RILAs showing ‘almost unprecedented’ growth, speaker says, here to stay

SALT LAKE CITY – The shine might be off registered indexed-linked annuities (RILAs) now that interest rates are climbing higher and higher, but RILAs remain a potent product.

In fact, RILA sales expanded by 6% from 2021 to 2022, said Sutton White, head of annuity product for Life Innovators.

"For as long as RILAs have been out, 13 years, people have had the question, 'What happens when interest rates come back?'" White noted. "'What happens when the market starts to not only get volatile, but potentially correct.' I think a lot of folks felt like once it started to happen, that RILAs would start to flatline or even go down.

"That the RILA category was still up to me is another very strong indicator that the value prop is there for this category."

White presented at an opening session Monday afternoon, titled "Capturing Market Share in the RILA Market," at the LIMRA Life and Annuity Conference.

Sales savior

RILAs are a tax-deferred long-term savings option that limit exposure to downside risk and provide the opportunity for growth, usually through a market index. The products offer more growth potential than a fixed-indexed annuity, but less potential return and less risk than a variable annuity.

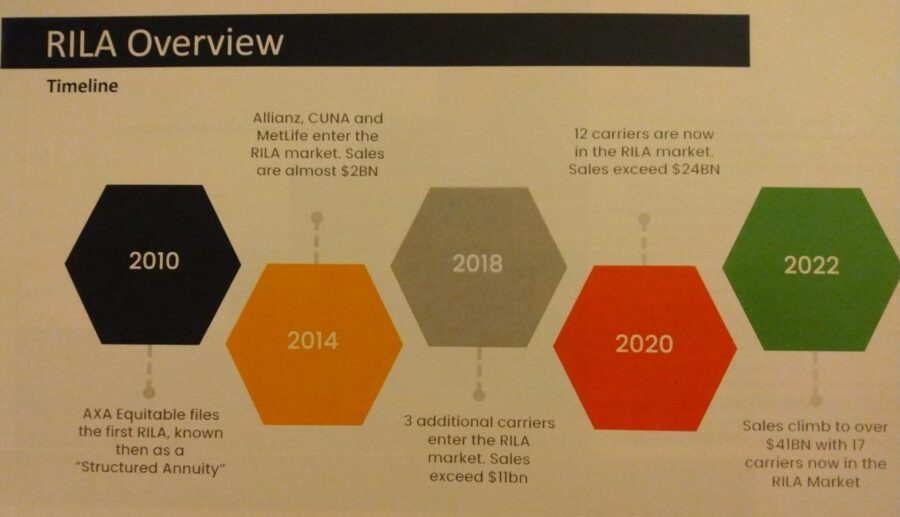

Introduced in 2010 by AXA Equitable Life Insurance Co., now known as Equitable, it took some time for RILAs to catch on. Known to come as structured or buffered annuities, RILAs hit $2 billion in sales by 2014, the year that Allianz, CUNA and MetLife introduced RILA products.

"That's sort of when I look at it as the birth of the modern RILA, when we started to see things escalate," White explained.

Today, there are 17 carriers offering RILAs and more than $41 billion in annual sales. Transamerica, Global Atlantic and Sammons all brought new RILA versions to the market in 2022.

"We're still seeing growth, even as we're seeing new carriers [introduce RILAs]," White pointed out. "You would expect to see growth potential flatline, or you start to see some share get diluted from top carriers. We've seen a little bit of that, but for the amount of carriers that have come into the market and you're still seeing exponential growth? It's almost unprecedented."

The top five carriers – Equitable, Brighthouse, Allianz, Prudential, and Lincoln – account for 80% to 85% of sales, White noted. Interestingly, captive agents are responsible for one-third of Equitable and Prudential sales, and nearly 100% of sales for RiverSource and New York Life, he added.

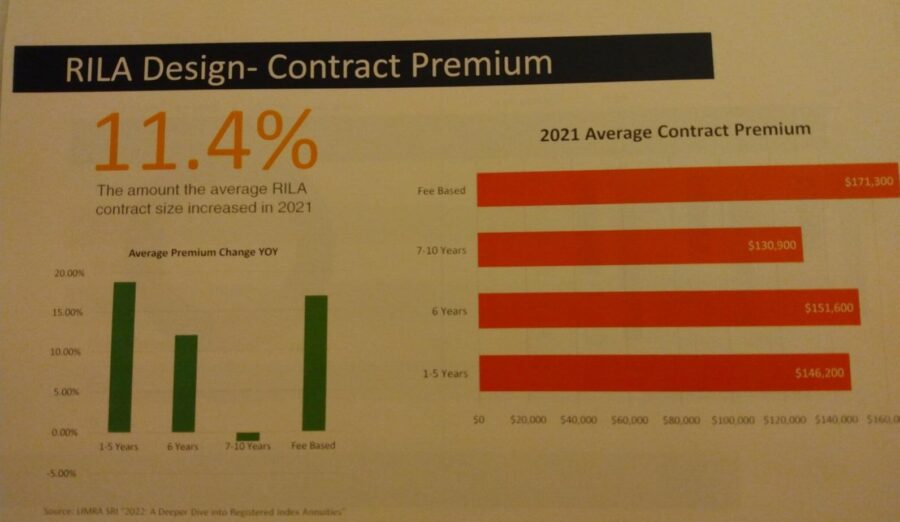

RILA sales are not only continuing to rise, but contract premium is rising at an even higher rate:

