RILAs Take The FIA Road In This Crisis

Consumers are rushing to safety as they did early in the Great Recession, but they are running toward different products during this economic downturn – and that trend is likely to continue even in this ultralow rate environment.

That is one of the projections to expect from Todd Giesing, senior director, annuity research, Secure Retirement Institute, and Teddy Panaitisor, senior research analyst, SRI, during their session, “The Sky Is Falling – How Plunging Financial Markets Affect The Annuity Market” scheduled for Tuesday afternoon during LIMRA’s Life & Retirement Virtual Conference.

Although the title refers to plunging equity markets, the researchers said they would be focusing on what is happening with products now and projecting into the next few years if things remain fairly constant.

They see a softening annuity market for the rest of this year and next, with slow growth in 2022.

“We expect sales to be down in the 8% to 15% range for 2020 compared to 2019,” Giesing said. “What's interesting is this puts us in the same impact as we saw from the financial crisis in 2008. In 2009, where I believe sales were down 10 or 11%. When you start looking at the individual products, this is where we'll see some differences.”

One of those key differences is in variable annuities.

“It's much different today than it was in 2007, 2008, 2009,” Giesing said. “Actually, it was all variable annuities -- 72% of all sales in 2007. At the end of 2019, variable annuities only accounted for 42% of the share. The carriers have diversified their business.”

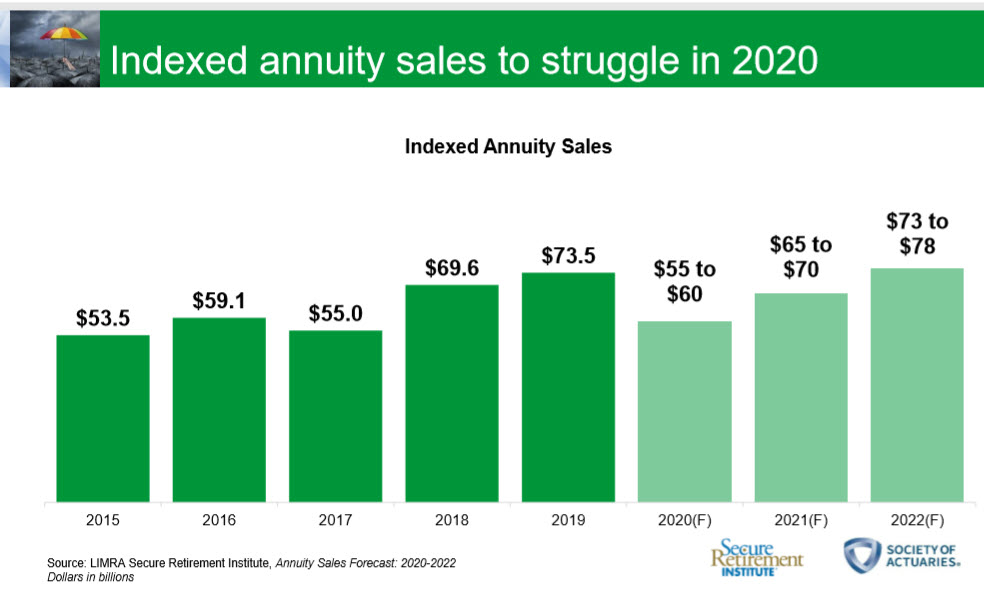

“We expect indexed annuities to be down 20 to 25%,” Giesing said. “There are many factors going on but it's basically difficult pricing environment for indexed annuities, which is making alternative solutions such as fixed rate deferred and registered indexed linked annuities more popular.”

FIAs require a longer holding period of at least several years, so consumers would be stuck with the low-rate product while other assets such as equities perform far better. Fixed-rate deferred annuities benefit by having the option of shorter durations of a few years.

“We expect fixed-rate deferred products to maintain or even grow slightly from last year,” Giesing said. “And last year was the highest year for fixed-rate deferred sale since the financial crisis. That’s the theme of protection. It's going to show up in fixed-rate deferred even though they're highly sensitive to interest rate changes.”

Even though the products’ rates are low, they serve as a safe place for consumers to land amid all the uncertainty.

“I think all of this is just putting individuals in a spot where they're just saying I just give me safety for a year or two or three,” Giesing said. “And for a portion of my money, we'll figure out in a couple of years what we're going to do from a longer term planning perspective.”

Other products with longer durations have not been faring as well.

“Income annuities are struggling because of the low interest rate environment and the pricing is way down on these products, and because they're irrevocable,” Giesing said. “We're under the assumption that advisors and clients are going to take a wait and see mentality, wait and see if things get better in six months or a year and then make the purchase at that point.”

Steven A. Morelli is editor-in-chief for InsuranceNewsNet. He has more than 25 years of experience as a reporter and editor for newspapers and magazines. He was also vice president of communications for an insurance agents’ association. Steve can be reached at [email protected].

© Entire contents copyright 2020 by InsuranceNewsNet. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.

Advisor News

- Study finds more households move investable assets across firms

- Could workplace benefits help solve America’s long-term care gap?

- The best way to use a tax refund? Create a holistic plan

- CFP Board appoints K. Dane Snowden as CEO

- TIAA unveils ‘policy roadmap’ to boost retirement readiness

More Advisor NewsAnnuity News

- $80k surrender charge at stake as Navy vet, Ameritas do battle in court

- Sammons Institutional Group® Launches Summit LadderedSM

- Protective Expands Life & Annuity Distribution with Alfa Insurance

- Annuities: A key tool in battling inflation

- Pinnacle Financial Services Launches New Agent Website, Elevating the Digital Experience for Independent Agents Nationwide

More Annuity NewsHealth/Employee Benefits News

- WATCH: BALDWIN TAKES TO SENATE FLOOR TO STOP GOP ATTACKS ON AFFORDABLE CARE ACT AND ATTEMPT TO KICK PEOPLE OFF COVERAGE

- Some farmers take hit on health insurance

- FACT SHEET: PLEDGES FROM MEDICAID TECHNOLOGY COMPANIES TO SUPPORT COMMUNITY ENGAGEMENT IMPLEMENTATION AND RELATED MEDICAID SYSTEM IMPROVEMENTS

- SSI in Florida: High Demand, Frequent Denials, and How Legal Help Makes a Difference

- SilverSummit continues investment in rural healthcare

More Health/Employee Benefits NewsLife Insurance News