Education, delivery methods are keys to self-directed retirement planning

If Americans are to successfully master the transition to self-directed retirement planning, it is going to take a lot of education.

Financial education is one part, the vehicle to provide it is yet another piece of the puzzle, said Bryan Hodgens, corporate vice president, distribution and annuities, member benefits, LIMRA and LOMA.

Hodgens is moderating a pair of sessions today at the 2023 LIMRA Annual Conference: Forging the Future, at National Harbor outside Washington, D.C. Both sessions tackle retirement planning and how to best connect Americans with better strategies.

The need for financial advice is acute at the moment, with the transition from defined benefit to defined contribution plans nearly complete. In addition, rising interest rates, schizophrenic equity markets and rampant talk of recession has many retirees and near-retirees lacking confidence.

"There's a lot of trends now today around more of a flexible spending dynamic in terms of retirement income planning, which means you're making adjustments each year based on market conditions, inflation," Hodgens explained. "Spend more, spend less, but make adjustments versus having a static withdrawal."

Studies show underlying issues

LIMRA conducts regulars studies digging into the stubborn resistance to certain retirement products and overall holistic planning. The reasons are obvious and well known: people put off retirement and mortality discussions, and they don't know enough about annuities to trust the products.

Its most-recent study, titled "The Evolving Retirement Landscape: the Consumer View" returned some interesting answers to questions such as, "I am confident that I will be able to live the retirement lifestyle I want.”

"These consumers have a household investable assets of at least $100,000 or more," Hodgens said. "So it is not pulling in everybody."

The survey found a historically low 20% "strongly agreed" with that statement, but another 49% "somewhat agreed." Together, 69% is at the high end of a decade-long trend line, and it shows that the industry has a confident and enthusiastic majority of Americans seeking financial help.

The answer to boost Americans' retirement comfort level might be found at the office, Hodgens said. Much like employers provide health care insurance options for millions of Americans, financial education and planning could start at work as well.

"We'll talk about how another trend that's occurring is holistic financial wellness that's occurring in the workplace," Hodgens explained. "We think that trend is going to continue and grow exponentially, because what we're seeing is employees are asking employers, 'Help me with my overall holistic financial planning while I'm in the workforce [and] working at your company.'"

Guaranteed income needed

Several LIMRA sessions will touch on guaranteed lifetime income, usually annuities, and how to better position these product promises that surveys show repeatedly that Americans hold in high regard.

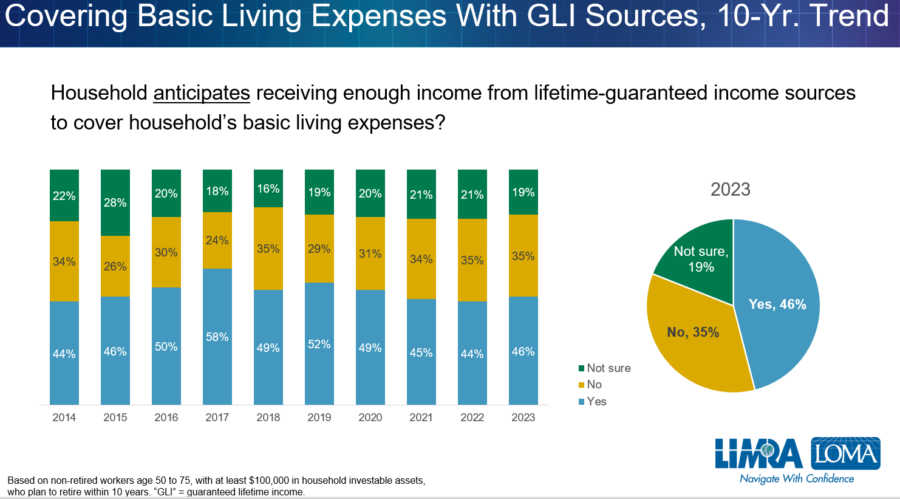

The LIMRA survey of consumers revealed a growing percentage of Americans who do not believe they will be able to cover "basic living expenses" with guaranteed living income sources, or income to supplement Social Security.

The Setting Every Community Up for Retirement Enhancement (SECURE) Act of 2019 and the followup Secure Act 2.0, signed into law in December, cleared the way for employer plans to offer annuity options -- among other things. SECURE 2.0 contains 92 new or modified provisions addressing retirement.

As a result, LIMRA researchers expect employers to embrace the idea of offering annuities inside plans.

"They have this view that they need to take care of their employees with a guaranteed income lifetime guaranteed income like the pension was," Hodgens said. "So, they're very interested in adding these guaranteed lifetime or annuity products to the to the workplace benefit plan."

InsuranceNewsNet Senior Editor John Hilton covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

© Entire contents copyright 2023 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

Advisor News

- Affordability on Florida lawmakers’ minds as they return to the state Capitol

- Gen X confident in investment decisions, despite having no plan

- Most Americans optimistic about a financial ‘resolution rebound’ in 2026

- Mitigating recession-based client anxiety

- Terri Kallsen begins board chair role at CFP Board

More Advisor NewsAnnuity News

- Reframing lifetime income as an essential part of retirement planning

- Integrity adds further scale with blockbuster acquisition of AIMCOR

- MetLife Declares First Quarter 2026 Common Stock Dividend

- Using annuities as a legacy tool: The ROP feature

- Jackson Financial Inc. and TPG Inc. Announce Long-Term Strategic Partnership

More Annuity NewsHealth/Employee Benefits News

- In Snohomish County, new year brings changes to health insurance

- Visitor Guard® Unveils 2026 Visitor Insurance Guide for Families, Seniors, and Students Traveling to the US

- UCare CEO salary topped $1M as the health insurer foundered

- Va. Republicans split over extending

Va. Republicans split over extending health care subsidies

- Governor's proposed budget includes fully funding Medicaid and lowering cost of kynect coverage

More Health/Employee Benefits NewsLife Insurance News