There are some misconceptions about RILAs and they can be easily confused with FIAs or VAs. But White used the analogy of a Chrysler 300 versus a Bentley.

"Yeah, they both have an engine and four wheels and steering wheel, but they're made very different," he said. "And they're made for two very different tasks. The Bentley is super performance driven where the Chrysler maybe not so much."

For his final stat supporting the staying power of RILAs, White noted that 61% of RILA premium is new money to the industry. In other words, not funds swapped from an existing annuity.

Regulatory news

The regulatory situation threatens to disrupt the RILA marketplace, but in a good way, White said. For starters, the RILA Act – which stands for the Registration for Index-Linked Annuities – await President Joe Biden's signature.

The bill would lower barriers to retirement income products by requiring the Securities and Exchange Commission to revise rules regarding developing and offering certain annuity products, including RILAs.

The bill would direct the SEC to create a new form to replace the forms annuity issuers currently are required to use when filing RILAs with the commission. These forms require the disclosure of financial information in line with GAAP, as well as other extensive information that is irrelevant for prospective annuity purchasers, industry lobbyists say.

Most notable is the S-1 form, filed with the SEC. The number of carriers offering RILAs could double if the RILA Act becomes law and they are not required to file the more cumbersome S-1 form, White predicted.

Secondly, talks with the Interstate Insurance Product Regulation Commission to add RILAs are nearing a successful conclusion, White said.

Created by the National Association of Insurance Commissioners in 2002, the interstate insurance compact reviews and approves (or disapproves) individual and group annuity, life insurance, disability income, and long-term care insurance products.

"RILA is not in compact currently," he explained. "So not only do you have to go through the arduous process of filing Form S-1, but you also then have to do a state-by-state filing of the final product, which tedious doesn't even begin to describe it because there's not really a lot of consistency [from state to state]."

InsuranceNewsNet Senior Editor John Hilton covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

© Entire contents copyright 2023 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

Advisor News

- Millennials are inheriting billions and they want to know what to do with it

- What Trump Accounts reveal about time and long-term wealth

- Wellmark still worries over lowered projections of Iowa tax hike

- Wellmark still worries over lowered projections of Iowa tax hike

- Could tech be the key to closing the retirement saving gap?

More Advisor NewsAnnuity News

- How to elevate annuity discussions during tax season

- Life Insurance and Annuity Providers Score High Marks from Financial Pros, but Lag on User Friendliness, JD Power Finds

- An Application for the Trademark “TACTICAL WEIGHTING” Has Been Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

- Annexus and Americo Announce Strategic Partnership with Launch of Americo Benchmark Flex Fixed Indexed Annuity Suite

- Rethinking whether annuities are too late for older retirees

More Annuity NewsHealth/Employee Benefits News

- Findings from Belmont University College of Pharmacy Provide New Insights into Managed Care and Specialty Pharmacy (Comparing rates of primary medication nonadherence and turnaround time among patients at a health system specialty pharmacy …): Drugs and Therapies – Managed Care and Specialty Pharmacy

- Study Data from Ohio State University Update Knowledge of Managed Care (Preventive Care Utilization, Employer-sponsored Benefits, and Influences On Utilization By Healthcare Occupational Groups): Managed Care

- Recent Findings from Cornell University Provides New Insights into Managed Care (The Law of Large Umbrellas: Away From Risk Reduction In Health Insurance): Managed Care

- New Findings on Cancer from University of Texas Arlington Summarized (Systematic Review of Health Insurance and Survival Among Adolescent and Young Adult Cancer Patients): Cancer

- ‘Absolutely ferocious’: Idaho introduces plan to repeal Medicaid expansion

More Health/Employee Benefits NewsLife Insurance News

- Gulf Guaranty Life Insurance Company Trademark Application for “OPTIBEN” Filed: Gulf Guaranty Life Insurance Company

- Marv Feldman, life insurance icon and 2011 JNR Award winner, passes away at 80

- Continental General Partners with Reframe Financial to Bring the Next Evolution of Reframe LifeStage to Market

- ASK THE LAWYER: Your beneficiary designations are probably wrong

- AM Best Affirms Credit Ratings of Cincinnati Financial Corporation and Subsidiaries

More Life Insurance News