Conference Speaker Offers New Way To View Retirement Assets

BOSTON - Moshe Milevsky thinks underwriters, risk analysts, and actuaries are seriously overlooking major elements of their business that could produce savings as well as make more money.

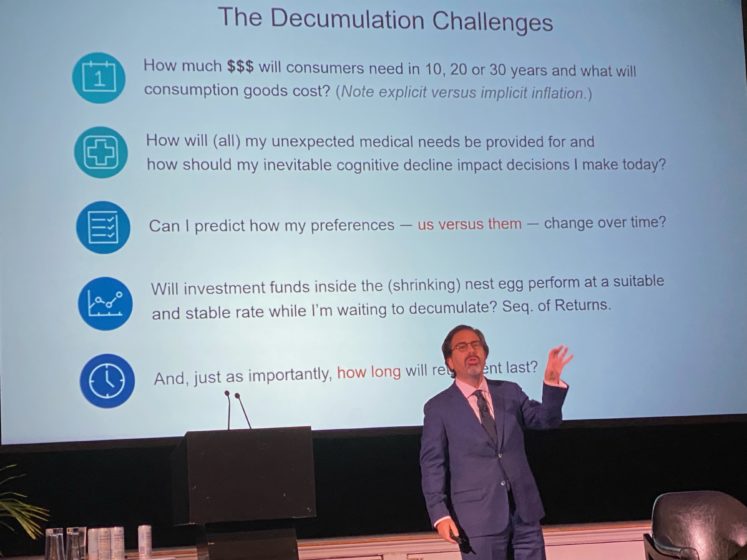

In a fast-paced entertaining 45-minute talk in the main ballroom at the Park Plaza here, which is hosting the 2022 Retirement Industry Conference hosted by Secure Retirement Institute and the Society of Actuaries, the fintech entrepreneur and finance professor, focused on “decumulation.” Decumulation is a relatively new word to describe how to calculate strategic ways to use retirement assets while ensuring everything one has accumulated during their life lasts for as long as it’s needed, with some left over for heirs.

Milevsky’s talk, billed as “Longevity Risk Management Post Pandemic: Purpose, Products, and Strategies,” was an examination of three basic factors that insurers might want to redefine or view from new perspectives to better calculate underwriting risks and actuarial tables in a changing world:

- Inflation

- Aging

- Annuities

The True Definition of Age

“I'm going to challenge you to think carefully about what the definition of inflation and age is and how we really measure them,” he began. “And I’m going to ask you what really is an annuity.”

Milevsky relied on information from two books he’s authored, “Longevity Insurance for a Biological Age,” and the upcoming “How to Build a Modern Tontine,” to show how there is really no single inflation rate – it can vary dramatically by region, age, race, and economic standing. That information should be specifically factored when trying to determine how long a retirement nest egg will last. And he showed how both chronological age as well as biological age should be considered when designing retirement portfolios.

“Your chronological age is simply how many times you’ve circled the sun,” he said.

Biological age, on the other hand, considers factors such as telomeres, the DNA sequences at the end of one’s chromosomes, and other biomarkers that reveal a person’s true health, mortality rate, and life expectancy that may not correlate with chronological age.

“Consider the implications for this as clients - people, humans - start to become aware of this and they’re on their iPhone or Fitbit, or iWatch, and it wakes them up in the morning and tells them their biological age just went up because of something they did last night,” he said.

Everyone wants their biological age to be lower than their chronological age.

“What happens to your retirement planning and asset allocation and investment models when you have two different numbers,” he asked. “What does that mean to an investment advisor, a Social Security Adviser, and so on.”

A Centenarian Trend

Milevsky surprised the audience when he polled them on what country had the most centenarians. The majority of respondents by far chose Japan, over China, US, Indonesia, and India. The answer, however, was the US, with 92,000 chronological centenarians.

“This is a trend that's increasing,” he said, again raising the implications on mortality rates and life expectancy. “We're going to have more of them.”

Finally, Milevsky took the audience through the history of tontines, which date back to the 1600s. Tontines are life insurance policies shared by subscribers to a loan or common fund, the shares increasing as subscribers die – the mortality credit – until the last survivor enjoys the entire income. Milevsky said there is a budding realization that tontines could find a resurgence in the retirement asset allocation business.

“More and more asset managers are saying: ‘We get the retirement income story. We get it, we understand that we have to provide them with something,’ ” he said. “But why does it have to be guaranteed? Why can't we just give them the mortality credits without the capital? And I think you have to keep an eye on what the investment industry is doing. Because this concept appeals to them and they want to compete in that particular space. I think they can do it.”

Essentially, he said, he believes the investment community will begin to buy up assets that appreciate from longevity improvements. “And what they're going to tell you is we're going to take that money, and we're going to put it in things that do well, if indeed, longevity breakthroughs take place,” he said.

Overall, Milevsky said, it’s a good time to be in the retirement business.

“A lot of players are going to come in and say ‘yeah, maybe we can do this differently,’” he said. “And there is going to be a big focus on managing longevity, expenditures, and uncertainty.”

Doug Bailey is a journalist and freelance writer who lives outside of Boston. He can be reached at [email protected].

© Entire contents copyright 2022 by InsuranceNewsNet.com Inc. All rights reserved. No part of this article may be reprinted without the expressed written consent from InsuranceNewsNet.com.

Advisor News

- OBBBA and New Year’s resolutions

- Do strong financial habits lead to better health?

- Winona County approves 11% tax levy increase

- Top firms’ 2026 market forecasts every financial advisor should know

- Retirement optimism climbs, but emotion-driven investing threatens growth

More Advisor NewsAnnuity News

- Judge denies new trial for Jeffrey Cutter on Advisors Act violation

- Great-West Life & Annuity Insurance Company Trademark Application for “EMPOWER BENEFIT CONSULTING SERVICES” Filed: Great-West Life & Annuity Insurance Company

- 2025 Top 5 Annuity Stories: Lawsuits, layoffs and Brighthouse sale rumors

- An Application for the Trademark “DYNAMIC RETIREMENT MANAGER” Has Been Filed by Great-West Life & Annuity Insurance Company: Great-West Life & Annuity Insurance Company

- Product understanding will drive the future of insurance

More Annuity NewsHealth/Employee Benefits News

- AMO CALLS OUT REPUBLICANS' HEALTH CARE COST CRISIS

- With federal backing, Wyoming's catastrophic 'BearCare' health insurance plan could become reality

- Our View: Arizona’s rural health plan deserves full funding — not federal neglect

- NEW YEAR, NEW LAWS: GOVERNOR HOCHUL ANNOUNCES AFFORDABLE HEALTH CARE LAWS GOING INTO EFFECT ON JANUARY 1

- Thousands of Alaskans face health care ‘cliff in 2026

More Health/Employee Benefits NewsLife Insurance News