2021 Annuity Sales Shake Pandemic With 16.5% Increase, Wink Finds

Total 2021 deferred annuity sales of $243.6 billion represented a major bounceback year for the industry and a 16.5% increase over 2020 sales, according to new Wink’s Sales & Market Report data.

Total 2020 deferred annuity sales fell to $209.1 billion amid the COVID-19 pandemic, Wink reported.

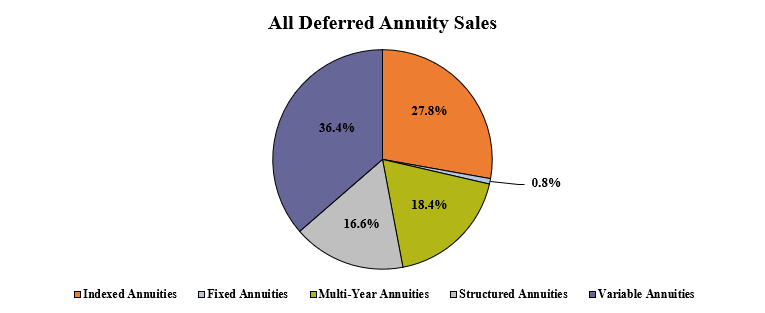

Total fourth-quarter sales for all deferred annuities were $60.9 billion, an increase of 1.7% compared to the previous quarter and 8.1% compared to the same period last year. All deferred annuities include the variable annuity, structured annuity, indexed annuity, traditional fixed annuity, and MYGA product lines.

Noteworthy highlights for all deferred annuity sales in the fourth quarter include Jackson National Life ranking as the No. 1 carrier overall for deferred annuity sales, with a market share of 8.1%. Equitable Financial moved into second place, while Massachusetts Mutual Life Companies, Allianz Life. and AIG rounded out the top five carriers in the market, respectively.

Jackson National’s Perspective II Flexible Premium Variable & Fixed Deferred Annuity, a variable annuity, was the No. 1 selling deferred annuity, for all channels combined in overall sales for the twelfth consecutive quarter.

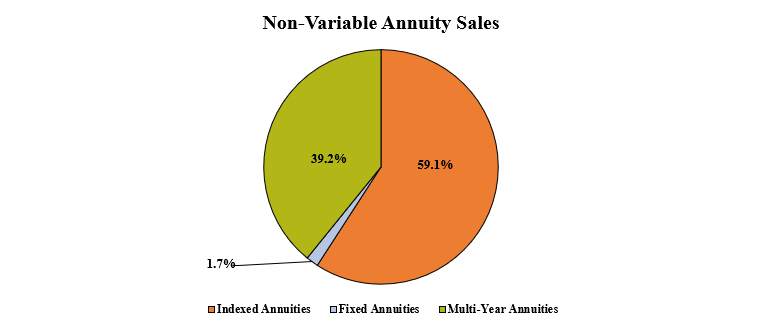

Total fourth-quarter non-variable deferred annuity sales were $28.6 billion, down more than 1.9% compared to the previous quarter and down more than 0.4% compared to the same period last year. Total 2021 non-variable deferred annuity sales were $117.7 billion. Non-variable deferred annuities include the indexed annuity, traditional fixed annuity, and MYGA product lines.

Noteworthy highlights for non-variable deferred annuity sales in the fourth quarter include Massachusetts Mutual Life Companies ranking as the No. 1 carrier overall for non-variable deferred annuity sales, with a market share of 12.3%. Athene USA moved into second place, while AIG, Allianz Life, and Global Atlantic Financial Group completed the top five carriers in the market, respectively.

Massachusetts Mutual Life’s Stable Voyage 3-Year, a MYGA, was the No. 1 selling non-variable deferred annuity, for all channels combined.

