the No. 1 selling non-variable deferred annuity, for all channels combined in overall sales for the third consecutive quarter.

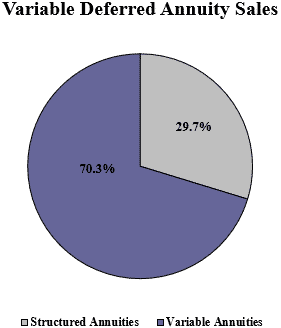

Total third-quarter variable deferred annuity sales were $30.6 billion, a decrease of 6.8% when compared to the previous quarter and an increase of 31.73% compared to the same period last year. Variable deferred annuities include the structured annuity and variable annuity product lines.

Noteworthy highlights for variable deferred annuity sales in the third quarter include Jackson National Life ranking as the No. 1 carrier overall for variable deferred annuity sales, with a market share of 15.4% Equitable Financial held onto the second-place position, as Lincoln National Life, Brighthouse Financial, and Nationwide concluded the top five carriers in the market, respectively.

Jackson National’s Perspective II Flexible Premium Variable & Fixed Deferred Annuity, a variable annuity, was the No. 1 selling variable deferred annuity, for all channels combined in overall sales for the eleventh consecutive quarter.

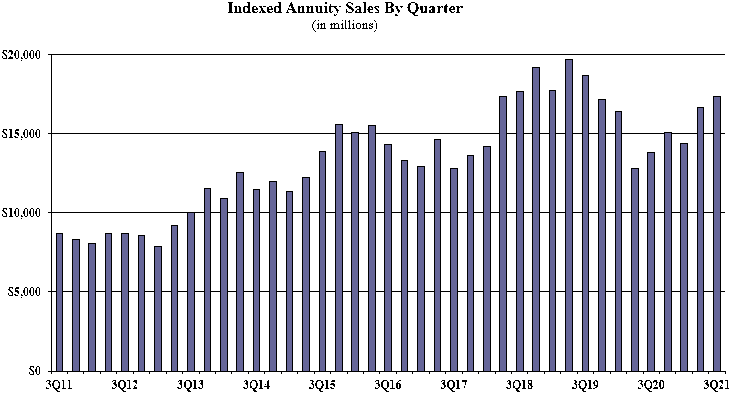

Indexed annuity sales for the third quarter were $17.3 billion, up 4% when compared to the previous quarter, and up 25.6% when compared with the same period last year. Indexed annuities have a floor of no less than zero percent and limited excess interest that is determined by the performance of an external index, such as Standard and Poor’s 500.

Noteworthy highlights for indexed annuities in the third quarter include Allianz Life ranking as the No. 1 seller of indexed annuities, with a market share of 13.3%. Athene USA maintained the second-ranked position while AIG, Fidelity & Guaranty Life and Sammons Financial Companies rounded out the top five carriers in the market, respectively.

Allianz Life’s Allianz Benefit Control Annuity was the #1 selling indexed annuity, for all channels combined for the fourth consecutive quarter.

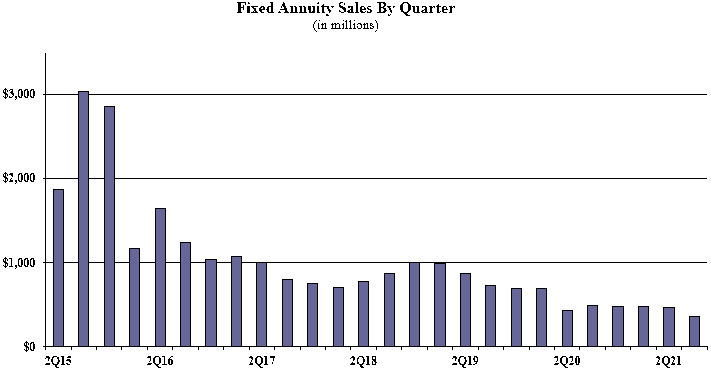

Traditional fixed annuity sales in the third quarter were $360.7 million. Sales were down 21.9% when compared to the previous quarter, and down more than 26.1% when compared with the same period last year. Traditional fixed annuities have a fixed rate that is guaranteed for one year only.

Noteworthy highlights for traditional fixed annuities in the third quarter include Global Atlantic Financial Group ranking as the No. 1 carrier in fixed annuities, with a market share of 22.6%. Jackson National Life ranked second, while American National, EquiTrust, and AIG rounded out the top five carriers in the market, respectively.

