Why Offering Remote Mental Health Care Is Necessary Now

Half of Americans have a mental health condition and the COVID-19 pandemic is pushing more of them into crisis, just when a one-on-one meeting with a professional may be hazardous to physical health.

It is an obvious time for more Americans to try out telehealth’s “virtual couch,” the subject of a Monday afternoon panel discussion during the National Association of Health Underwriters’ virtual annual conference.

One in four people have a diagnosed mental health condition and another one in four has an undiagnosed condition, said Paul Kowalski, vice president and general manager of Teladoc Health, who was one of four panelists for "The Virtual Couch: The Time is Now for Behavioral Telehealth." About a quarter of Americans deals with a mental health issue at some point during an average year.

But this has been a far from average year, with Teledoc dealing with double the number of telemedicine consults, lodging 2 million, as compared to 1 million at this point last year, he said.

“Our mental health volume is now actually 400-plus percent over this time last year,” Kowalski said. “We went north of 22,000 consults in a single day at the peak.”

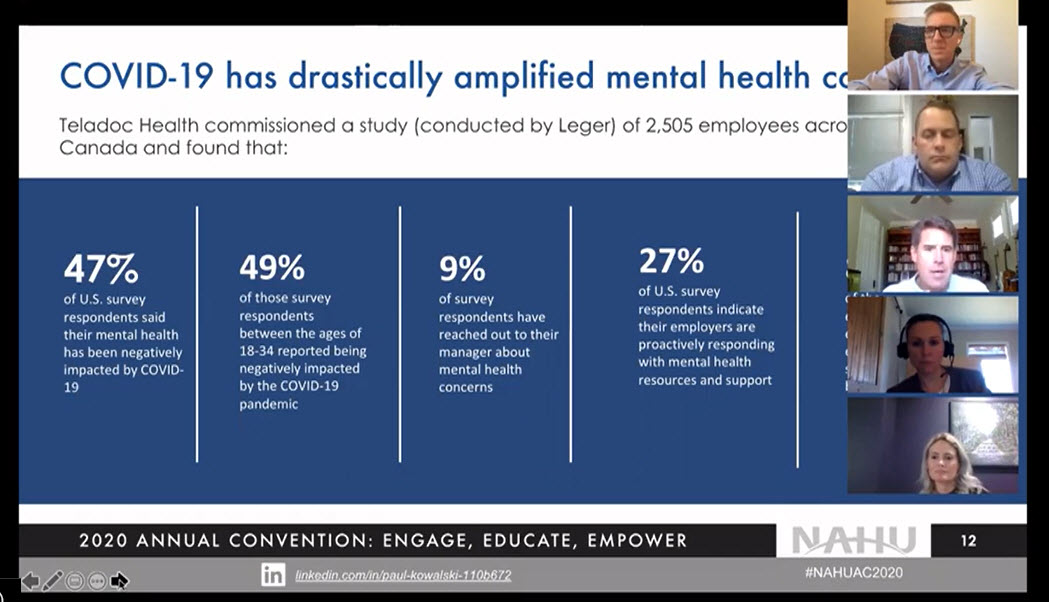

A survey Teledoc conducted further confirmed that it has been anything but a normal year, with 47% of U.S. respondents saying that the pandemic has negatively affected their mental health at some point.

When people need help, they might be in one of the rural areas where mental health professionals are scarce, he said, adding more evidence that brokers should be offering telehealth access to their employer clients.

“Word to the wise is if you're not bringing services to your employers that they need, another broker is happy to step in and try to take that case from you,” Kowalski said, emphasizing how much turnover he has seen with employers changing benefits brokers.

He spotlighted three reasons brokers should be offering remote mental health care to their employer clients:

Employee demand: Although the Teledoc survey found that 27% of U.S. employers are proactively responding to their employees with mental health resources and support, 79% of Americans indicated strongly that employee benefits plans should include virtual care for mental health needs, just as they do physical health needs. A Teledoc poll taken late last year showed only 40% said that they would welcome remote forms of care.

Snap-back economy: Once the economy recovers and workers can change jobs again, they are going to be looking for the benefits they now recognize they need. In the full employment market before COVID, workers were looking for employers who could offer better benefits. During the recovery, good employees are going to be scouting for benefits.

Comorbidity: According to the Centers for Disease Control, 70% of Americans with behavioral health issues also have a medical condition. “We know inattention to mental health issues drives other comorbidities,” Kowalski said. “So if you're that employer with that self-fund plan, and you're not paying attention to your mental health needs, you're likely going to see it catch you in other places where your claims spike because of the comorbidities.”

In fact, because of the high number of cases that Telemed has handled, the company has been able to track return on investment of remote mental health care. Taking care of mental health cuts down on comorbidities that tend to cost significant dollars, particularly emergency room care.

And it is not the only way employers pay when their workers’ mental health conditions are not treated. These conditions are long-lasting, so the impact on absenteeism and presenteeism can be significant.

“The amount of time people are missing work because of mental health issues or being in second gear, if you will, because their head's just not there,” Kowalski said, “it's a dramatic amount of costs that the employer world is losing to having people not functionally all there.”

Steven A. Morelli is editor-in-chief for InsuranceNewsNet. He has more than 25 years of experience as a reporter and editor for newspapers and magazines. He was also vice president of communications for an insurance agents’ association. Steve can be reached at [email protected].

© Entire contents copyright 2020 by InsuranceNewsNet. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.

Advisor News

- Diagnosing miscommunication in retirement planning

- Election creates an opportunity for advisor/client dialogue

- Trump 2.0: Planning around uncertainty

- MDRT study: Nearly half of financial advisors’ clients seek financial advice on social media

- EBRI study uncovers concerning trends in retirement spending

More Advisor NewsAnnuity News

- Third Quarter 2024 Statutory Financial Statement for Athene Annuity and Life Company

- Calif. insurance dept. slammed on alleged failure to provide annuity sales complaint data

- Area Insurance Professional Receives “Noble Achievement Award”

- Election creates an opportunity for advisor/client dialogue

- Luma Financial Technologies Expands into Life Insurance, Offering the First Integrated Technology Platform Solution for Life Insurance and Annuities

More Annuity NewsHealth/Employee Benefits News

- Business People: Thrivent chief Terry Rasmussen to lead H.B. Fuller board

- When premiums increase

The Savings Game: Older long-term care insurance policies lack premium protection

- Costly mistakes Floridians should avoid during open enrollment

- INTEGRIS may not honor Humana Advantage after this year

- It’s Medicare enrollment; learn about changes

More Health/Employee Benefits NewsLife Insurance News

- Third Quarter 2024 Statutory Financial Statement for Athene Annuity and Life Company

- Area Insurance Professional Receives “Noble Achievement Award”

- PFSL Fund Management Ltd. Announces Risk Rating Change for Primerica Income Fund

- AM Best Affirms Credit Ratings of Delphi Financial Group, Inc. and Its Subsidiaries

- Election creates an opportunity for advisor/client dialogue

More Life Insurance News