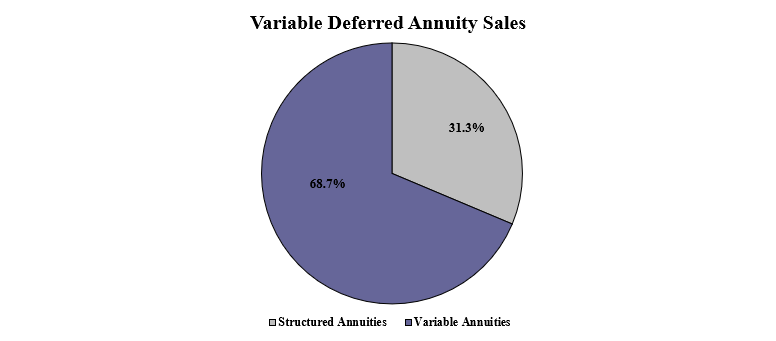

Total fourth-quarter variable deferred annuity sales were $32.2 billion, an increase of 5.2% compared to the previous quarter and an increase of 17.2% compared to the same period last year. Total 2021 variable deferred annuity sales were $125.9 billion. Variable deferred annuities include the structured annuity and variable annuity product lines.

Noteworthy highlights for variable deferred annuity sales in the fourth quarter include Jackson National Life ranking as the No. 1 carrier overall for variable deferred annuity sales, with a market share of 15.2% Equitable Financial held onto the second-place position, as Lincoln National Life, Allianz Life, and Brighthouse Financial concluded the top five carriers in the market, respectively.

Jackson National’s Perspective II Flexible Premium Variable & Fixed Deferred Annuity, a variable annuity, was the No. 1 selling variable deferred annuity, for all channels combined in overall sales for the twelfth consecutive quarter.

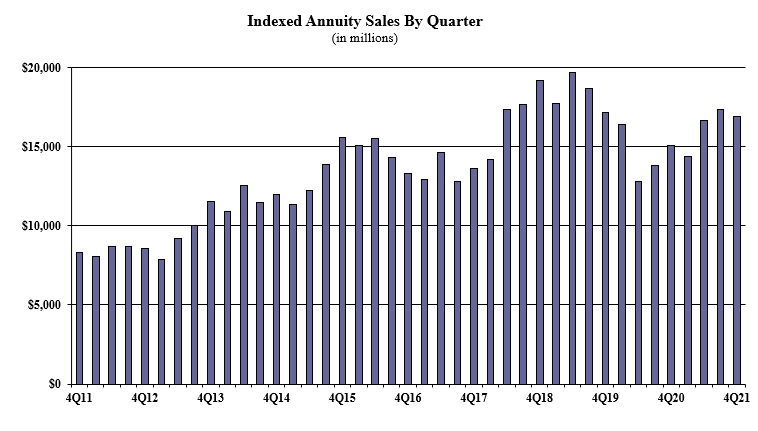

Indexed annuity sales for the fourth quarter were $16.9 billion, down 2.3% when compared to the previous quarter, and up 12.3% when compared with the same period last year. Total 2021 indexed annuity sales were $65.5 billion. Indexed annuities have a floor of no less than zero percent and limited excess interest that is determined by the performance of an external index, such as Standard and Poor’s 500®.

Noteworthy highlights for indexed annuities in the fourth quarter include Athene USA ranking as the No. 1 seller of indexed annuities, with a market share of 14.1%. Allianz Life moved into the second-ranked position while AIG, Sammons Financial Companies, and Fidelity & Guaranty Life rounded out the top five carriers in the market, respectively.

Allianz Life’s Allianz Benefit Control Annuity was the No. 1 selling indexed annuity, for all channels combined for the fifth consecutive quarter.

“Indexed annuity sales are down, but don’t count them out," said Sheryl Moore, CEO of both Wink, Inc. and Moore Market Intelligence. "With the markets steadily rising and fixed interest rates so depressed, I anticipate that sales of this line will bounce back by the second quarter of the new year.”