Forethought Life’s ForeCare Fixed Annuity was the No. 1 selling fixed annuity, for all channels combined for the fifth consecutive quarter.

Sheryl Moore, CEO of both Wink, Inc. and Moore Market Intelligence: “Indexed annuity sales not only increased, but they are up more than 25% from this time last year. If it not for this, annuity sales would have been down across the board this quarter.”

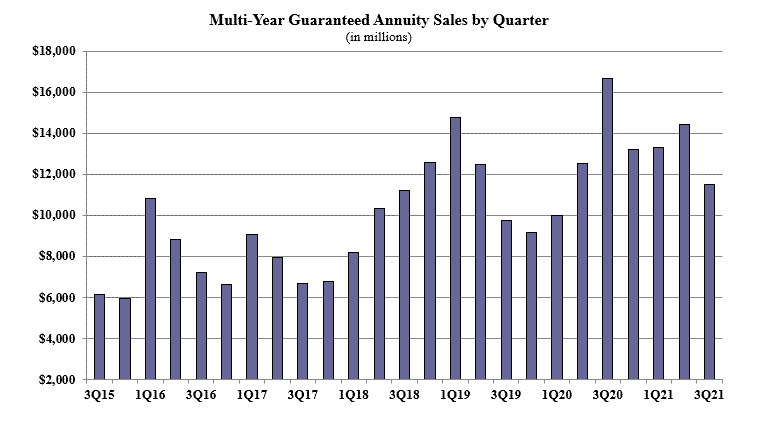

Multi-year guaranteed annuity sales in the third quarter were $11.5 billion, down 20.2% when compared to the previous quarter, and down 30.8% when compared to the same period last year. MYGAs have a fixed rate that is guaranteed for more than one year.

Noteworthy highlights for MYGAs in the third quarter include Massachusetts Mutual Companies ranking as the No. 1 carrier, with a market share of 17.5%. New York Life moved to the second-ranked position, as Global Atlantic Financial Group, AIG, and Symetra Financial rounded out the top five carriers in the market, respectively.

Massachusetts Mutual Life’s Stable Voyage 3-Year was the No. 1 selling multi-year guaranteed annuity for all channels combined for the second consecutive quarter.

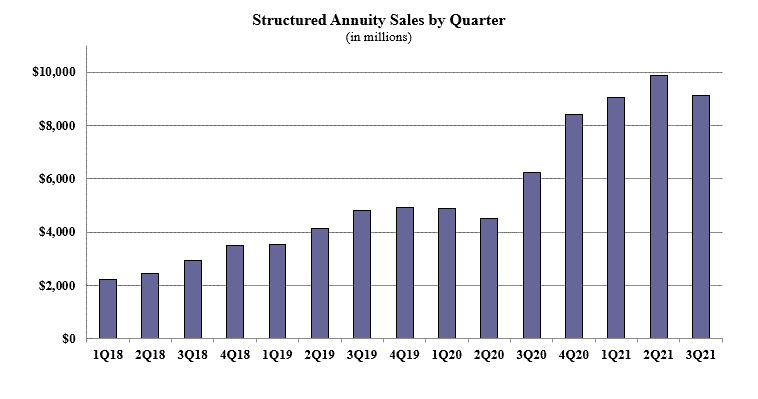

Structured annuity sales in the third quarter were $9.1 billion, down 7.5% as compared to the previous quarter, and up 45.8% as compared to the previous year. Structured annuities have a limited negative floor and limited excess interest that is determined by the performance of an external index or subaccounts.

Noteworthy highlights for structured annuities in the third quarter include Equitable Financial ranking as the No. 1 carrier in structured annuity sales, with a market share of 20.9%. Allianz Life ranked second, while Brighthouse Financial, Prudential, and Lincoln National Life completed the top five carriers in the market, respectively. Pruco Life’s Prudential FlexGuard Indexed VA was the No. 1 selling structured annuity for all channels combined.

“After four straight quarters of sales increases, structured annuity sales took a hit," Moore said. “That said, structured annuity sales YTD already put the line of business in a record sales position.”

