Strong annuity sales forecast through at least 2027, LIMRA says

Annuity sales have settled in on a new tier – a $300 billion-a-year tier – and are expected to remain there through at least 2027, LIMRA reports.

Prior to 2022, the $265 billion worth of annuities sold in 2008 stood as the record for single-year sales. And that was looked at as an anomaly as investors raced to stash money in fixed annuities amid the economic downturn.

Last year set a new standard, LIMRA's Individual Annuity Sales Survey found, as annuity sales reached nearly $313 billion. While disruptions lurk – particularly in the form of regulation activities – sales should remain in that neighborhood, said Todd Giesing, assistant vice president, LIMRA Annuity Research.

Giesing is scheduled to host a session today titled, "Annuity Market: Review and Forecast," at the LIMRA Life Insurance and Annuity Conference in Salt Lake City. He talked to InsuranceNewsNet before the conference started.

Baby boomers are continuing to age and looking for guaranteed income, so that customer base keeps growing, he said.

"For most product types, we look at the demographic there, and as we move forward, there's simply going to be more Americans in those traditional retirement ages," Giesing explained. "About an increase of about 8 million people every five years that are aged 65 and older. So, a larger potential customer base as we move forward, which will be a benefit for individual annuity sales."

LIMRA provides quarterly sales data updates on its website.

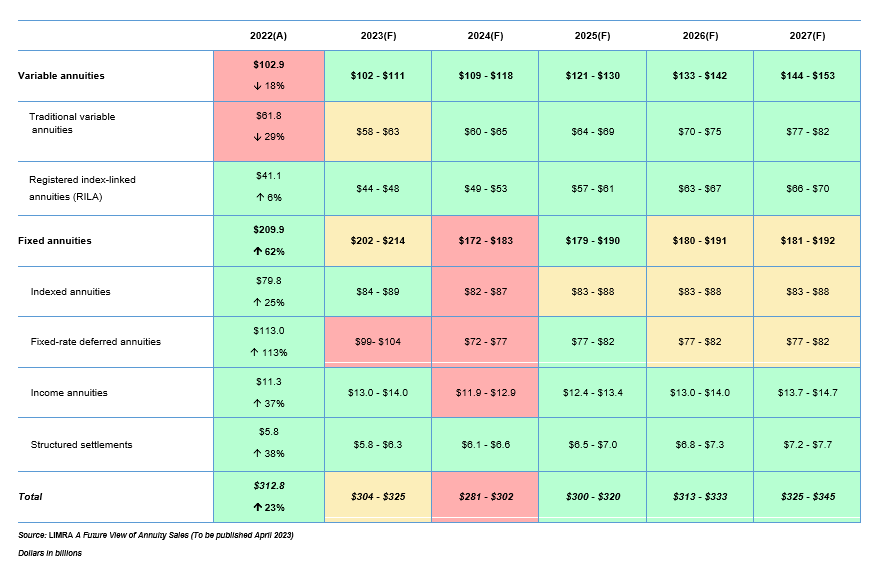

As the chart above shows, LIMRA adjusted its forecast for ongoing economic trends, primarily interest rates. But also the equity markets. Recent volatility in the equity markets drives annuity buyers to look for protection and security, or fixed products, and away from variable annuities.

That could shift some in the coming years, Giesing said.

"The anticipation is that equity markets will start to turn around in 2023 and then slowly improve in 2024 and beyond," he said.

Fixed-rate deferred annuity sales are likely to suffer if equity markets do rebound. LIMRA forecasts about a 30% decline in this category, but Giesing noted that even with the projected decline, those are still historically strong sales.

New contract features

Steadily rising interest rates are expected to have a big impact on annuity sales going forward. After all, when rates get better, insurers can sweeten the annuity payouts. But it might take some time for insurance companies to adjust, Giesing said.

"I think what was happening last year was we obviously had a ton of volume coming through in protection-focused annuity product," he explained. "And that was simply a distraction. We're hearing from the industry that there's been backlogs and that insurance companies had to quickly expand their headcount in new business processing to be able to handle the volume."

Looking out to 2025 to 2027, Giesing expects money in motion from consumers who bought shorter-term annuity contracts of three to five years.

"The challenge is where's the money going to go?" he asked. "Given the economic scenarios, and where these products are sold, we do expect a good chunk to come back into fixed-rate deferred. But if equity markets are back in a growth pattern, we would expect a portion of that money to look at products such as fixed indexed, or [registered indexed-linked annuities]."

InsuranceNewsNet Senior Editor John Hilton covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

© Entire contents copyright 2023 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

Advisor News

- Study finds more households move investable assets across firms

- Could workplace benefits help solve America’s long-term care gap?

- The best way to use a tax refund? Create a holistic plan

- CFP Board appoints K. Dane Snowden as CEO

- TIAA unveils ‘policy roadmap’ to boost retirement readiness

More Advisor NewsAnnuity News

- $80k surrender charge at stake as Navy vet, Ameritas do battle in court

- Sammons Institutional Group® Launches Summit LadderedSM

- Protective Expands Life & Annuity Distribution with Alfa Insurance

- Annuities: A key tool in battling inflation

- Pinnacle Financial Services Launches New Agent Website, Elevating the Digital Experience for Independent Agents Nationwide

More Annuity NewsHealth/Employee Benefits News

- Idaho is among the most expensive states to give birth in. Here are the rankings

- Some farmers take hard hit on health insurance costs

Farmers now owe a lot more for health insurance (copy)

- Providers fear illness uptick

- JAN. 30, 2026: NATIONAL ADVOCACY UPDATE

- Advocates for elderly target utility, insurance costs

More Health/Employee Benefits NewsLife Insurance News

- AM Best Affirms Credit Ratings of Etiqa General Insurance Berhad

- Life insurance application activity hits record growth in 2025, MIB reports

- AM Best Revises Outlooks to Positive for Well Link Life Insurance Company Limited

- Investors holding $130M in PHL benefits slam liquidation, seek to intervene

- Elevance making difficult decisions amid healthcare minefield

More Life Insurance News