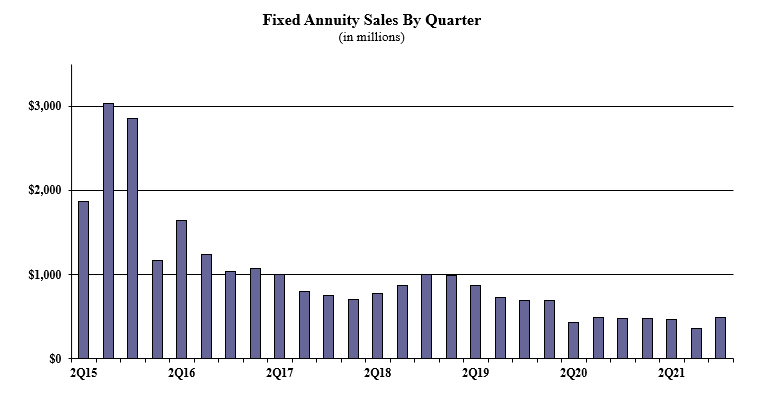

Traditional fixed annuity sales in the fourth quarter were $486.9 million, sales were up 34.9% compared to the previous quarter, and up more than 2.6 % compared with the same period last year. Total 2021 traditional fixed annuity sales were $1.7 billion. Traditional fixed annuities have a fixed rate that is guaranteed for one year only.

Noteworthy highlights for traditional fixed annuities in the fourth quarter include Global Atlantic Financial Group ranking as the No. 1 carrier in fixed annuities, with a market share of 20.6%. Modern Woodmen of America ranked second, while American National, EquiTrust, and Brighthouse Financial rounded out the top five carriers in the market, respectively.

Forethought Life’s ForeCare Fixed Annuity was the No. 1 selling fixed annuity, for all channels combined for the sixth consecutive quarter.

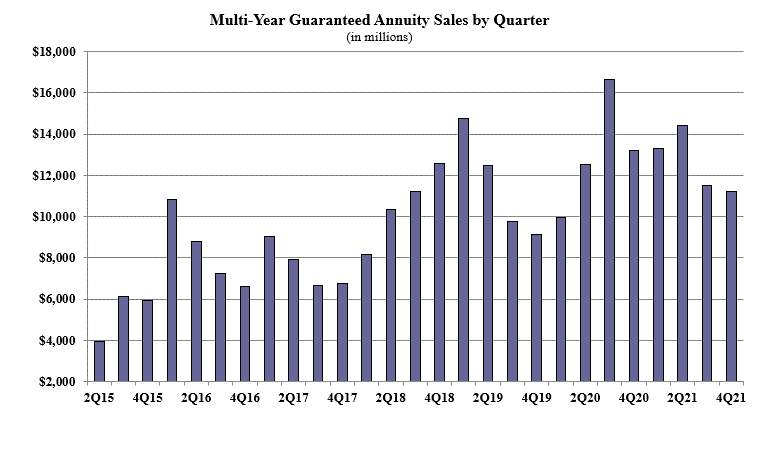

Multi-year guaranteed annuity (MYGA) sales in the fourth quarter were $11.2 billion, down 2.5% compared to the previous quarter, and down 15.1% compared to the same period last year. Total 2021 MYGA sales were $50.4 billion. MYGAs have a fixed rate that is guaranteed for more than one year.

Noteworthy highlights for MYGAs in the fourth quarter include Massachusetts Mutual Companies ranking as the No. 1 carrier, with a market share of 23.3%. New York Life moved to the second-ranked position, while AIG, Pacific Life Companies, and Western-Southern Life Assurance Company rounded out the top five carriers in the market, respectively.

Massachusetts Mutual Life’s Stable Voyage 3-Year was the No. 1 selling multi-year guaranteed annuity for all channels combined for the third consecutive quarter.

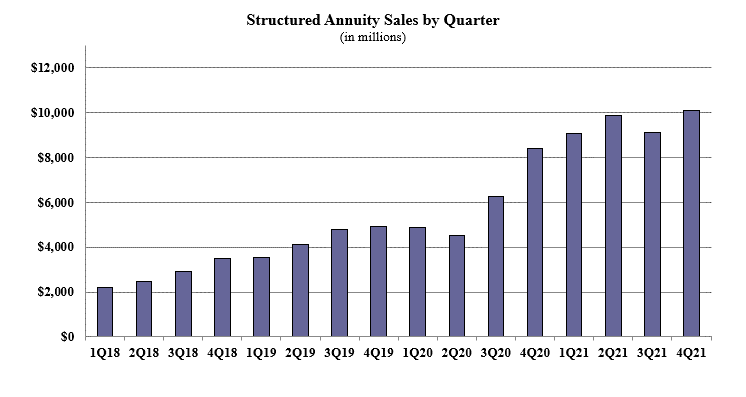

Structured annuity sales in the fourth quarter were $10.1 billion, up more than 10.9% compared to the previous quarter, and up 20.2% compared to the previous year. Total 2021 structured annuity sales were $38.1 billion. Structured annuities have a limited negative floor and limited excess interest that is determined by the performance of an external index or subaccounts.