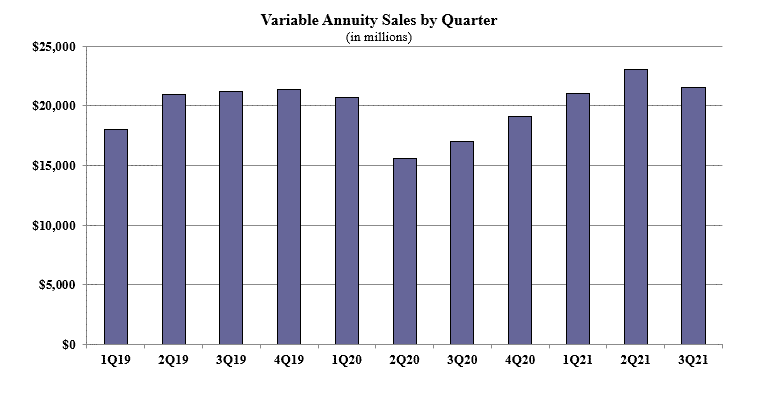

Variable annuity sales in the third quarter were $21.5 billion, a decrease of 6.5% as compared to the previous quarter and an increase of 26.5% as compared to the same period last year. Variable annuities have no floor, and potential for gains/losses that are determined by the performance of the subaccounts that may be invested in an external index, stocks, bonds, commodities, or other investments.

Noteworthy highlights for variable annuities in the third quarter include Jackson National Life ranking as the No. 1 carrier in variable annuities, with a market share of 21.9%. Nationwide ranked second, while Equitable Financial, Lincoln National Life, and Pacific Life Companies finished out the top five carriers in the market, respectively.

Jackson National’s Perspective II Flexible Premium Variable & Fixed Deferred Annuity was the No. 1 selling variable annuity for the eleventh consecutive quarter, for all channels combined.

Sixty-three indexed annuity providers, 46 fixed annuity providers, 69 multi-year guaranteed annuity (MYGA) providers, 14 structured annuity providers, and 43 variable annuity providers participated in the 97th edition of Wink’s Sales & Market Report for 3rd Quarter, 2021.

Wink reports on indexed annuity, fixed annuity, multi-year guaranteed annuity, structured annuity, variable annuity, and multiple life insurance lines’ product sales. Sales reporting on additional product lines will follow in the future, Moore said.

COVID-19 Takes Its Toll On Caregivers, Northwestern Mutual Finds

Life Insurance Premium Up 18% In The Third Quarter, LIMRA Reports

Advisor News

- Athene Enhances Flagship Annuity Products, Expands Innovative Preset Allocation Feature

- Advisor gives students a lesson in financial reality

- NC Senate budget would set future tax cuts, cut state positions, raise teacher pay

- Americans believe they will need $1.26M to retire comfortably

- Digitize your estate plan for peace of mind

More Advisor NewsAnnuity News

- Athene Enhances Flagship Annuity Products, Expands Innovative Preset Allocation Feature

- GBU Life introduces Defined Benefit Annuity

- EXL named a Leader and a Star Performer in Everest Group's 2025 Life and Annuities Insurance BPS and TPA PEAK Matrix® Assessment

- Michal Wilson "Mike" Perrine

- Emerging digital annuity sales process cutting cycle times by 94%, IRI says

More Annuity NewsHealth/Employee Benefits News

- Keeping insurers in check while assisting consumers

- New lawsuit challenges state's Medicaid eligibility rules

- In defiant speech, Lawson-Remer calls for bigger county spending, unity against federal cuts

- Editorial | Why Medicaid funding crisis matters here

- Recent Findings in Liver Cancer Described by Researchers from Kaohsiung Chang Gung Memorial Hospital (Comparing Health Insurance-reimbursed Lenvatinib and Self-paid Atezolizumab Plus Bevacizumab In Patients With Unresectable Hepatocellular …): Oncology – Liver Cancer

More Health/Employee Benefits NewsLife Insurance News

- Closing the life insurance coverage gap by investing in education

- MIB Group introduces first e-signature platform specifically for life insurance

- $184.2M financing secured for Seagis East Coast industrial portfolios

- AFBA and 5Star Life Insurance Company Name Erica L. Jenkins Senior Vice President, General Counsel, and Corporate Secretary

- Athene Enhances Flagship Annuity Products, Expands Innovative Preset Allocation Feature

More Life Insurance News