Speaker: will life insurance companies stop writing policies less than $250,000?

SALT LAKE CITY – Inflation and rising interest rates. Regulatory pressure and market volatility. These unique economic conditions might force insurers to abandon small-sized life insurance product policies.

"When I talk to some of my peers out there they're suggesting that small policies are going to be tougher and tougher to deal with," said Steve Cox, head of life and combination products for Life Innovators, an independent product development company.

Life insurance product trends

The trends in life insurance product development were the subject of a pair of sessions Tuesday at the LIMRA Life Insurance and Annuity Conference. Cox joined a panel titled, "Impact of the Current Economic Environment on Life Insurance and Annuities."

Some insurers might set minimum life policies as high as $250,000, Cox said. "I think it’s hard to say you’re serving middle America when you do that," he added.

Inflation is a double whammy for insurers, the panel noted. Although inflation declined for nine straight months, down to 5% in March, it is still well above the Federal Reserve target of 2%. Furthermore, economists say the pain to the household budget is going to be felt for some time to come.

"Certainly there’s a challenge for small policies," said Elizabeth Dietrich, chief actuary for Prudential Retirement Strategies. "Compared to what else people are spending money on, do they have enough left in their discretionary income to put money aside for some of these other things?”

The life insurance industry is not taking advantage of the increased awareness that accompanied the COVID-19 pandemic, Cox insisted. According to the 2022 LIMRA Barometer Study, one in three (31%) US adults say they are more likely to purchase life insurance because of the pandemic.

Technology can be help smooth delivery of life insurance, Cox noted.

"What we can do as product people to build something to take advantage of that heightened awareness," he added. "In so many ways consumers are demanding [automation]… We’re going to be really challenged to meet those needs."

Life getting RILA'd?

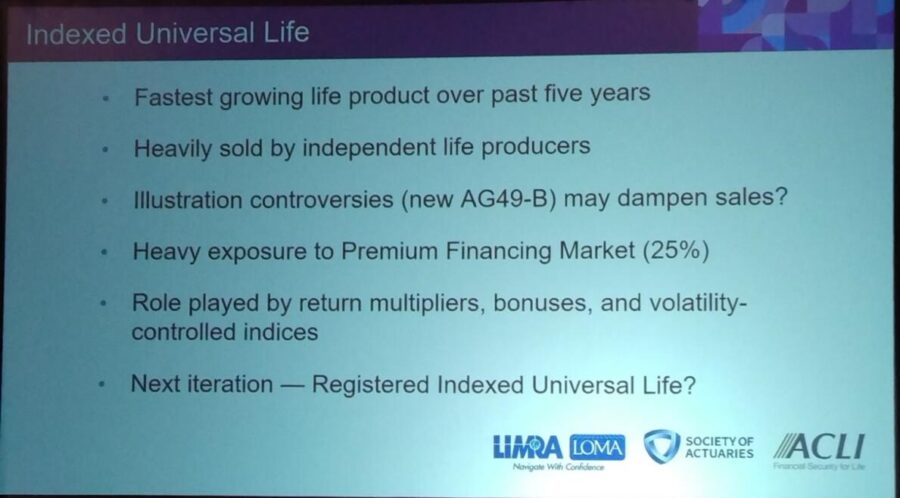

Imitation can be very flattering, or so they say. And registered indexed-linked annuities sold so well over the past five years that it was only a matter of time before a registered indexed universal life product emerged, created by Prudential.

The question remains whether RIUL spreads throughout the life insurance world, said Tim Pfeifer, president of Pfeifer Advisory, which offer consulting services on life insurance product designs. Brighthouse has filed for its own RIUL product, he added.

"Is this the next thing we'll see?" he said. "This will be a securities-type product that will be structured like an IUL. ... So this would be kind of a counterpart to the RILA product."

Pfeifer delivered a solo session titled, "Life Insurance Products: What's the Latest?" He focused heavily on IUL issues:

IUL illustrations an issue

IUL remains a very popular product category, or as Pfeifer called it, a "Swiss army knife" product. In 2022, IUL new premium totaled $3.9 billion, up 13% over 2021 results. IUL held 25% of the total individual life insurance market in 2022.

But regulators continue to monitor IUL illustrations, Pfeifer noted. On May 1, insurers must comply with Actuarial Guideline 49-B, which states that no index account can be illustrated above the benchmark index account and the new maximum illustrated rate must be inclusive of any bonuses.

In addition, AG 49-B limits illustrated rates to a maximum of 145% of whatever an IUL portfolio is earning. AG 49-B would not have been needed if AG 49-A or the original AG 49 had done the job of reining in IUL illustrations. But each time, insurers adopted new policy designs to get around the AG change.

Regulators settle for actuarial guidelines because they can be done quickly and applied to the states quickly, Pfeifer said.

"There's a lot of elements of what is now going into actuarial guidelines that are not actuarial," Pfeifer explained. "Actuarial guidelines have a specific intention, a specific purpose. So rather than deal with some of the concerns around illustrations through a new model regulation, regulators chose a while back to use the AG route."

Regulators are likely to end up trying to redo the overall life insurance model reg for illustrations, a process that "will take forever," Pfeifer said. The NAIC wrote and adopted the overall life insurance illustration model in an acrimonious process that concluded in 1997, well before IUL existed.

Or they can continue down the AG 49 route. "I think we have an AG 49-C in our future," Pfeifer quipped.

InsuranceNewsNet Senior Editor John Hilton covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

© Entire contents copyright 2023 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

Advisor News

- D.C. Digest: 'One Big Beautiful Bill' rebranded 'Working Families Tax Cut'

- OBBBA and New Year’s resolutions

- Do strong financial habits lead to better health?

- Winona County approves 11% tax levy increase

- Top firms’ 2026 market forecasts every financial advisor should know

More Advisor NewsAnnuity News

- Judge denies new trial for Jeffrey Cutter on Advisors Act violation

- Great-West Life & Annuity Insurance Company Trademark Application for “EMPOWER BENEFIT CONSULTING SERVICES” Filed: Great-West Life & Annuity Insurance Company

- 2025 Top 5 Annuity Stories: Lawsuits, layoffs and Brighthouse sale rumors

- An Application for the Trademark “DYNAMIC RETIREMENT MANAGER” Has Been Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

- Product understanding will drive the future of insurance

More Annuity NewsHealth/Employee Benefits News

- ‘Egregious’: Idaho insurer says planned hospital’s practices could drive up costs

- D.C. DIGEST

- Medicaid agencies stepping up outreach

- D.C. Digest: 'One Big Beautiful Bill' rebranded 'Working Families Tax Cut'

- State employees got insurance without premiums

More Health/Employee Benefits NewsLife Insurance News