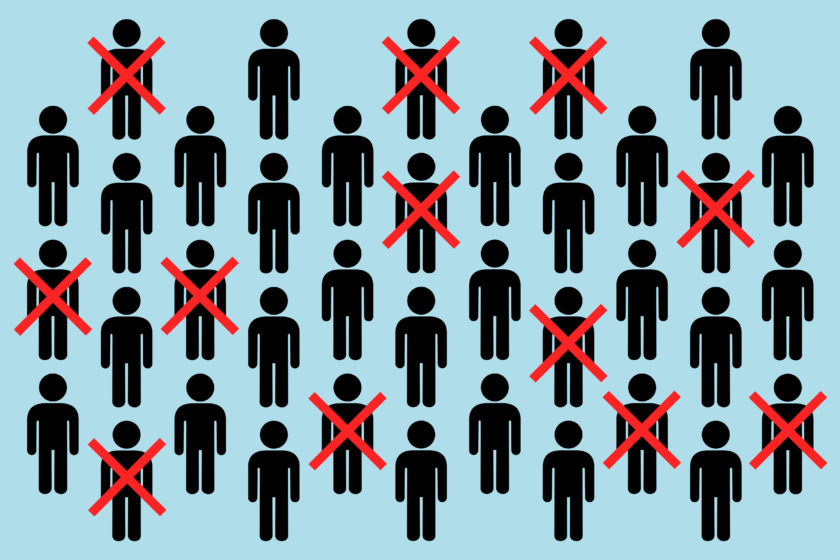

‘Deaths of despair’ rising dramatically and insurers feel the pain

About 2.5 million Americans died between 1999 and 2021 from what experts are calling “deaths of despair” related to suicide, drugs and alcohol.

That number only increased during the COVID-19 pandemic. While a societal problem on a number of levels, as well as tragic for loved ones of the victims, the "deaths of despair" have an impact on life insurance as well.

Dan Jolivet, workplace possibilities practice consultant with The Standard, discussed the issues at stake today during the 2022 LIMRA Annual Conference. He was joined by Brian Casey, police sergeant and employee assistance program director with the Saint Paul Police Department for a session titled, "Deaths of Despair: Identifying Solutions to a Growing Epidemic."

Suicide deaths increased from about 30,000 in 1999 to almost 50,000 in 2018. Suicides declined slightly in 2019 and again in 2020, Jolivet said, and researchers are not sure why.

Data from the National Center for Health Statistics indicate there were an estimated 107,622 drug overdose deaths in the United States during 2021, an increase of nearly 15% from the 93,655 deaths estimated in 2020. Overdose deaths rose 30% from 2019 to 2020.

"They are primarily fueled by people feeling like they have no opportunities, no meaning, no purpose," Jolivet said. "...These are all treatable conditions. These deaths are almost all preventable."

Impact on insurance

Jolivet acknowledged that many of the overdose victims come from poorer backgrounds and are often without life insurance. In response to an audience question, he noted that suicide victims are more likely to have life insurance and many insurers do pay death claims if the policy is held for a specific timeframe.

Deaths of despair also impact life insurers when life expectancy declines, as it has in the U.S.

"Obviously if you've got elevated mortality, and decreased life expectancy, that's going to have an impact," Jolivet said. "And that's going to drive up premiums."

Life expectancy at birth in the United States declined nearly a year from 2020 to 2021, according to data from the Centers for Disease Control’s National Center for Health Statistics. That decline – 77.0 to 76.1 years – took U.S. life expectancy at birth to its lowest level since 1996. The 0.9 year drop in life expectancy in 2021, along with a 1.8 year drop in 2020, represent the biggest two-year decline in life expectancy since 1921-1923.

The Society of Actuaries recently noted that the deaths of despair in the last 20 years have "completely wiped out improvements in life expectancy in the U.S. related to better treatment of cardiac disease," Jolivet said.

What can insurers do?

The Standard had an existing business relationship with the Saint Paul Police Department. That grew when the insurer stepped up to help with grants and development related to the city's Employee Assistance Program.

Jolivet encouraged insurers to "take public positions" on societal programs that can reduce drug and alcohol abuse and improve access to mental health services.

"Also making sure that we're not just giving money," he added, "but that we're encouraging our employees to volunteer."

InsuranceNewsNet Senior Editor John Hilton has covered business and other beats in more than 20 years of daily journalism. John may be reached at [email protected]. Follow him on Twitter @INNJohnH.

© Entire contents copyright 2022 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

Advisor News

- Changes, personalization impacting retirement plans for 2026

- Study asks: How do different generations approach retirement?

- LTC: A critical component of retirement planning

- Middle-class households face worsening cost pressures

- Metlife study finds less than half of US workforce holistically healthy

More Advisor NewsAnnuity News

- Trademark Application for “INSPIRING YOUR FINANCIAL FUTURE” Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

- Jackson Financial ramps up reinsurance strategy to grow annuity sales

- Insurer to cut dozens of jobs after making splashy CT relocation

- AM Best Comments on Credit Ratings of Teachers Insurance and Annuity Association of America Following Agreement to Acquire Schroders, plc.

- Crypto meets annuities: what to know about bitcoin-linked FIAs

More Annuity NewsHealth/Employee Benefits News

- Senior Health Insurance in Florida Adapts to 2026 Care Costs

- Officials Report Record Enrollment In CT's Health Insurance Marketplace

- 'Washington is broken': Democratic U.S. Senate candidate Roy Cooper pledges to fight for affordable health insurance, Medicaid expansion

- Kontoor updates executive severance package amid talk of more potential departures

- Patients feel strain of Florida Blue fallout with Broward hospitals: ‘Just lunacy’

More Health/Employee Benefits NewsLife Insurance News