Noteworthy highlights for structured annuities in the fourth quarter include Allianz Life ranking as the No. 1 carrier in structured annuity sales, with a market share of 20.7%. Equitable Financial ranked second, while Brighthouse Financial, Prudential, and Lincoln National Life completed the top five carriers in the market, respectively.

Pruco Life’s Prudential FlexGuard Indexed VA was the No. 1 selling structured annuity for all channels combined, for the second consecutive quarter.

“This was both a record-setting quarter and a record-setting year for structured annuity sales” Moore said. “The 2021 sales topped the prior year’s record by nearly 59%. And soon, more companies will enter this growing market.”

Variable annuity sales in the fourth quarter were $22.1 billion, an increase of 2.8% compared to the previous quarter and an increase of 15.9% compared to the same period last year. Total 2021 variable annuity sales were $87.7 billion. Variable annuities have no floor, and potential for gains/losses that are determined by the performance of the subaccounts that may be invested in an external index, stocks, bonds, commodities, or other investments.

Noteworthy highlights for variable annuities in the fourth quarter include Jackson National Life ranking as the No. 1 carrier in variable annuities, with a market share of 21.7%. Equitable Financial ranked second, while Nationwide, Lincoln National Life, and Pacific Life Companies finished out the top five carriers in the market, respectively.

Jackson National’s Perspective II Flexible Premium Variable & Fixed Deferred Annuity was the No. 1 selling variable annuity for the twelfth consecutive quarter, for all channels combined.

Sixty-three indexed annuity providers, 46 fixed annuity providers, 69 multi-year guaranteed annuity (MYGA) providers, 15 structured annuity providers, and 45 variable annuity providers participated in the 98th edition of Wink’s Sales & Market Report for 4th Quarter, 2021.

Wink reports on indexed annuity, fixed annuity, multi-year guaranteed annuity, structured annuity, variable annuity, and multiple life insurance lines’ product sales. Sales reporting on additional product lines will follow in the future, Moore said.

OneAmerica Names New Head Of Employee Benefits

Heightened Inflation Is Eroding Plan Participants’ Retirement Savings

Advisor News

- Estate planning during the great wealth transfer

- Main Street families need trusted financial guidance to navigate the new Trump Accounts

- Are the holidays a good time to have a long-term care conversation?

- Gen X unsure whether they can catch up with retirement saving

- Bill that could expand access to annuities headed to the House

More Advisor NewsHealth/Employee Benefits News

Life Insurance News

- Reliance Standard Life Insurance Company Trademark Application for “RELIANCEMATRIX” Filed: Reliance Standard Life Insurance Company

- Jackson Awards $730,000 in Grants to Nonprofits Across Lansing, Nashville and Chicago

- AM Best Affirms Credit Ratings of Lonpac Insurance Bhd

- Reinsurance Group of America Names Ryan Krueger Senior Vice President, Investor Relations

- iA Financial Group Partners with Empathy to Deliver Comprehensive Bereavement Support to Canadians

More Life Insurance NewsProperty and Casualty News

- TULSA COUNTY, OKLAHOMA FLOOD MAPS BECOME FINAL

- FISCHER JOINS COLLEAGUES IN CALLING FOR REPEAL OF HARMFUL BIDEN-ERA HOUSING REGULATION

- CONGRESSWOMAN LIZZIE FLETCHER, CONGRESSMAN TROY CARTER, AND COLLEAGUES INTRODUCE BIPARTISAN LEGISLATION TO PREVENT FLOOD INSURANCE FROM LAPSING DURING GOVERNMENT SHUTDOWNS

- REPS. CARTER, EZELL, FIELDS, LETLOW, FLETCHER, AND HIGGINS INTRODUCE THE NATIONAL FLOOD INSURANCE PROGRAM AUTOMATIC EXTENSION ACT OF 2025

- What your homeowners insurance doesn’t cover anymore

More Property and Casualty News